Answered step by step

Verified Expert Solution

Question

1 Approved Answer

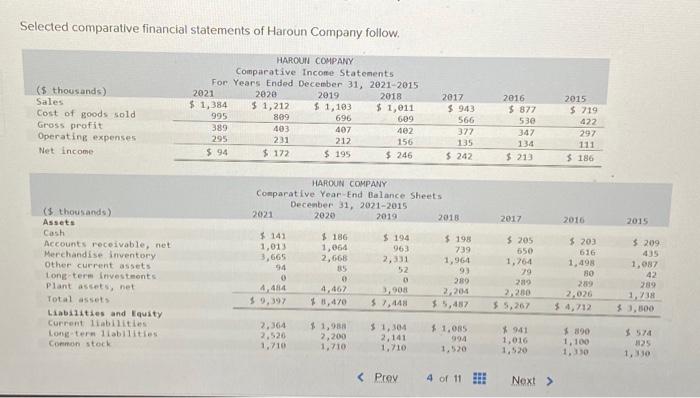

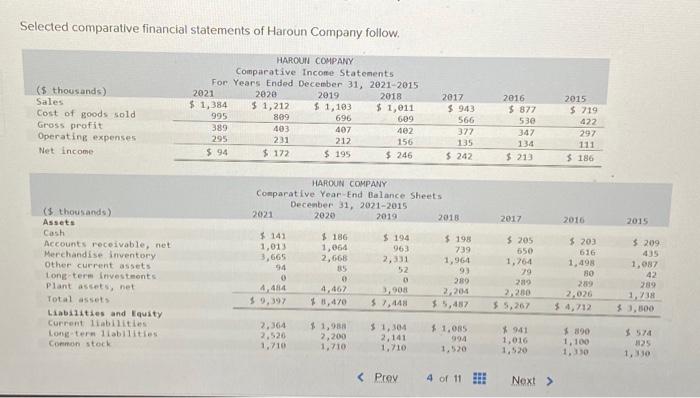

Selected comparative financial statements of Haroun Company follow. HAROUN COMPANY Comparative Income Statements For Years Ended December 31, 2021-2015 2019 2018 ($ thousands) Sales Cost

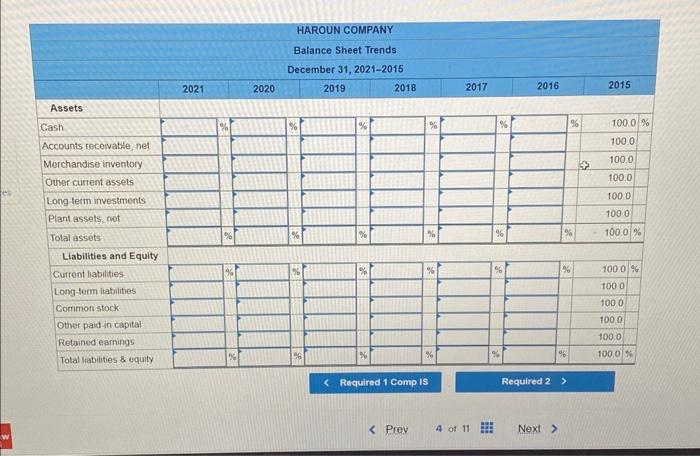

Selected comparative financial statements of Haroun Company follow. HAROUN COMPANY Comparative Income Statements For Years Ended December 31, 2021-2015 2019 2018 ($ thousands) Sales Cost of goods sold Gross profit Operating expenses Net income ($ thousands) Assets Cash Accounts receivable, net Merchandise inventory Other current assets Long-term investments Plant assets, net Total assets Liabilities and Equity Current liabilities Long-term liabilities Common stock 2021 $1,384 995 389 295 $94 2020 $ 1,212 809 403 231 $172 2021 $141 1,013 3,665 94 0 HAROUN COMPANY Comparative Year-End Balance Sheets December 31, 2021-2015 2020 2019 4,484 $9,397 $ 1,103 696 407 212 $195 2,364 2,526 1,710 $186 1,064 2,668 85 0 4,467 $ 8,470 $ 1,011 609 $ 1,988 2,200 1,710 402 156 $246 $194 963 2,331 52 0 3,908 $ 7,448 $ 1,304 2,141 2017

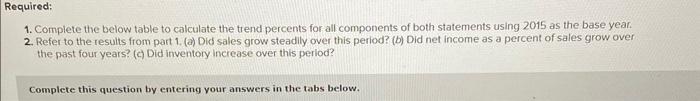

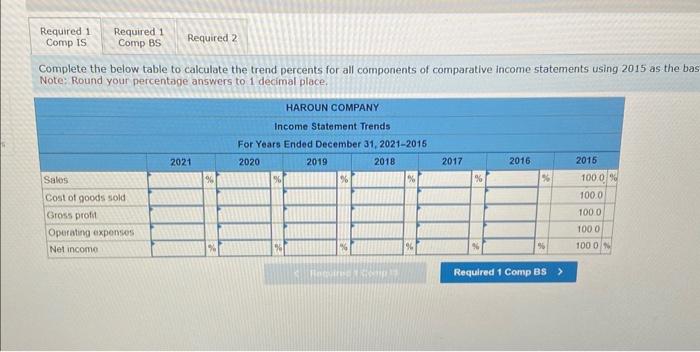

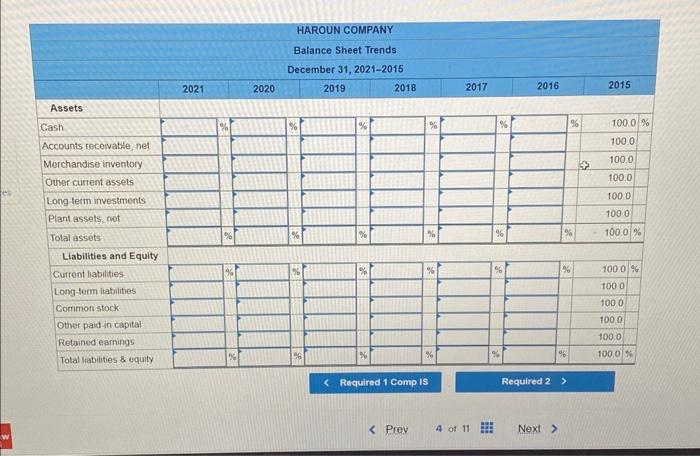

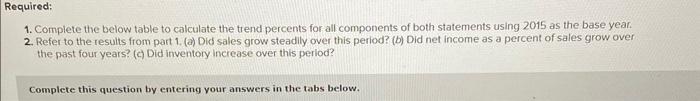

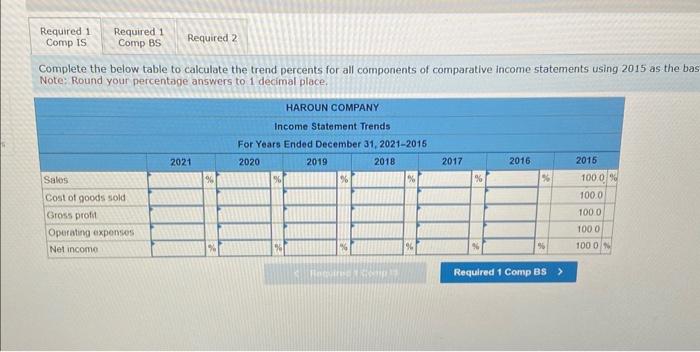

1. Complete the below table to calculate the trend percents for all components of both statements using 2015 as the base year. 2. Refer to the results from part 1. (a) Did sales grow steadily over this period? (b) Did net income as a percent of sales grow over the past four years? (c) Did inventory increase over this period? Complete the below table to calculate the trend percents for all components of comparative income statements using 2015 as the Note: Round your percentage answers to 1 decimal place. Selected comparative financial statements of Haroun Company follow

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started