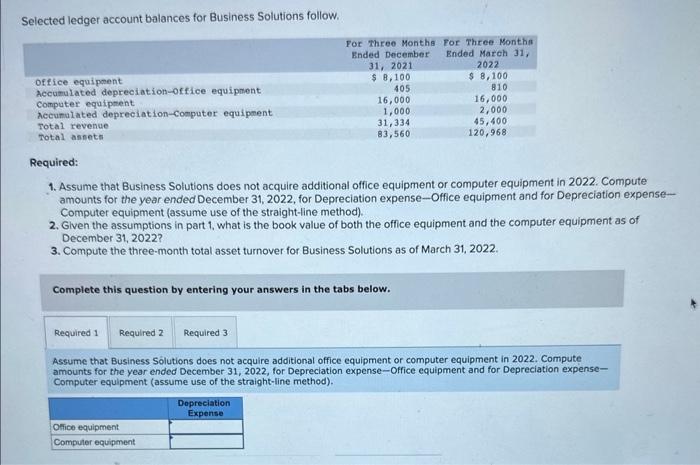

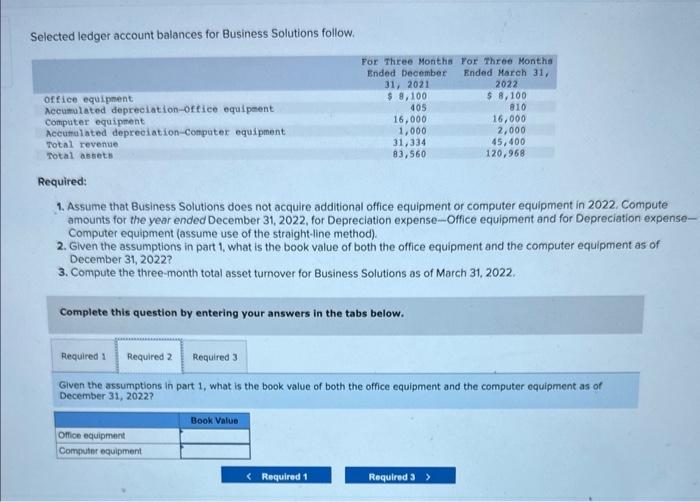

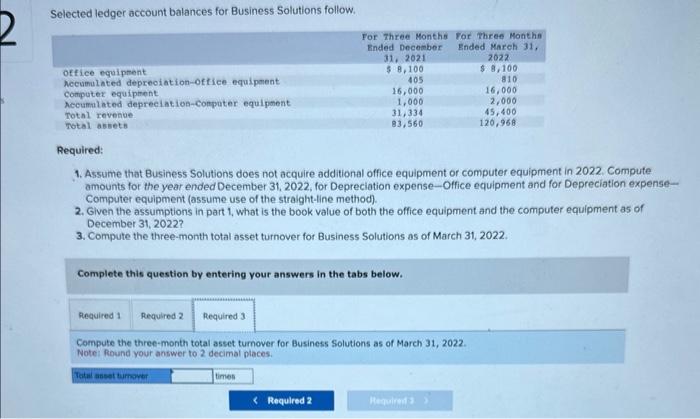

Selected ledger account balances for Business Solutions follow. Required: 1. Assume that Business Solutions does not acquire additional office equipment or computer equipment in 2022. Compute amounts for the year ended December 31, 2022, for Depreciation expense-Office equipment and for Depreciation expenseComputer equipment (assume use of the straight-line method). 2. Glven the assumptions in part 1, what is the book value of both the office equipment and the computer equipment as of December 31, 2022? 3. Compute the three-month total asset turnover for Business Solutions as of March 31, 2022. Complete this question by entering your answers in the tabs below. Assume that Business Sollutions does not acquire additional office equipment or computer equipment in 2022. Compute amounts for the year ended December 31, 2022, for Depreciation expense-Office equipment and for Depreciation expenseComputer equipment (assume use of the straight-line method). Selected ledger account balances for Business Solutions follow. Required: 1. Assume that Business Solutions does not acquire additional office equipment or computer equipment in 2022, Compute amounts for the year ended December 31, 2022, for Depreciation expense-Office equipment and for Depreciation expenseComputer equipment (assume use of the straight-line method). 2. Given the assumptions in part 1, what is the book value of both the office equipment and the computer equipment as of December 31, 2022? 3. Compute the three-month total asset tumover for Business Solutions as of March 31, 2022. Complete this question by entering your answers in the tabs below. Given the assumptions in part 1, what is the book value of both the office equipment and the computer equipment as of December 31,2022 ? Selected ledger account balances for Business Solutions follow. Required: 1. Assume that Business Solutions does not acquire additional office equipment or computer equipment in 2022 . Compute amounts for the year ended December 31, 2022, for Depreciation expense-Office equipment and for Depreciation expenseComputer equipment (assume use of the straight-line method). 2. Glven the assumptions in part 1, what is the book value of both the office equipment and the computer equipment as of December 31, 2022? 3. Compute the three-month total asset turnover for Business Solutions as of March 31, 2022. Complete this question by entering your answers in the tabs below. Compute the three-month total asset tumover for Business Solutions as of March 31, 2022. Notel Round your antwer to 2 decimal places