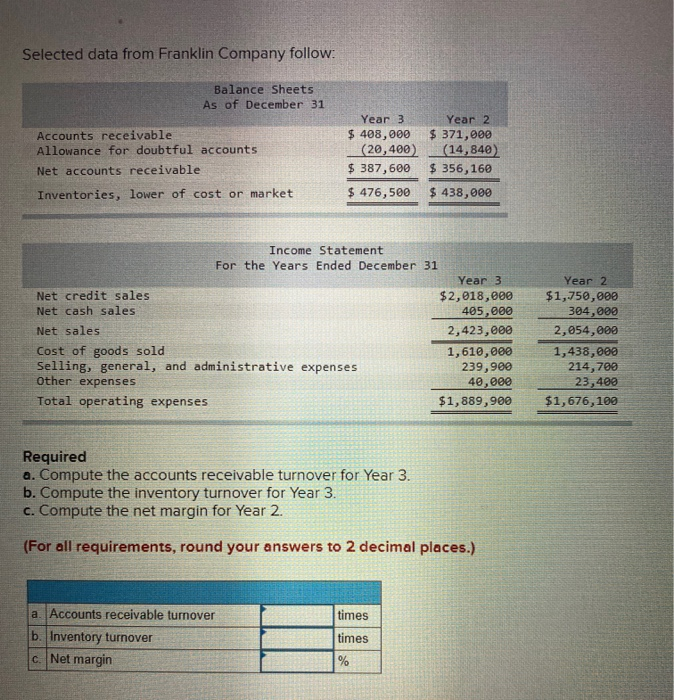

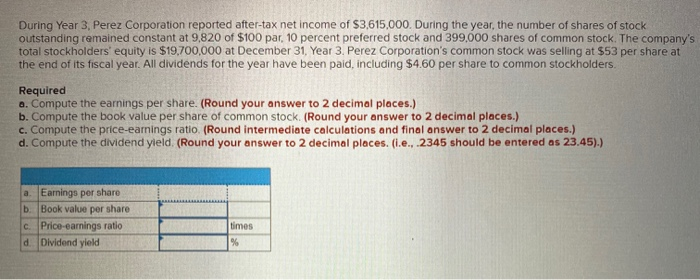

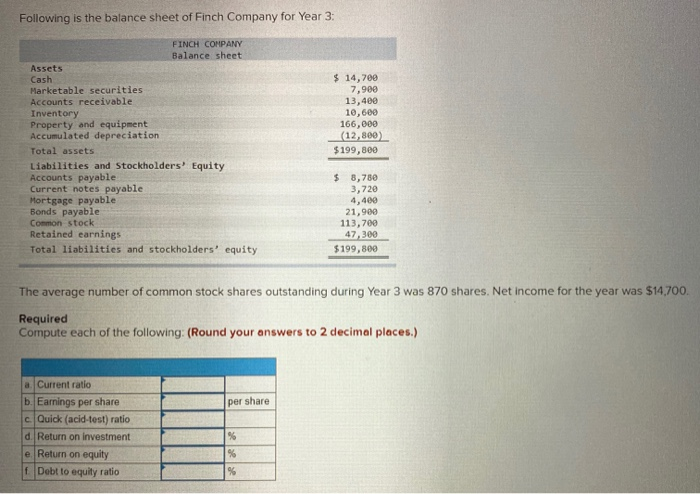

Selected data from Franklin Company follow: Balance Sheets As of December 31 Accounts receivable Allowance for doubtful accounts Net accounts receivable Year 3 Year 2 $ 408,000 $ 371,000 (20,400) (14,840) $ 387,600 $ 356,160 $ 476,500 438,000 Inventories, lower of cost or market Income Statement For the Years Ended December 31 Year 3 Net credit sales $2,018,000 Net cash sales 405,000 Net sales 2,423,000 Cost of goods sold 1,610,000 Selling, general, and administrative expenses 239,900 Other expenses 40,000 Total operating expenses $1,889,900 Year 2 $1,750,000 304,000 2,054,000 1,438,000 214,700 23,400 $1,676,100 Required a. Compute the accounts receivable turnover for Year 3. b. Compute the inventory turnover for Year 3. c. Compute the net margin for Year 2. (For all requirements, round your answers to 2 decimal places.) a. Accounts receivable turnover b. Inventory turnover c. Net margin times times % During Year 3. Perez Corporation reported after-tax net income of $3,615,000. During the year, the number of shares of stock outstanding remained constant at 9,820 of $100 par, 10 percent preferred stock and 399,000 shares of common stock. The company's total stockholders' equity is $19.700,000 at December 31, Year 3. Perez Corporation's common stock was selling at $53 per share at the end of its fiscal year. All dividends for the year have been paid, including $4.60 per share to common stockholders. Required a. Compute the earnings per share. (Round your answer to 2 decimal places.) b. Compute the book value per share of common stock. (Round your answer to 2 decimal places.) c. Compute the price-earnings ratio (Round intermediate calculations and final answer to 2 decimal places.) d. Compute the dividend yield. (Round your answer to 2 decimal places. (i.e.,.2345 should be entered as 23.45).) a. Earnings per share b. Book value per share c. Price-earnings ratio d. Dividend yield times % Following is the balance sheet of Finch Company for Year 3: FINCH COMPANY Balance sheet Assets Cash Marketable securities Accounts receivable Inventory Property and equipment Accumulated depreciation Total assets Liabilities and Stockholders' Equity Accounts payable Current notes payable Mortgage payable Bonds payable Common stock Retained earnings Total liabilities and stockholders' equity $ 14,700 7,900 13,400 10,600 166,000 12,800) $199,800 $ 8,780 3,720 4,400 21,900 113,700 47,300 $199,800 The average number of common stock shares outstanding during Year 3 was 870 shares. Net income for the year was $14.700. Required Compute each of the following: (Round your answers to 2 decimal places.) per share a. Current ratio b. Earnings per share c. Quick (acid-test) ratio d. Return on investment e. Return on equity f Debt to equity ratio % % %