Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3.Penelope is a surgeon at the local hospital. However, the long hours have been very draining, and she has decided to take a leave

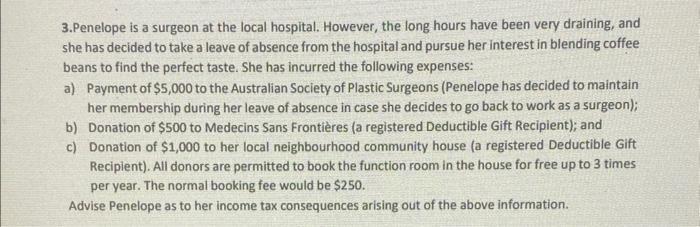

3.Penelope is a surgeon at the local hospital. However, the long hours have been very draining, and she has decided to take a leave of absence from the hospital and pursue her interest in blending coffee beans to find the perfect taste. She has incurred the following expenses: a) Payment of $5,000 to the Australian Society of Plastic Surgeons (Penelope has decided to maintain her membership during her leave of absence in case she decides to go back to work as a surgeon); b) Donation of $500 to Medecins Sans Frontires (a registered Deductible Gift Recipient); and c) Donation of $1,000 to her local neighbourhood community house (a registered Deductible Gift Recipient). All donors are permitted to book the function room in the house for free up to 3 times per year. The normal booking fee would be $250. Advise Penelope as to her income tax consequences arising out of the above information.

Step by Step Solution

★★★★★

3.33 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Answer Before Answering the questions made Penelope do...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started