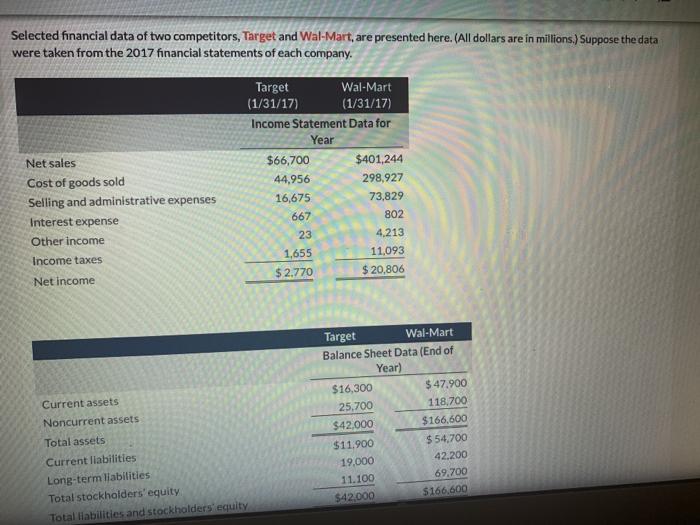

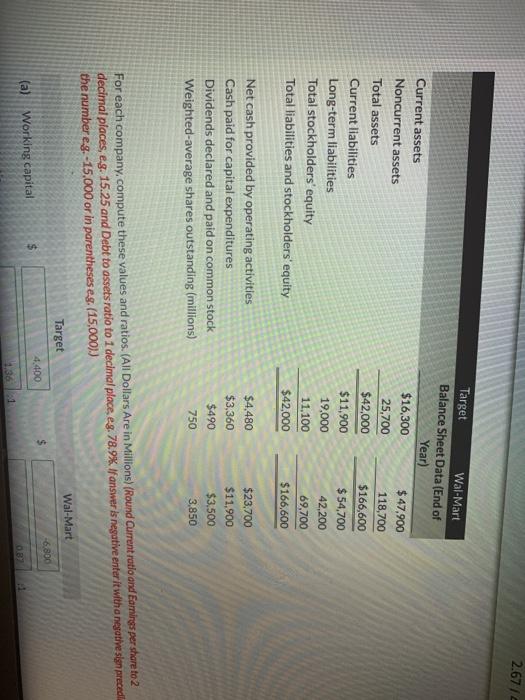

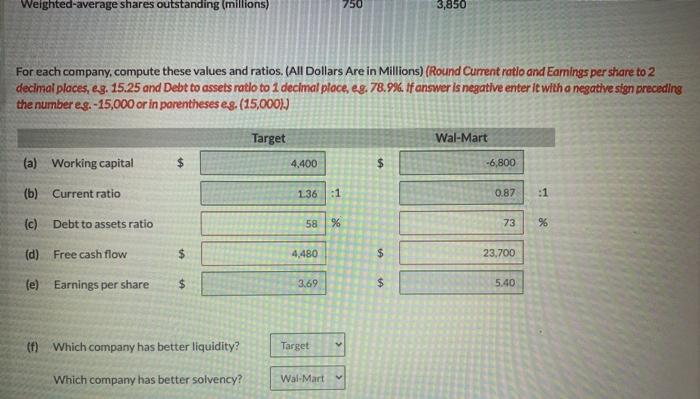

Selected financial data of two competitors, Target and Wal-Mart, are presented here. (All dollars are in millions.) Suppose the data were taken from the 2017 financial statements of each company. Net sales Cost of goods sold Selling and administrative expenses Interest expense Other income Income taxes Target Wal-Mart (1/31/17) (1/31/17) Income Statement Data for Year $66,700 $401,244 44,956 298,927 16,675 73,829 667 802 23 4,213 1,655 11,093 $ 2.770 $ 20,806 Net Income Current assets Noncurrent assets Total assets Target Wal-Mart Balance Sheet Data (End of Year) $16,300 $ 47.900 25,700 118,700 $42.000 $166,600 $11.900 $ 54,700 19.000 42.200 11.100 69,700 $42.000 $ 166,600 Current liabilities Long-term llabilities Total stockholders' equity Total liabilities and stockholders' equity 2.6712 Current assets Noncurrent assets Total assets Current liabilities Long-term liabilities Total stockholders' equity Total liabilities and stockholders' equity Target Wal-Mart Balance Sheet Data (End of Year) $16,300 $ 47,900 25,700 118,700 $42.000 $166,600 $11.900 $ 54,700 19,000 42,200 11,100 69,700 $42,000 $166,600 Net cash provided by operating activities Cash paid for capital expenditures Dividends declared and paid on common stock Weighted average shares outstanding (millions) $4,480 $3,360 $490 $23,700 $11.900 $3,500 3,850 750 For each company.compute these values and ratios. (All Dollars Are in Millions) (Round Current ratio and Earnings per share to 2 decimal places, eg. 15.25 and Debt to assets ratio to 1 decimal place. eg.78.9%. If answer is negative enter it with a negative sign precedi the number eg.-15.000 or in parentheses eg. (15,000).) Wal-Mart Target -6.800 4.400 (a) Working capital Weighted average shares outstanding (millions) 750 3,850 For each company, compute these values and ratios. (All Dollars Are in Millions) (Round Current ratio and Eamings per share to 2 decimal places, eg. 15.25 and Debt to assets ratio to 1 decimal place, eg. 78.9%. If answer is negative enter it with a negative sign preceding the number es. -15,000 or in parentheses es. (15,000).) Target Wal-Mart (a) Working capital $ 4,400 $ -6,800 (b) Current ratio 136 :1 0.87 :1 58 % 73 % (c) Debt to assets ratio (d) Free cash flow $ 4,480 $ 23,700 (e) Earnings per share $ 3,69 $ 5.40 (1) Which company has better liquidity? Target Which company has better solvency? Wal-Mart