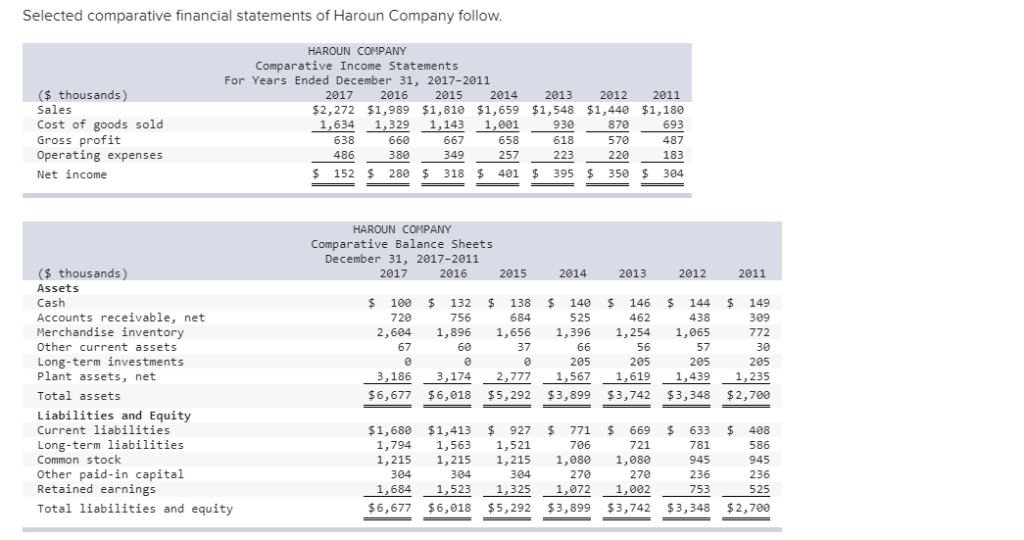

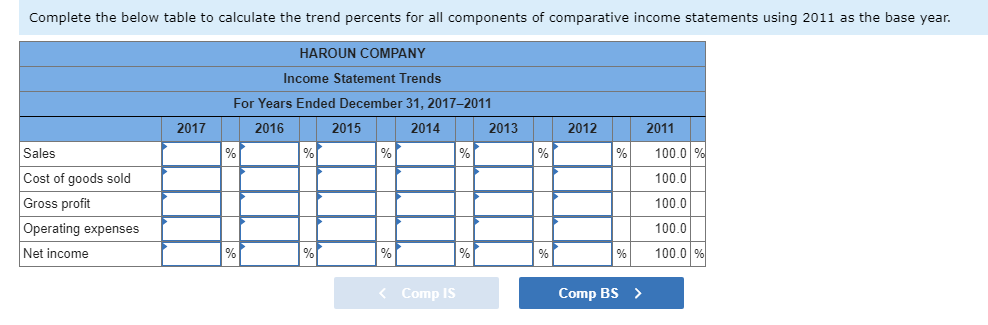

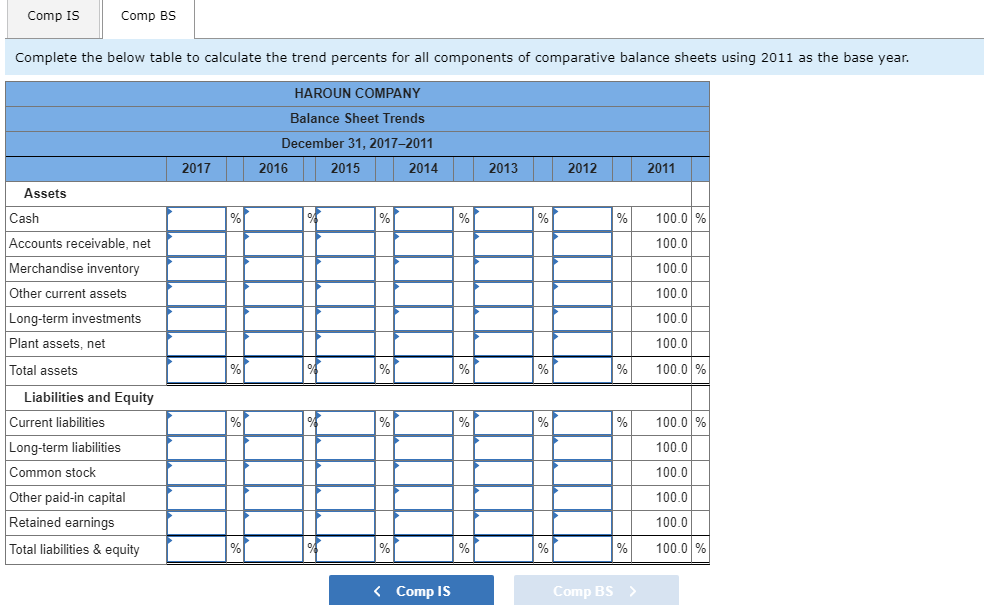

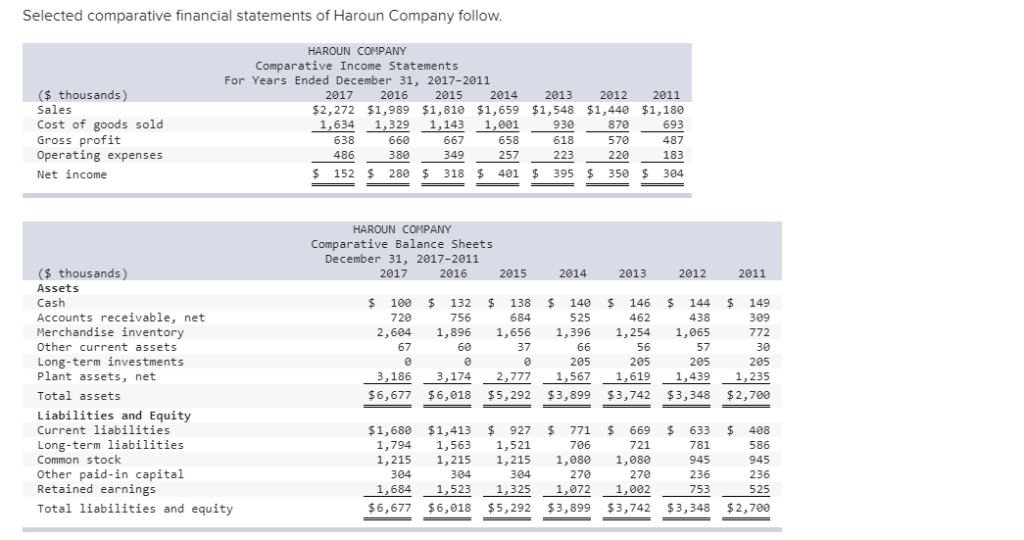

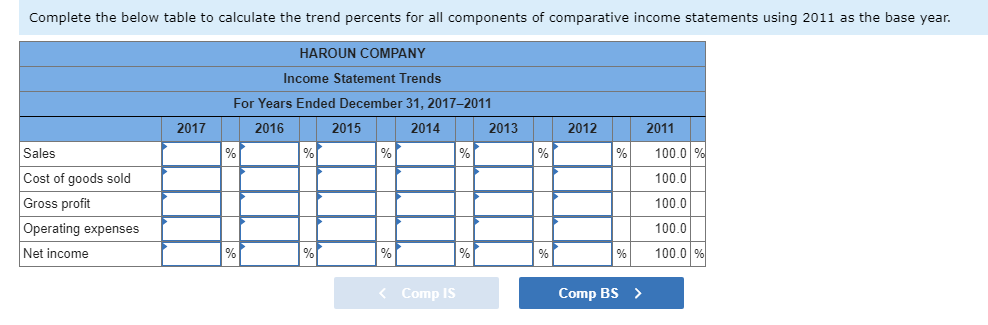

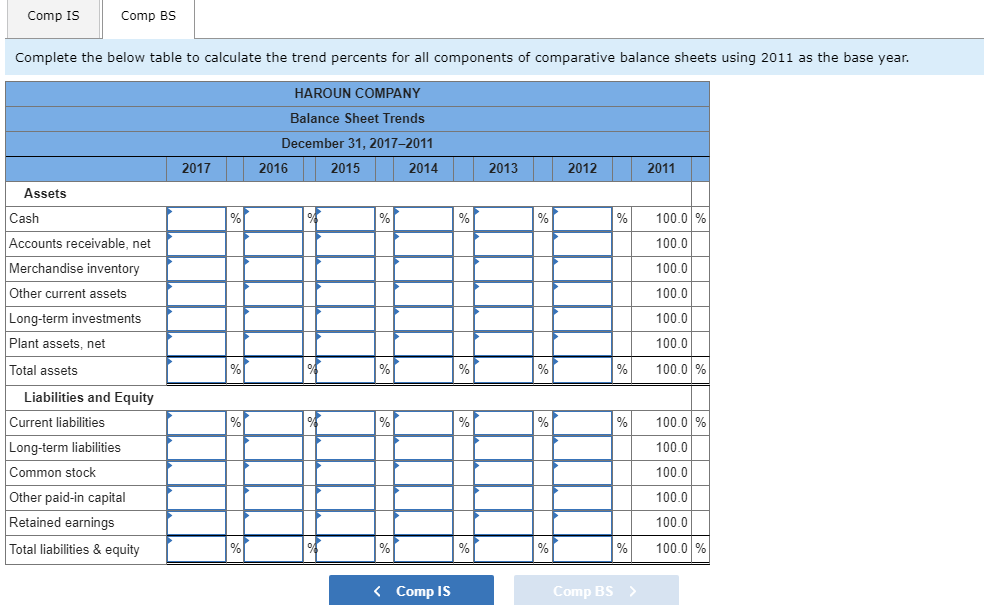

Selected comparative financial statements of Haroun Company follow HAROUN COMPANY Comparative Income Statements For Years Ended December 31, 2017-2011 (s thousands) Sales Cost of goods sold Gross profit Operating expenses Net income 2017 2016 2015 2014 2013 2012 2011 $2,272 $1,989 $1,810 $1,659 $1,548 $1,440 $1,180 693 487 183 1,634 1,329 1,143 1,001 658 257 930 618 870 570 220 638 486 660 667 349 22320 $15228318 $401 395$ 350 304 HAROUN COMPANY Comparative Balance Sheets December 31, 2017-2011 ($ thousands) Assets Cash Accounts receivable, net Merchandise inventory Other current assets Long-term investments Plant assets, net Total assets 2017 2016 2015 2014 2013 2012 2011 $ 100 132138 684 140146 462 144 149 309 438 2,604 1,896 1,656 1,396 1,254 1,065 57 205 720 756 525 772 30 205 3,186 3,174 2,777 1,567 1,619 1,439 1,235 $6,677 $6,018 $5,292 $3,899 $3,742 $3,348 $2,700 37 56 205 205 Liabilities and Equity Current 1iabilities Long-term liabilities Common stock Other paid-in capital Retained earnings $1,680 $1,413 927 771 706 669 633 408 586 945 236 525 $6,677 $6,018 $5,292 3,899 $3,742 $3,348 2,7ee 781 945 236 753 721 1,215 1,215 1,215 1,080 1,080 270 1,684 1,523 1,325 1,072 1,002 1,794 1,563 1,521 304 304 304 270 Total liabilities and equity Complete the below table to calculate the trend percents for all components of comparative income statements using 2011 as the base year. HAROUN COMPANY Income Statement Trends For Years Ended December 31, 2017-2011 2014 2017 2016 2015 2013 2012 2011 %) 100.0 100.0 100.0 100.0 100.0 Sales Cost of goods sold Gross profit Operating expenses Net income Comp IS Comp BS Comp IS Comp Bs Complete the below table to calculate the trend percents for all components of comparative balance sheets using 2011 as the base year. HAROUN COMPANY Balance Sheet Trends December 31, 2017-2011 2017 2016 2015 2014 2013 2012 2011 Assets Cash Acco Merchandise inventory Other current assets Long-term investments Plant assets, net Total assets %) 100.01% 100.0 100.0 100.0 100.0 100.0 100.01% unts receivable, net %) Liabilities and Equity Current liabilities Long-term liabilities Common stock Other paid-in capital Retained earnings Total liabilities & equity %) 100.01% 100.0 100.0 100.0 100.0 100.01% %) Comp is Comp BS