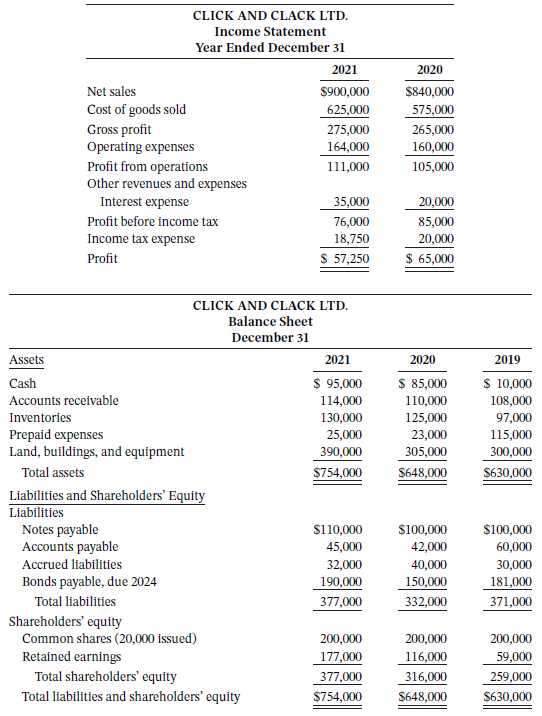

Comparative financial statements for Click and Clack Ltd. are shown below Additional information: 1. Seventy-five percent of

Question:

Comparative financial statements for Click and Clack Ltd. are shown below

Additional information:

1. Seventy-five percent of the sales were on account.

2. The allowance for doubtful accounts was $4,000 in 2021, $5,000 in 2020, and $3,000 in 2019.

3. In 2021 and 2020, dividends of $3,000 and $8,000, respectively, were paid to the common shareholders.

4. Cash provided by operating activities was $103,500 in 2021 and $129,000 in 2020.

5. Cash used by investing activities was $115,500 in 2021 and $35,000 in 2020.

Instructions

a. Calculate all possible liquidity, solvency, and profitability ratios for 2021 and 2020.

b. Identify whether the change in each ratio from 2020 to 2021 calculated in part (a) was favourable (F), unfavourable (U), or no change (NC).

c. Explain whether overall (1) liquidity, (2) solvency, and (3) profitability improved, deteriorated, or remained the same between 2020 and 2021.

Taking It Further

Does this problem employ an intracompany comparison or an intercompany comparison? Which do you think is more useful?

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Accounting Principles Volume 2

ISBN: 978-1119502555

8th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak