Answered step by step

Verified Expert Solution

Question

1 Approved Answer

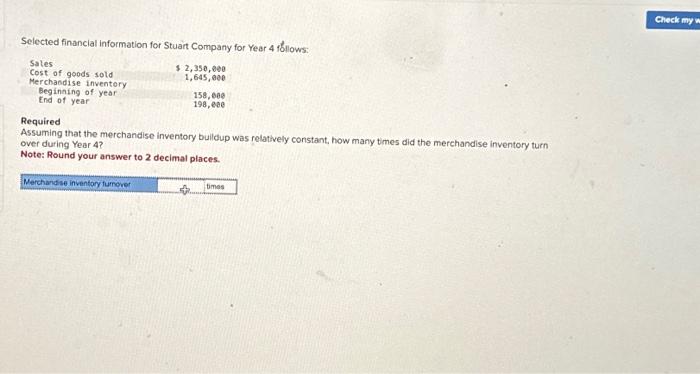

Selected financial information for Stuart Company for Year 4 follows: $ 2,350,000 1,645,000 Sales Cost of goods sold Merchandise inventory Beginning of year End of

Selected financial information for Stuart Company for Year 4 follows: $ 2,350,000 1,645,000 Sales Cost of goods sold Merchandise inventory Beginning of year End of year 158,000 198,000 Required Assuming that the merchandise inventory buildup was relatively constant, how many times did the merchandise inventory turn over during Year 4? Note: Round your answer to 2 decimal places. Merchandise inventory turnover times Check my w

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started