Question

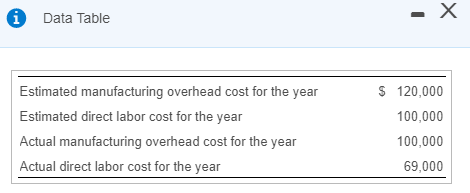

Selected cost data for a company are as follows: . 1. Compute the predetermined overhead allocation rate per direct labor dollar. Predetermined overhead / =

Selected cost data for a company are as follows:

.

1. Compute the predetermined overhead allocation rate per direct labor dollar.

|

|

|

|

| Predetermined overhead | |

|

| / |

| = | allocation rate | |

|

| / |

| = |

| % |

2 . Prepare the journal entry to allocate overhead cost for the year. (Record debits first, then credits. Exclude explanations from journalentries.)

| Date | Accounts | Debit | Credit | ||

| Dec. 31 |

|

|

| ||

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. Use a T-account to determine the amount of underallocated or overallocated manufacturing overhead.

Start by posting the actual and allocated manufacturing overhead to the T-account. (Use the first available cell to post each amount. Do not input the balance in the T-account.)

| Manufacturing Overhead | |||||

|

|

|

| |||

|

|

|

| |||

| Manufacturing overhead is |

| by $ |

| . |

Requirement 4 . Prepare the journal entry to adjust for the underallocated or overallocated manufacturing overhead. (Record debits first, then credits. Exclude explanations from journal entries.)

| Date | Accounts | Debit | Credit | ||

| Dec. 31 |

|

|

| ||

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started