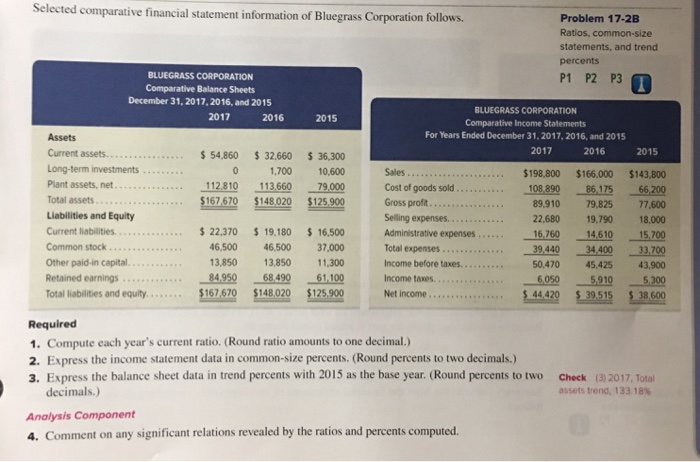

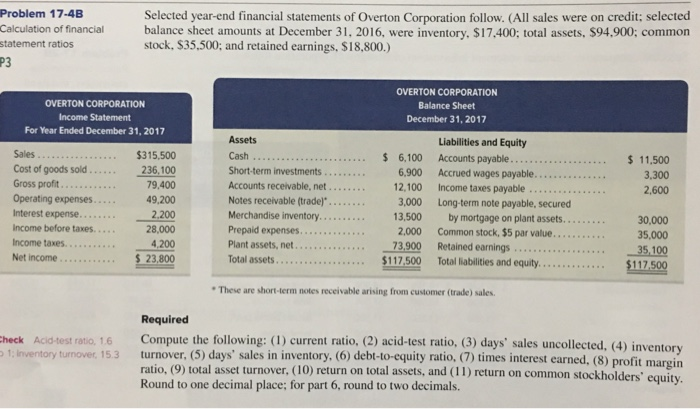

Selected comparative financial statement information of Bluegrass Corporation follows. Problem 17-2B Ratios, common-size statements, and trend percents BLUEGRASS CORPORATION Comparative Balance Sheets December 31, 2017,2016, and 2015 P1P2 P30 BLUEGRASS CORPORATION Comparative Income Statements For Years Ended December 31, 2017, 2016, and 2015 2017 2016 2015 Assets 2017 2016 2015 0 1,700 10,600 Sales $198,800 $166.000 $143,800 Plant assets, net 112,810 113660 79000 Cost of goods sold 167670 $148020 $125900 Gross proft. 89,91079,825 77,600 22,680 19,790 18,000 16.7601461015,700 Total expenses39.440 34,40033,700 50,47045,425 43,900 60505.9105.300 Liabilities and Equity Selling expenses Administrative expenses Common stock Other paid-in capital. 46,500 46,500 37,000 3,850 13,850 11,300 84.95068.49061,100 Income taxes Total liabilities and equity... 670 $148.020 $125,900 Net income 44.4 Required 1. Compute each year's current ratio. (Round ratio amounts to one decimal.) 2. Express the income statement data in common-size percents. (Round percents to two decimals.) 3. Express the balance sheet data in trend percents with 2015 as the base year. (Round percents to two Check (3)2017, Total assets trend, 1 331 8% decimals.) Analysis Component 4. Comment on any significant relations revealed by the ratios and percents computed Problem 17-4B Calculation of financial statement ratios P3 Selected year-end financial statements of Overton Corporation follow. (All sales were on credit; selected balance sheet amounts at December 31, 2016, were inventory, $17.400: total assets, $94,900; common stock, S35.500; and retained earnings, $18,800.) OVERTON CORPORATION Income Statement OVERTON CORPORATION Balance Sheet December 31, 2017 For Year Ended December 31, 2017 Assets Liabilities and Equity Sales Cost of goods sold Gross profit Operating expenses... Interest expense.... 315,500 236,100 79,400 49,200 2,200 28,000 4.200 11,500 3.300 2,600 Short-term investments Accounts receivable, net Notes receivable (tradej" Merchandise inventory 2,100 Income taxes payable 3,000 Long-term note payable, secured 30,000 35,000 -35.100 Income taxes 73,900 Retained earnings. 5 23800 117,500 These are short-term notes receivable arising from customer (trade) sales. Required heck Acid-test ratio, 1.6 Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected. (4) inventor 1, Inventory turnover 15.3 turnover, (5) days' sales in inventory, (6) debt-to-equity ratio. (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return on common stockholde Round to one decimal place; for part 6, round to two decimals