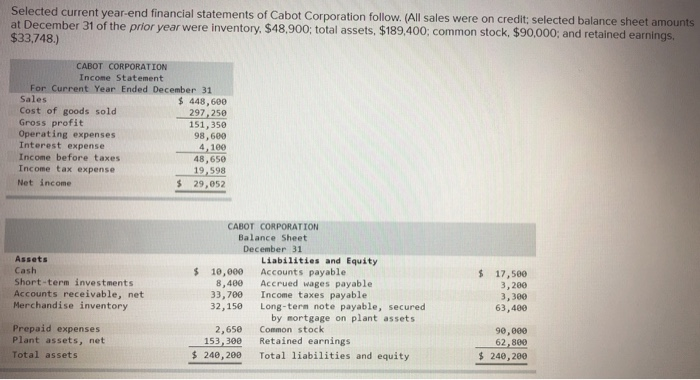

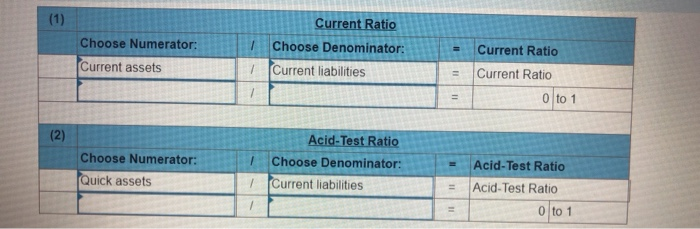

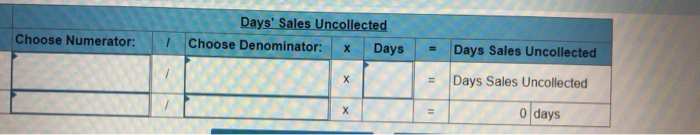

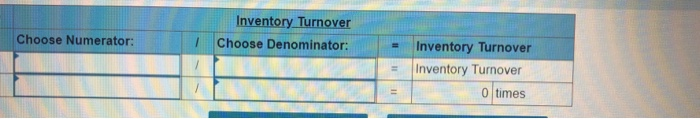

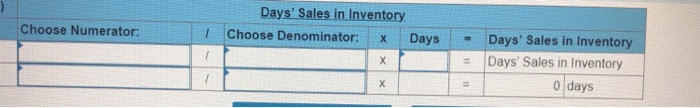

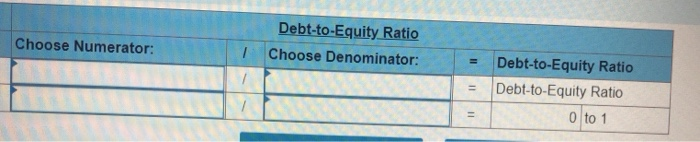

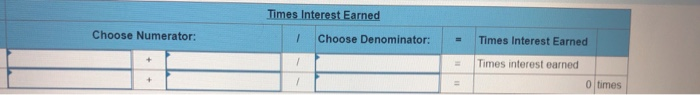

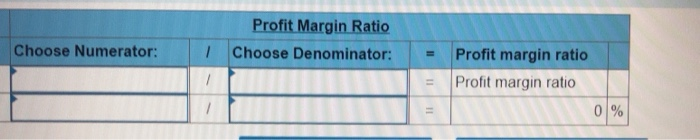

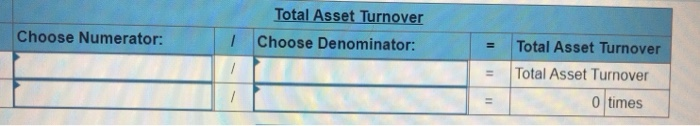

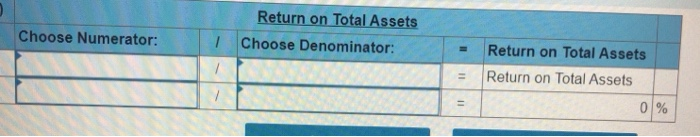

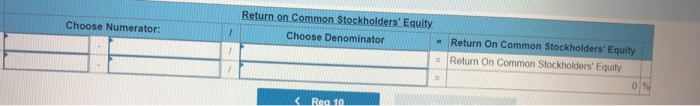

Selected current year-end financial statements of Cabot Corporation follow. (All sales were on credit; selected balance sheet amounts at December 31 of the prior year were inventory, $48,900; total assets, $189.400; common stock. $90,000; and retained earnings. $33,748.) CABOT CORPORATION Income Statement For Current Year Ended December 31 Sales $ 448,600 Cost of goods sold 297,250 Gross profit 151, 350 Operating expenses 98,600 Interest expense 4,100 Income before taxes 48,650 Income tax expense 19,598 Net income $ 29,052 Assets Cash Short-term investments Accounts receivable, net Merchandise inventory CABOT CORPORATION Balance Sheet December 31 Liabilities and Equity $ 10,000 Accounts payable 8,400 Accrued wages payable 33,700 Income taxes payable 32,150 Long-tern note payable, secured by mortgage on plant assets 2,650 Common stock 153,300 Retained earnings $ 240, 200 Total liabilities and equity $ 17,500 3,200 3,300 63,400 Prepaid expenses Plant assets, net Total assets 90,000 62,800 $ 240, 200 (1) Choose Numerator: = Current Ratio Current Ratio 7 Choose Denominator: 1 Current liabilities 7 Current assets Current Ratio 0 to 1 (2) 1 Choose Numerator: Quick assets Acid-Test Ratio Choose Denominator: Current liabilities 1 Acid-Test Ratio Acid-Test Ratio 0 to 1 Choose Numerator: Days' Sales Uncollected 1 Choose Denominator: Days Days Sales Uncollected Days Sales Uncollected 0 days Choose Numerator: Inventory Turnover Choose Denominator: Inventory Turnover Inventory Turnover 0 times Choose Numerator: 1 Days' Sales in Inventory Choose Denominator: Days X Days' Sales in Inventory Days' Sales in Inventory o days Choose Numerator: Debt-to-Equity Ratio 1 Choose Denominator: Il 11 Debt-to-Equity Ratio Debt-to-Equity Ratio 0 to 1 Times Interest Earned Choose Numerator: 1 Choose Denominator: Times Interest Earned Times interest earned 0 times Profit Margin Ratio Choose Denominator: Choose Numerator: 1 = 1 Profit margin ratio Profit margin ratio 0 % 1 Choose Numerator: Total Asset Turnover Choose Denominator: / II 1 = Total Asset Turnover Total Asset Turnover 0 times 1 11 Choose Numerator: Return on Total Assets Choose Denominator: 7 Return on Total Assets Return on Total Assets 11 0 % Choose Numerator: Return on Common Stockholders' Equity Choose Denominator - Return On Common Stockholders' Equity = Return On Common Stockholders' Equity 0