Answered step by step

Verified Expert Solution

Question

1 Approved Answer

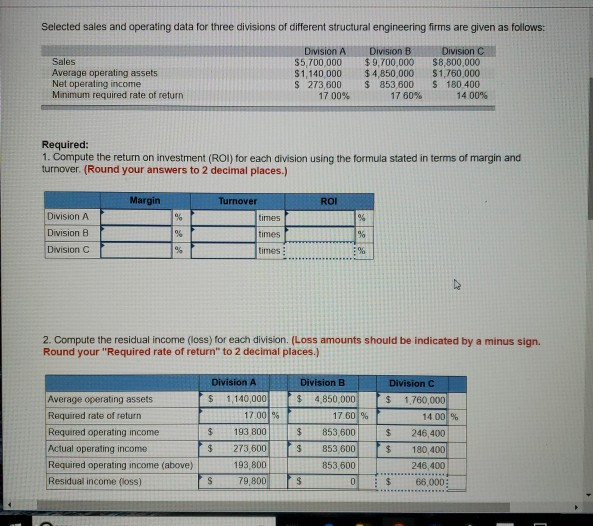

Selected sales and operating data for three divisions of different structural engineering firms are given as follows: Sales Average operating assets Net operating income Minimum

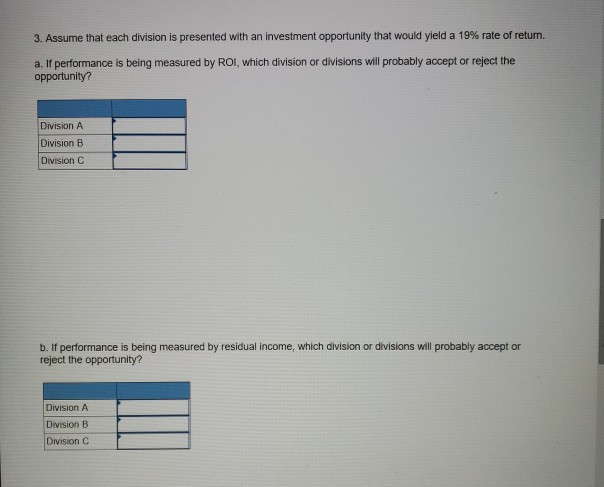

Selected sales and operating data for three divisions of different structural engineering firms are given as follows: Sales Average operating assets Net operating income Minimum required rate of return Division A Division B Division C $5,700,000 $9,700,000$8,800,000 S1,140,000 $4,850,000 S1,760,000 S 273,600 S 853,600 S 180 400 17 00% 17 60% 14 00% Required: 1. Compute the return on investment (ROI) for each division using the formula stated in terms of margin and turnover. (Round your answers to 2 decimal places.) Margin Turnover ROI Division A Division B Division C times times 2. Compute the residual income (loss) for each division. (Loss amounts should be indicated by a minus sign. Round your "Required rate of return" to 2 decimal places.) Division A Division B Division C Average operating assets Required rate of return Required operating income Actual operating income Required operating income (above) Residual income (loss) S 1,140,000 4,850,000 S 1,760,000 17 001% 17 601% 14 00 % S193 800 $273,600s 193,800 79,800 S853,600 853 600 853,600 $ 246,400 $ 180,400 246,400 $ 66,000; 3600 3, Assume that each division is presented with an investment opportunity that would yield a 19% rate of return. a. If performance is being measured by ROl, which division or divisions will probably accept or reject the opportunity? Division A Division B Division C b. If performance is being measured by residual income, which division or divisions will probably accept or reject the opportunity? Division A Division B Division C

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started