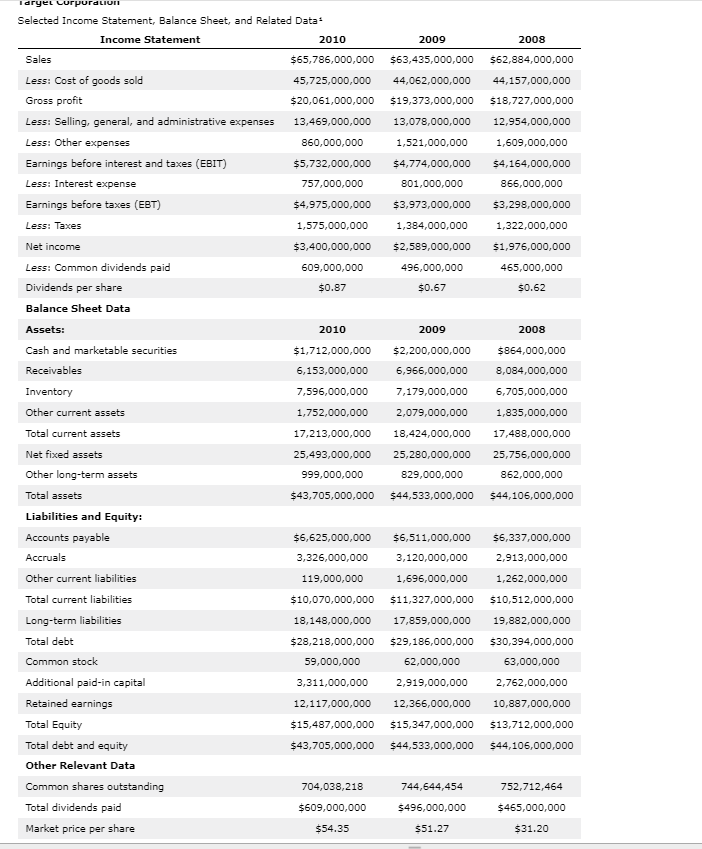

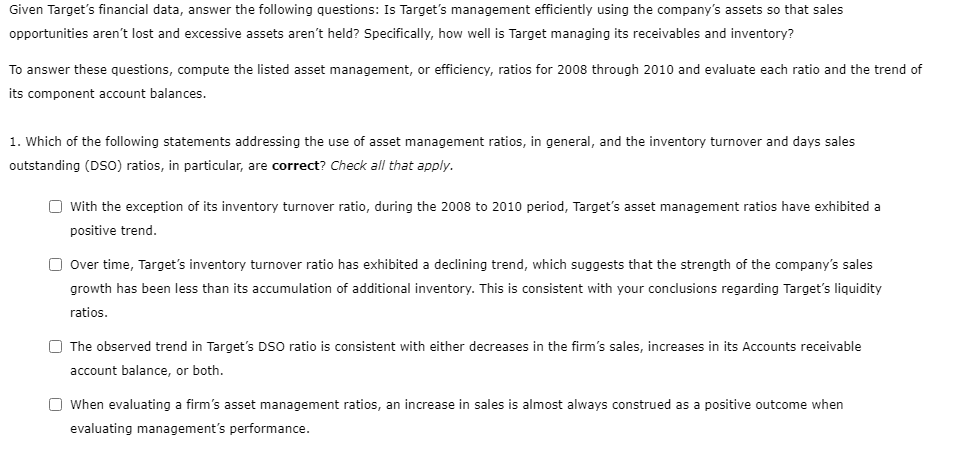

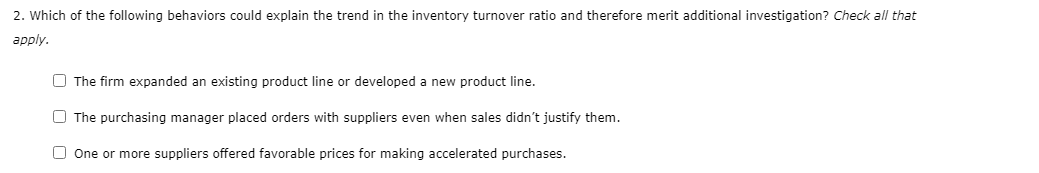

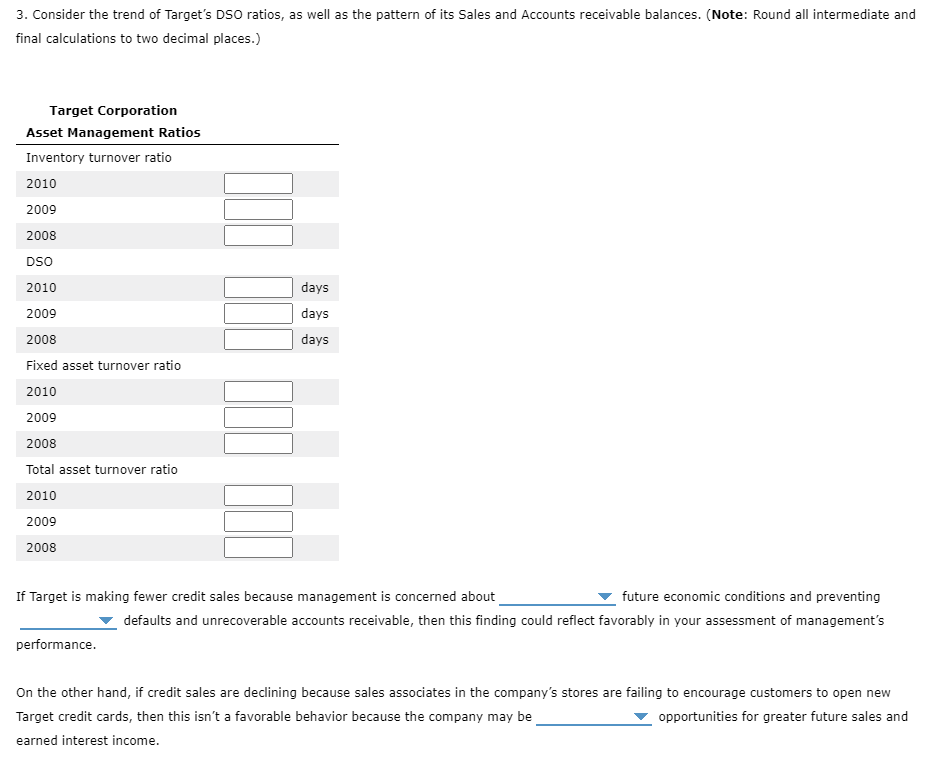

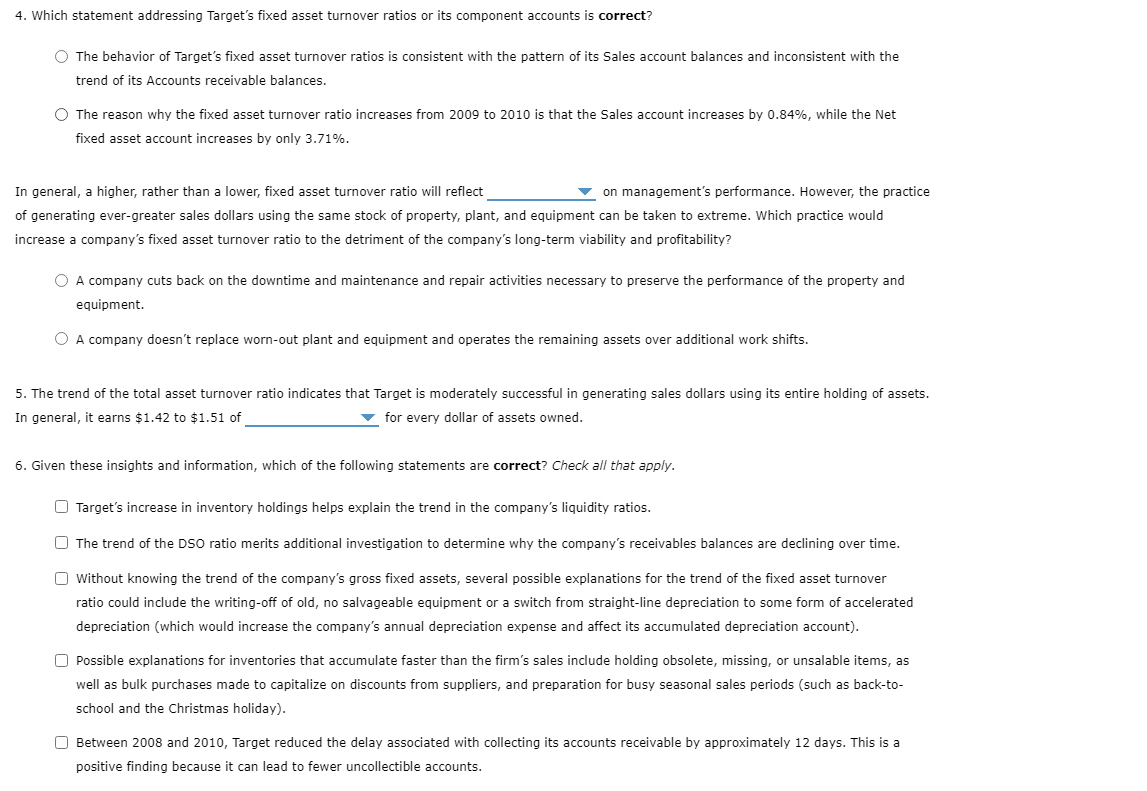

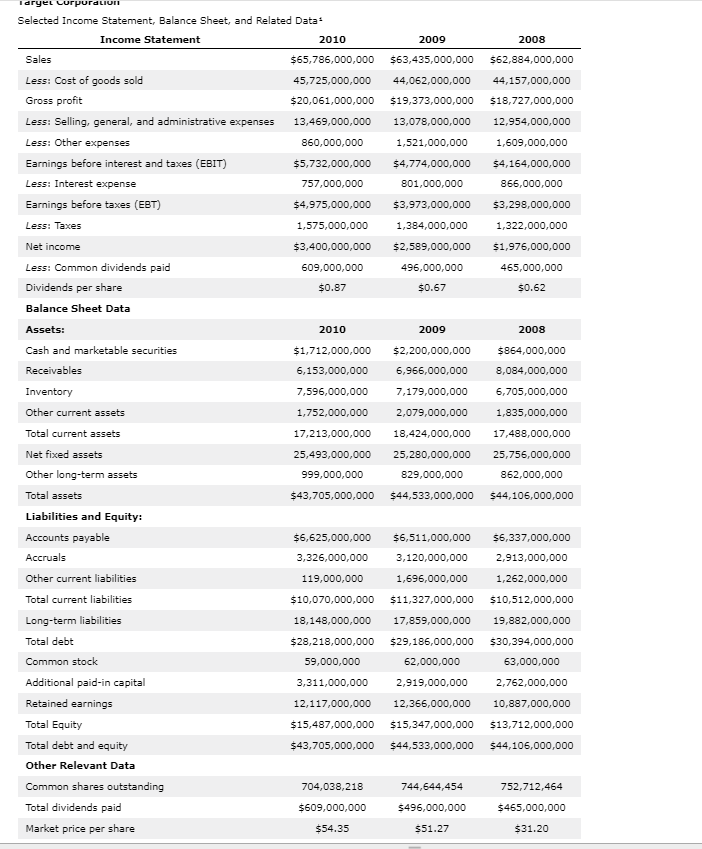

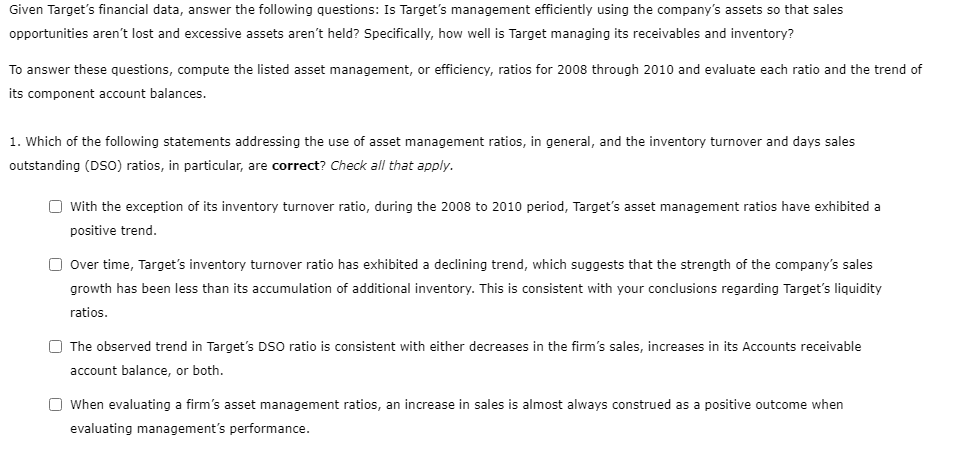

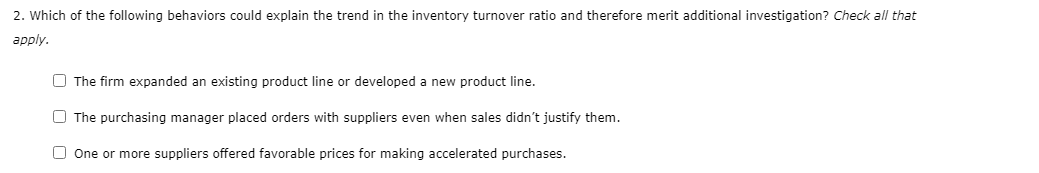

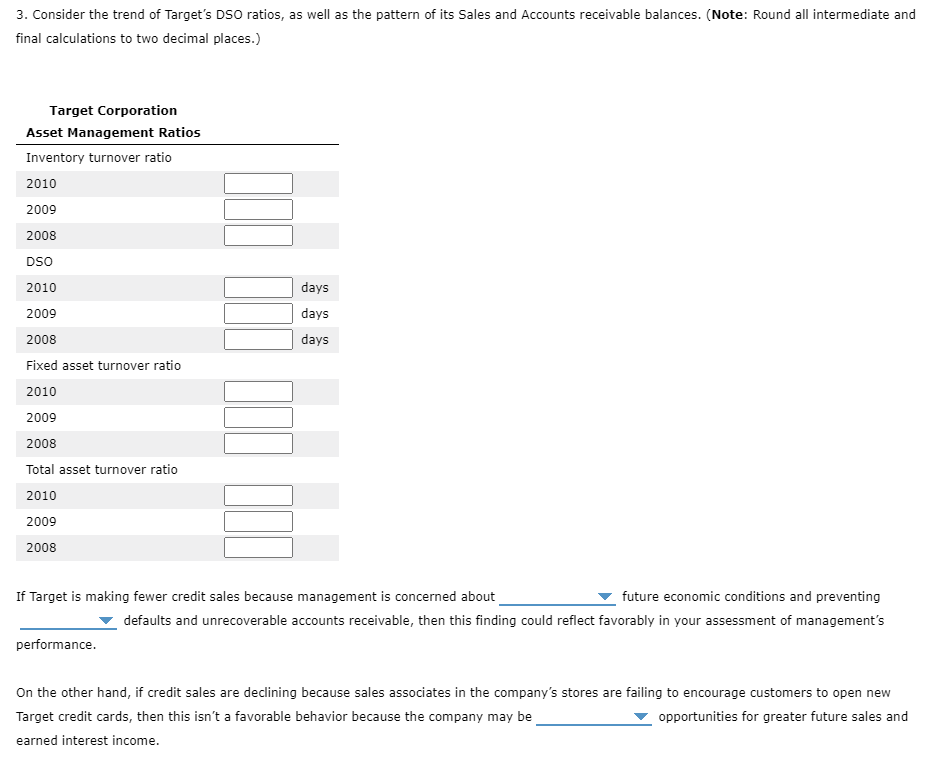

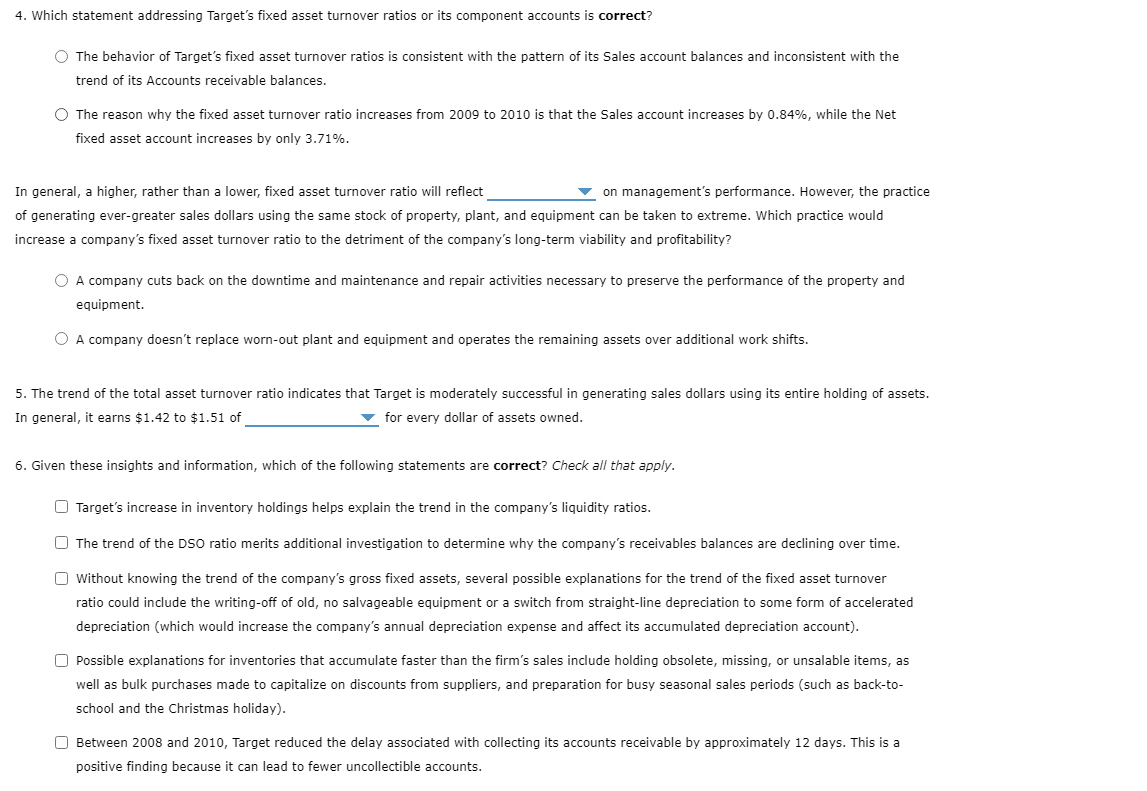

Selected Income Statement, Balance Sheet, and Related Data Liabilities and Equity: AccountspayableAccrualsOthercurrentliabilitiesTotalcurrentliabilitiesLong-termliabilitiesTotaldebtCommonstockAdditionalpaid-incapitalRetainedearningsTotalEquityTotaldebtandequity$6,625,000,0003,326,000,000119,000,000$10,070,000,00018,148,000,000$28,218,000,00059,000,000$311,000,00012,117,000,000$15,487,000,000$43,705,000,000$6,511,000,0003,120,000,0001,696,000,000$11,327,000,00017,859,000,000$29,186,000,00062,000,0002,919,000,00012,366,000,000$15,347,000,000$44,533,000,000$6,337,000,0002,913,000,0001,262,000,000$10,512,000,00019,882,000,000$30,394,000,00063,000,0002,762,000,00010,887,000,000$13,712,000,000$44,106,000,000 Given Target's financial data, answer the following questions: Is Target's management efficiently using the company's assets so that sales opportunities aren't lost and excessive assets aren't held? Specifically, how well is Target managing its receivables and inventory? To answer these questions, compute the listed asset management, or efficiency, ratios for 2008 through 2010 and evaluate each ratio and the trend its component account balances. 1. Which of the following statements addressing the use of asset management ratios, in general, and the inventory turnover and days sales outstanding (DSO) ratios, in particular, are correct? Check all that apply. With the exception of its inventory turnover ratio, during the 2008 to 2010 period, Target's asset management ratios have exhibited a positive trend. Over time, Target's inventory turnover ratio has exhibited a declining trend, which suggests that the strength of the company's sales growth has been less than its accumulation of additional inventory. This is consistent with your conclusions regarding Target's liquidity ratios. The observed trend in Target's DSO ratio is consistent with either decreases in the firm's sales, increases in its Accounts receivable account balance, or both. When evaluating a firm's asset management ratios, an increase in sales is almost always construed as a positive outcome when evaluating management's performance. 2. Which of the following behaviors could explain the trend in the inventory turnover ratio and therefore merit additional investigation? Check all that apply. The firm expanded an existing product line or developed a new product line. The purchasing manager placed orders with suppliers even when sales didn't justify them. One or more suppliers offered favorable prices for making accelerated purchases. 3. Consider the trend of Target's DSO ratios, as well as the pattern of its Sales and Accounts receivable balances. (Note: Round all intermediate and final calculations to two decimal places.) If Target is making fewer credit sales because management is concerned about future economic conditions and preventing defaults and unrecoverable accounts receivable, then this finding could reflect favorably in your assessment of management's performance. On the other hand, if credit sales are declining because sales associates in the company's stores are failing to encourage customers to open new Target credit cards, then this isn't a favorable behavior because the company may be opportunities for greater future sales and earned interest income. 4. Which statement addressing Target's fixed asset turnover ratios or its component accounts is correct? The behavior of Target's fixed asset turnover ratios is consistent with the pattern of its Sales account balances and inconsistent with the trend of its Accounts receivable balances. The reason why the fixed asset turnover ratio increases from 2009 to 2010 is that the Sales account increases by 0.84%, while the Net fixed asset account increases by only 3.71%. of generating ever-greater sales dollars using the same stock of property, plant, and equipment can be taken to extreme. Which practice increase a company's fixed asset turnover ratio to the detriment of the company's long-term viability and profitability? A company cuts back on the downtime and maintenance and repair activities necessary to preserve the performance of the property and equipment. A company doesn't replace worn-out plant and equipment and operates the remaining assets over additional work shifts. 5. The trend of the total asset turnover ratio indicates that Target is moderately successful in generating sales dollars using its entire holding of assets. In general, it earns $1.42 to $1.51 of for every dollar of assets owned. 6. Given these insights and information, which of the following statements are correct? Check all that apply. Target's increase in inventory holdings helps explain the trend in the company's liquidity ratios. The trend of the DSO ratio merits additional investigation to determine why the company's receivables balances are declining over time. Without knowing the trend of the company's gross fixed assets, several possible explanations for the trend of the fixed asset turnover ratio could include the writing-off of old, no salvageable equipment or a switch from straight-line depreciation to some form acceleration depreciation (which would increase the company's annual depreciation expense and affect its accumulated depreciation account). Possible explanations for inventories that accumulate faster than the firm's sales include holding obsolete, missing, or unsalable items, as well as bulk purchases made to capitalize on discounts from suppliers, and preparation for busy seasonal sales periods (such as back-toschool and the Christmas holiday). Between 2008 and 2010, Target reduced the delay associated with collecting its accounts receivable by approximately 12 days. This is a positive finding because it can lead to fewer uncollectible accounts. Selected Income Statement, Balance Sheet, and Related Data Liabilities and Equity: AccountspayableAccrualsOthercurrentliabilitiesTotalcurrentliabilitiesLong-termliabilitiesTotaldebtCommonstockAdditionalpaid-incapitalRetainedearningsTotalEquityTotaldebtandequity$6,625,000,0003,326,000,000119,000,000$10,070,000,00018,148,000,000$28,218,000,00059,000,000$311,000,00012,117,000,000$15,487,000,000$43,705,000,000$6,511,000,0003,120,000,0001,696,000,000$11,327,000,00017,859,000,000$29,186,000,00062,000,0002,919,000,00012,366,000,000$15,347,000,000$44,533,000,000$6,337,000,0002,913,000,0001,262,000,000$10,512,000,00019,882,000,000$30,394,000,00063,000,0002,762,000,00010,887,000,000$13,712,000,000$44,106,000,000 Given Target's financial data, answer the following questions: Is Target's management efficiently using the company's assets so that sales opportunities aren't lost and excessive assets aren't held? Specifically, how well is Target managing its receivables and inventory? To answer these questions, compute the listed asset management, or efficiency, ratios for 2008 through 2010 and evaluate each ratio and the trend its component account balances. 1. Which of the following statements addressing the use of asset management ratios, in general, and the inventory turnover and days sales outstanding (DSO) ratios, in particular, are correct? Check all that apply. With the exception of its inventory turnover ratio, during the 2008 to 2010 period, Target's asset management ratios have exhibited a positive trend. Over time, Target's inventory turnover ratio has exhibited a declining trend, which suggests that the strength of the company's sales growth has been less than its accumulation of additional inventory. This is consistent with your conclusions regarding Target's liquidity ratios. The observed trend in Target's DSO ratio is consistent with either decreases in the firm's sales, increases in its Accounts receivable account balance, or both. When evaluating a firm's asset management ratios, an increase in sales is almost always construed as a positive outcome when evaluating management's performance. 2. Which of the following behaviors could explain the trend in the inventory turnover ratio and therefore merit additional investigation? Check all that apply. The firm expanded an existing product line or developed a new product line. The purchasing manager placed orders with suppliers even when sales didn't justify them. One or more suppliers offered favorable prices for making accelerated purchases. 3. Consider the trend of Target's DSO ratios, as well as the pattern of its Sales and Accounts receivable balances. (Note: Round all intermediate and final calculations to two decimal places.) If Target is making fewer credit sales because management is concerned about future economic conditions and preventing defaults and unrecoverable accounts receivable, then this finding could reflect favorably in your assessment of management's performance. On the other hand, if credit sales are declining because sales associates in the company's stores are failing to encourage customers to open new Target credit cards, then this isn't a favorable behavior because the company may be opportunities for greater future sales and earned interest income. 4. Which statement addressing Target's fixed asset turnover ratios or its component accounts is correct? The behavior of Target's fixed asset turnover ratios is consistent with the pattern of its Sales account balances and inconsistent with the trend of its Accounts receivable balances. The reason why the fixed asset turnover ratio increases from 2009 to 2010 is that the Sales account increases by 0.84%, while the Net fixed asset account increases by only 3.71%. of generating ever-greater sales dollars using the same stock of property, plant, and equipment can be taken to extreme. Which practice increase a company's fixed asset turnover ratio to the detriment of the company's long-term viability and profitability? A company cuts back on the downtime and maintenance and repair activities necessary to preserve the performance of the property and equipment. A company doesn't replace worn-out plant and equipment and operates the remaining assets over additional work shifts. 5. The trend of the total asset turnover ratio indicates that Target is moderately successful in generating sales dollars using its entire holding of assets. In general, it earns $1.42 to $1.51 of for every dollar of assets owned. 6. Given these insights and information, which of the following statements are correct? Check all that apply. Target's increase in inventory holdings helps explain the trend in the company's liquidity ratios. The trend of the DSO ratio merits additional investigation to determine why the company's receivables balances are declining over time. Without knowing the trend of the company's gross fixed assets, several possible explanations for the trend of the fixed asset turnover ratio could include the writing-off of old, no salvageable equipment or a switch from straight-line depreciation to some form acceleration depreciation (which would increase the company's annual depreciation expense and affect its accumulated depreciation account). Possible explanations for inventories that accumulate faster than the firm's sales include holding obsolete, missing, or unsalable items, as well as bulk purchases made to capitalize on discounts from suppliers, and preparation for busy seasonal sales periods (such as back-toschool and the Christmas holiday). Between 2008 and 2010, Target reduced the delay associated with collecting its accounts receivable by approximately 12 days. This is a positive finding because it can lead to fewer uncollectible accounts