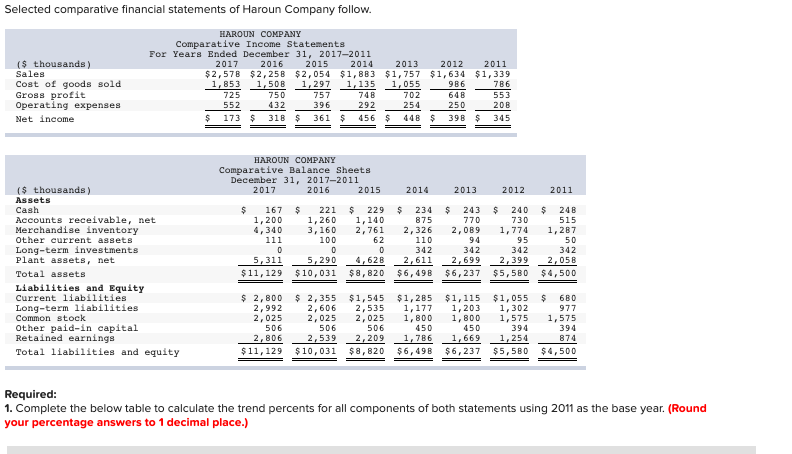

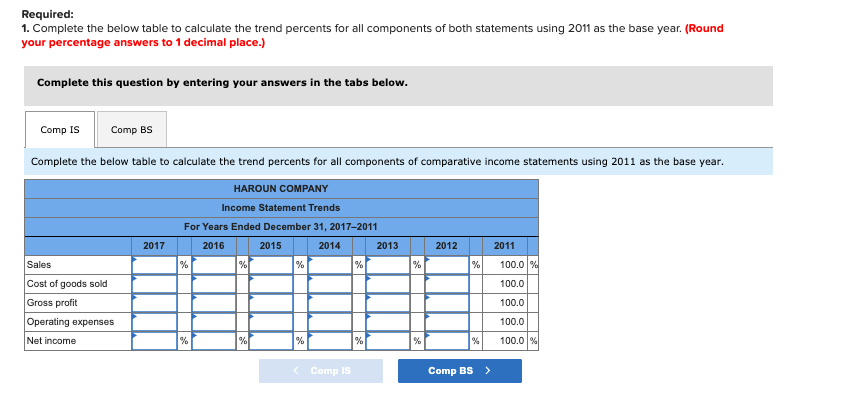

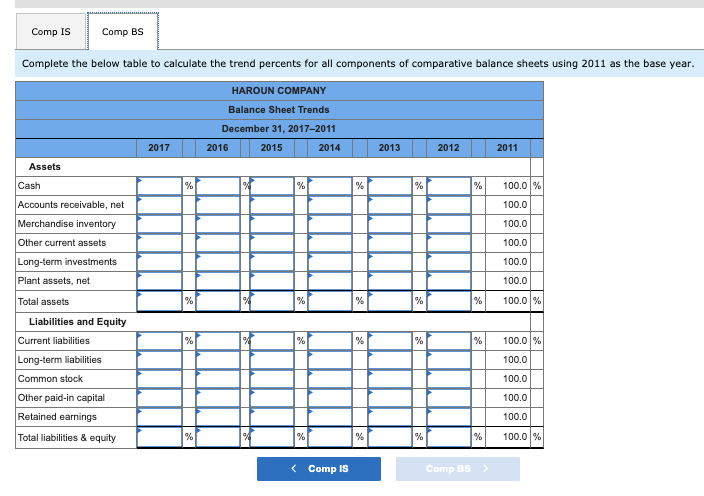

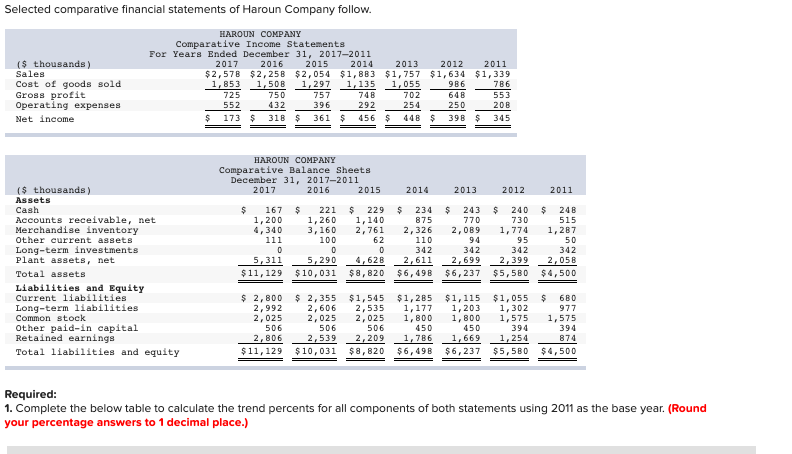

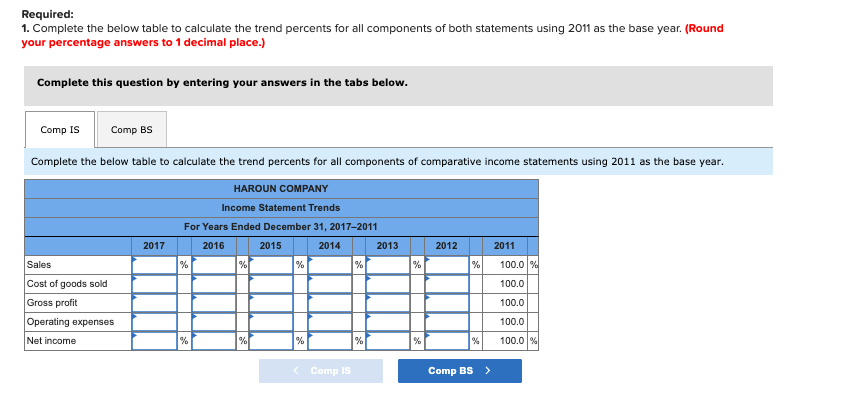

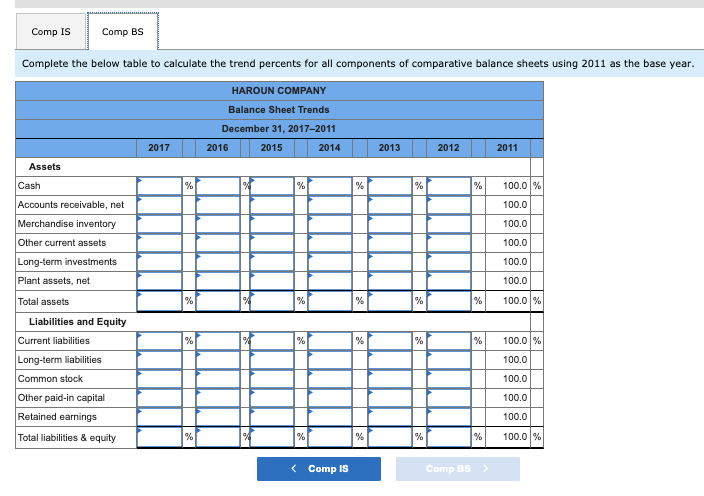

Selected comparative financial statements of Haroun Company follow. ($ thousands) Sales Cost of goods sold Gross profit Operating expenses Net income HAROUN COMPANY Comparative Income Statements For Years Ended December 31, 2017-2011 2017 2016 2015 2014 2013 2012 2011 $2,578 $2,250 $2,054 $1,883 $1,757 $1,634 $1,339 1,853 1,500 1,297 1,135 1,055 9B6 786 725 750 757 748 702 64B 553 552 432 396 292 254 250 20B $ 173 $ 318 $ 361 $ 456 S $ 398 $ 345 HAROUN COMPANY Comparative Balance Sheets December 31, 2017-2011 2017 2016 2015 2014 2013 2012 2011 ($ thousands) Assets Cash Accounts receivable, net Merchandise inventory Other current assets Long-term investments Plant assets, net Total assets Liabilities and Equity Current liabilities Long-term liabilities Common stock Other paid-in capital Retained earnings Total liabilities and equity $ 167 $ 221 1,200 1,260 4,340 3,160 111 100 0 0 5,311 5,290 $11,129 $10,031 $ 229 1,140 2,761 62 0 4,628 $8,820 $ 234 $ 243 $ 240 $ 248 875 770 730 515 2,326 2,089 1,774 1,287 110 94 95 50 342 342 342 342 2,611 2,699 2,399 2,058 $6,498 $6,237 $5,500 $4,500 $ 2,800 $ 2,355 2,992 2,606 2,025 2,025 506 506 2,806 2,539 $11,129 $10,031 $1,545 2,535 2,025 506 2,209 $8,820 $1,285 $1,115 $1,055 $ 680 1,177 1,203 1, 302 977 1,800 1,800 1,575 1,575 450 450 394 394 1,786 1,669 1,254 874 $6,498 $6,237 $5,500 $4,500 Required: 1. Complete the below table to calculate the trend percents for all components of both statements using 2011 as the base year. (Round your percentage answers to 1 decimal place.) Comp IS Comp BS Complete the below table to calculate the trend percents for all components of comparative balance sheets using 2011 as the base year. HAROUN COMPANY Balance Sheet Trends December 31, 2017-2011 2017 2016 2015 2014 2013 2012 2011 Assets % % % % % 100.0 % 100.0 100.0 Cash Accounts receivable, net Merchandise inventory Other current assets Long-term investments Plant assets, net 100.0 100.0 100.0 % % % % % 100.0 % Total assets Liabilities and Equity Current liabilities % % % % % 100.0 % Long-term liabilities 100.0 100.0 100.0 Common stock Other paid-in capital Retained earnings Total liabilities & equity 100.0 % % % % % 100.0 %