Question

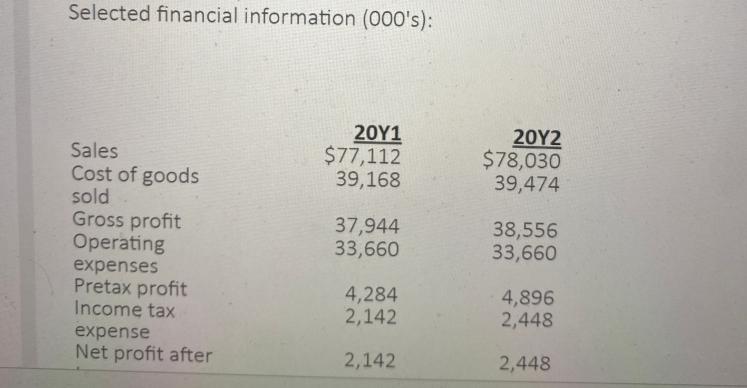

Selected financial information (000's): Sales Cost of goods sold Gross profit Operating expenses Pretax profit Income tax expense Net profit after 20Y1 $77,112 39,168

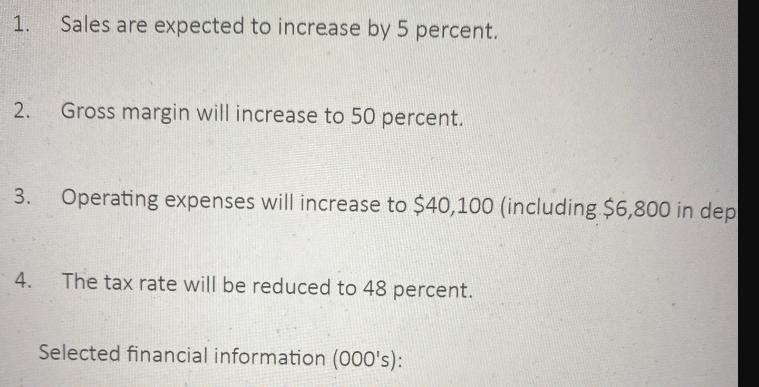

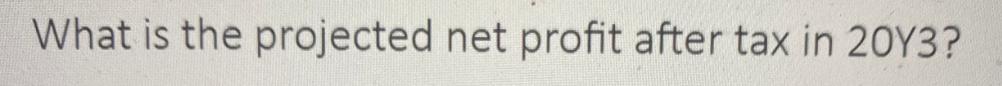

Selected financial information (000's): Sales Cost of goods sold Gross profit Operating expenses Pretax profit Income tax expense Net profit after 20Y1 $77,112 39,168 37,944 33,660 4,284 2,142 2,142 20Y2 $78,030 39,474 38,556 33,660 4,896 2,448 2,448 1. Sales are expected to increase by 5 percent. 2. Gross margin will increase to 50 percent. 3. Operating expenses will increase to $40,100 (including $6,800 in dep 4. The tax rate will be reduced to 48 percent. Selected financial information (000's): What is the projected net profit after tax in 20Y3?

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To analyze the impact of the given changes on the financial information lets calculate the revised f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting Tools for Business Decision Making

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso, Barbara Trenholm, Wayne Irvine

7th Canadian edition

1119368456, 978-1119211587, 1119211581, 978-1119320623, 978-1119368458

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App