Answered step by step

Verified Expert Solution

Question

1 Approved Answer

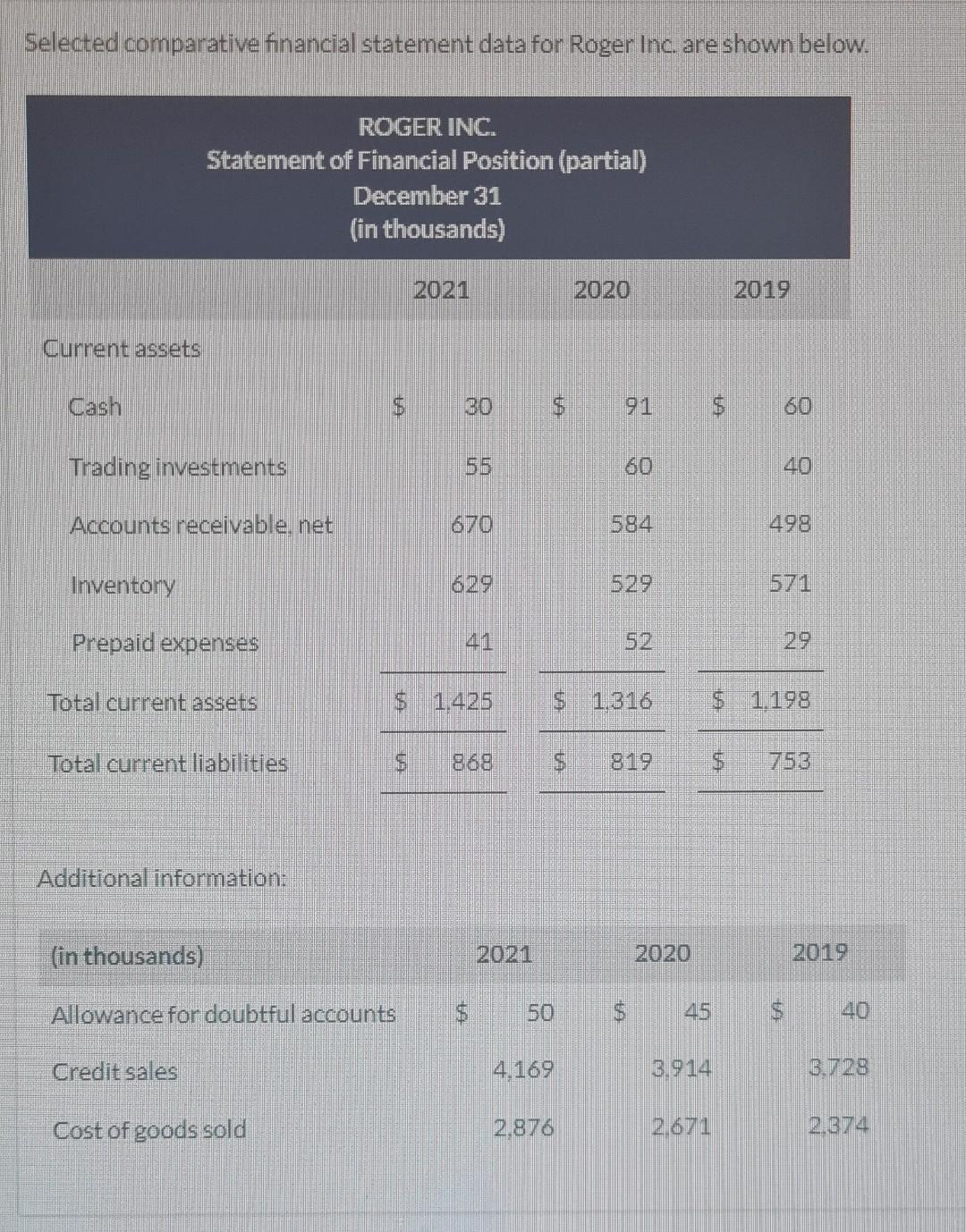

Selected comparative financial statement data for Roger Inc. are shown below. ROGER INC. Statement of Financial Position (partial) December 31 (in thousands) 2021 2020 2019

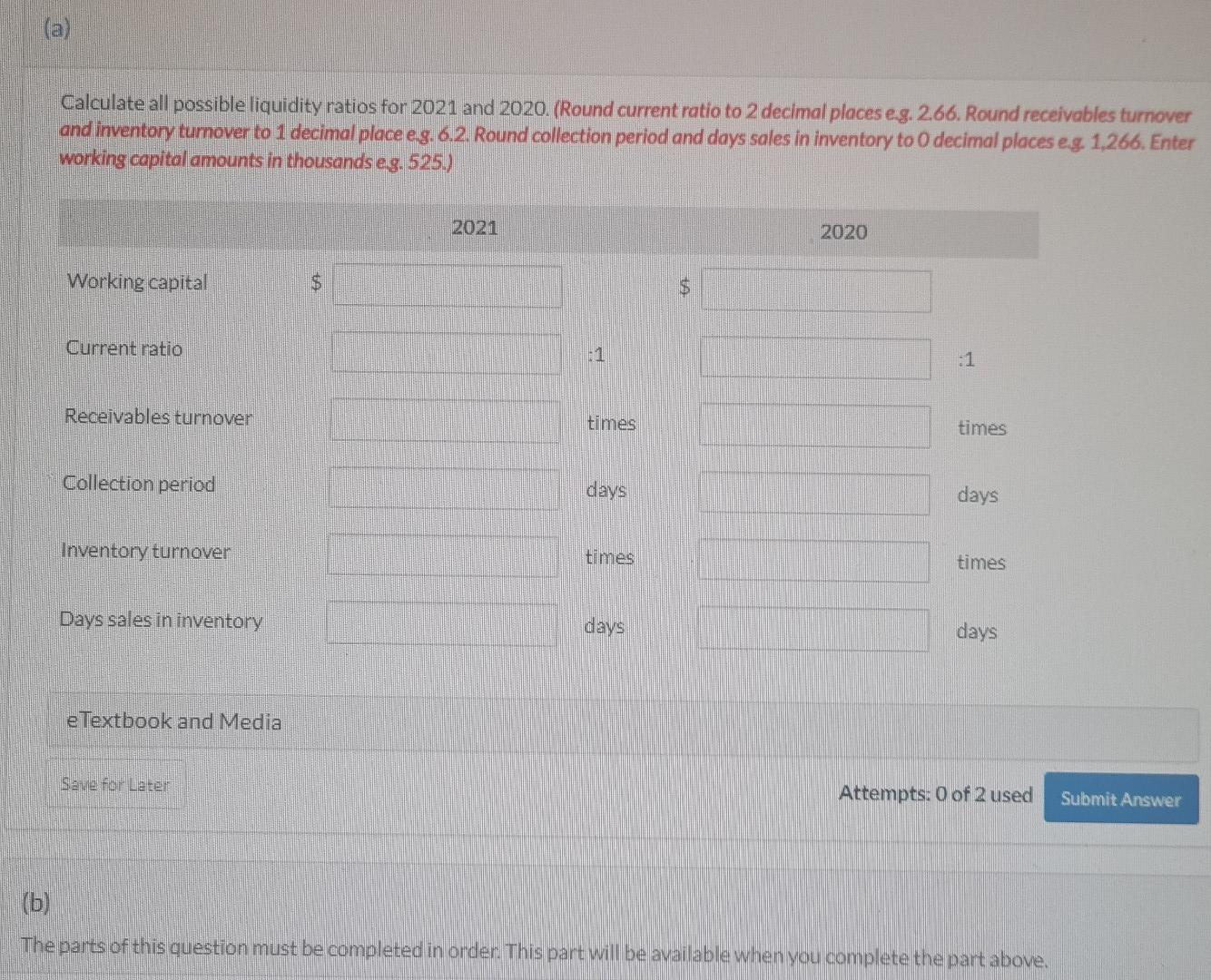

Selected comparative financial statement data for Roger Inc. are shown below. ROGER INC. Statement of Financial Position (partial) December 31 (in thousands) 2021 2020 2019 Current assets 30 $ 91 $ 60 Trading investments 55 60 40 Accounts receivable. net 670 498 Inventory 629 529 571 Prepaid expenses 41 52 29 Total current assets $ 1.425 $ 1,316 $ 1.198 Total current liabilities $ 868 $ $ Additional information: (in thousands) 2020 2019 Allowance for doubtful accounts $ 50 40 Credit sales 4,169 3.914 3.728 Cost of goods sold 2.876 2.571 2.374 (a) Calculate all possible liquidity ratios for 2021 and 2020. (Round current ratio to 2 decimal places eg. 2.66. Round receivables turnover and inventory turnover to 1 decimal place eg. 6.2. Round collection period and days sales in inventory to 0 decimal places e.g. 1,266. Enter working capital amounts in thousands eg. 525.) 2021 2020 Working capital $ Current ratio 1 1 Receivables turnove times times Collection period days days Inventory turnover times times Days sales in inventory days days e Textbook and Media save for Later Attempts: 0 of 2 used Submit Answer (b) The parts of this question must be completed in order. This part will be available when you complete the part above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started