Answered step by step

Verified Expert Solution

Question

1 Approved Answer

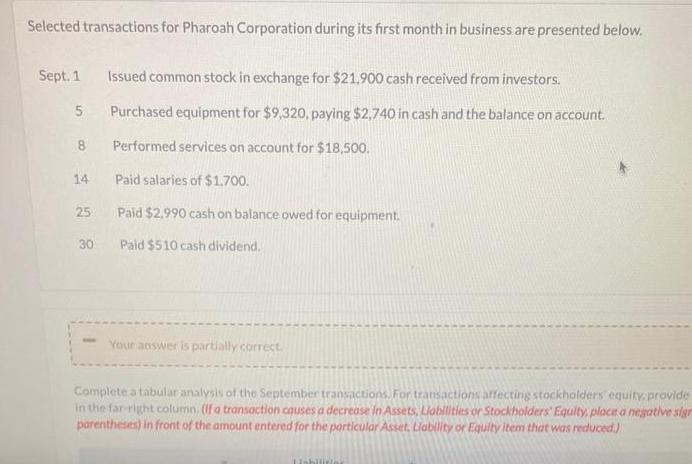

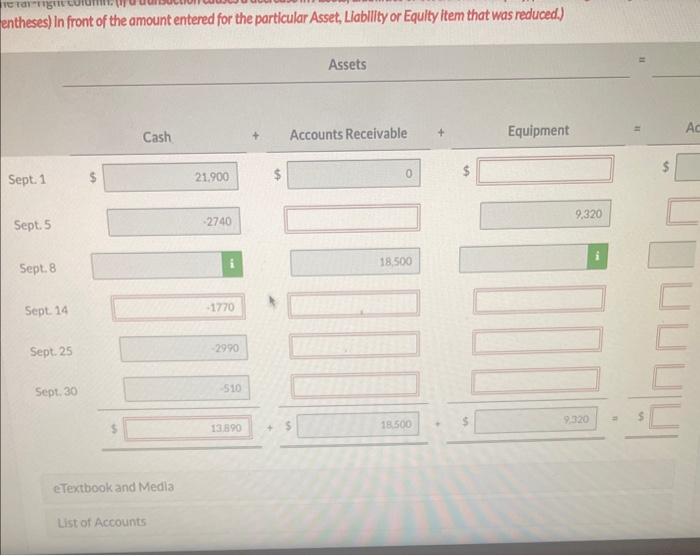

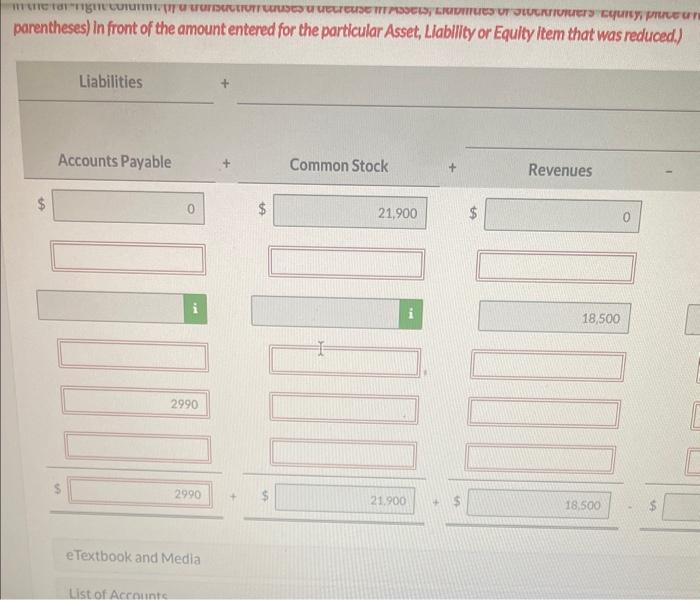

Selected transactions for Pharoah Corporation during its first month in business are presented below. Issued common stock in exchange for $21,900 cash received from

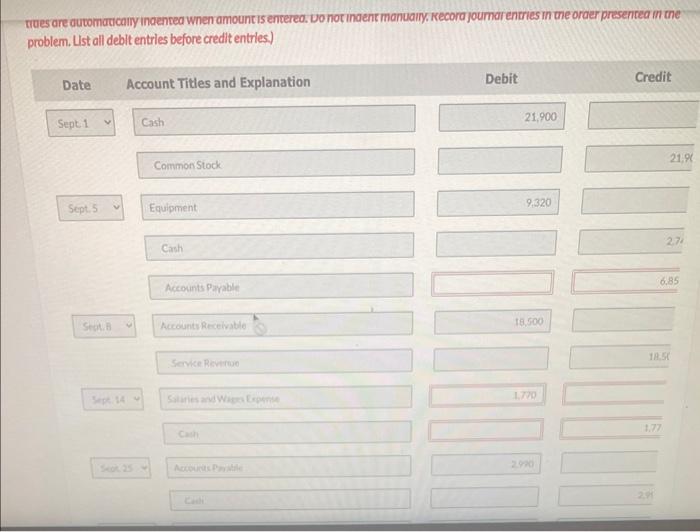

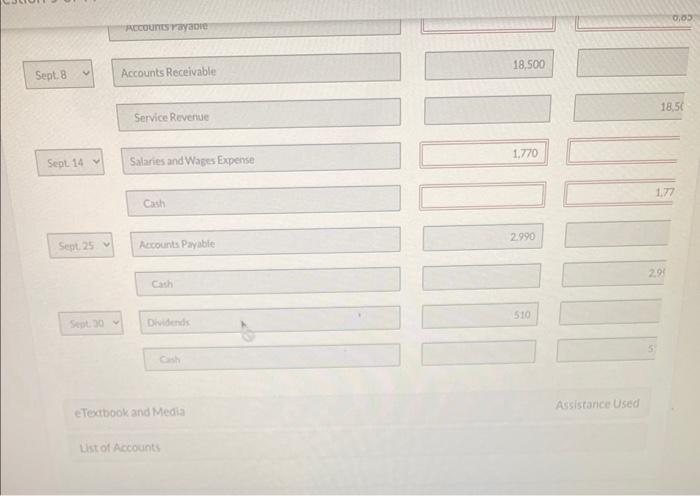

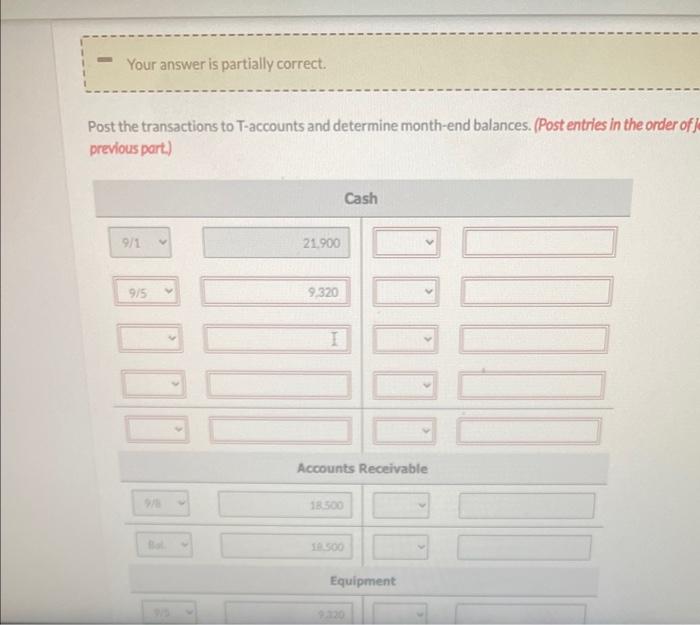

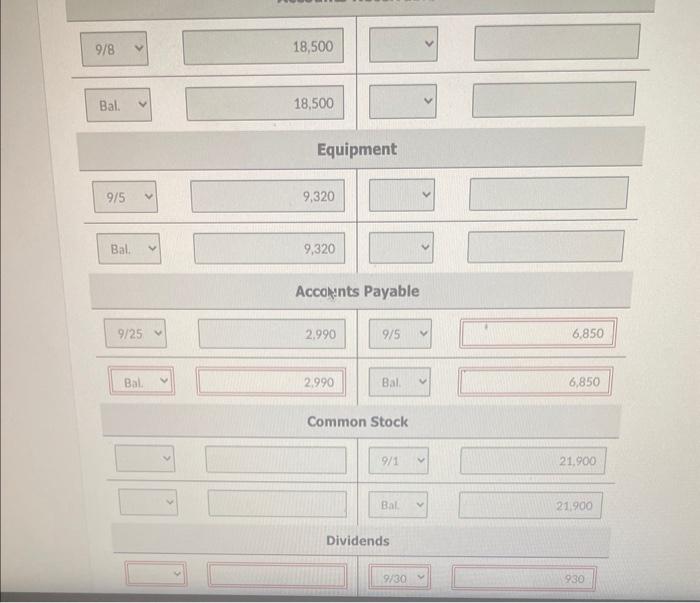

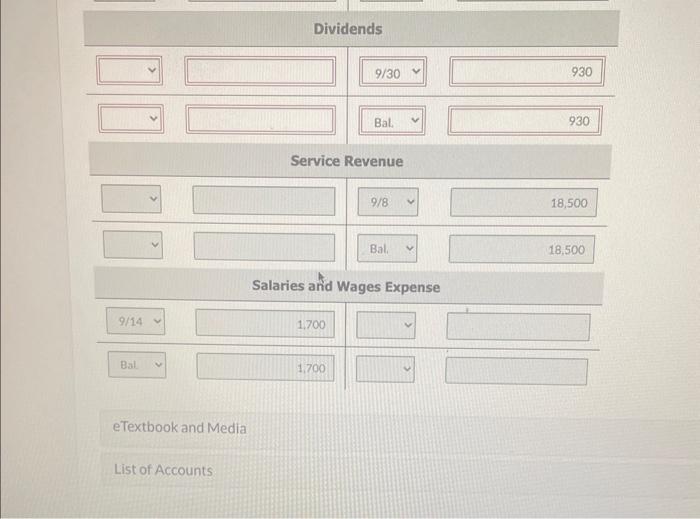

Selected transactions for Pharoah Corporation during its first month in business are presented below. Issued common stock in exchange for $21,900 cash received from investors. Purchased equipment for $9,320, paying $2,740 in cash and the balance on account. Performed services on account for $18,500. Paid salaries of $1,700. Paid $2,990 cash on balance owed for equipment. Paid $510 cash dividend. Sept. 1 5 8 14 25 30 Your answer is partially correct. Complete a tabular analysis of the September transactions. For transactions affecting stockholders equity, provide in the far-right column. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sigr parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Liabilitie he far right entheses) In front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Sept. 1 Sept. 5 Sept. 8 Sept. 14 Sept. 25 Sept. 30 Cash eTextbook and Media List of Accounts 21.900 -2740 -1770 -2990 -510 13.890 Assets Accounts Receivable 18,500 18,500 Equipment 9,320 JULE 9,320 Ac muneta night comum transaction causes a decrease PSSELS, RIDE ers cquity, procen parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) A Liabilities Accounts Payable S 2990 List of Accounte 2990 eTextbook and Media Common Stock 21,900 21.900 SA Revenues 18,500 100 18,500 The Tal arentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) enues 18.500 18.500 Stockholders' Equity Expenses eTextbook and Media List of Accounts I Retained Earnings 1.700 1,700 i Dividends 510 510 0 Issued Stock Service Revenue Salaries and Wages Expense Issued Stock Dividends trues are automatically indented when amount is entered. Do not indent manuairy. Recora journar entries in the order presented in the problem. List all debit entries before credit entries.) Date Sept. 1 Sept. 5 V Sept. B Account Titles and Explanation Cash Common Stock Equipment Cash Accounts Payable Accounts Receivable Service Revenue Salaries and Wages Expense Cash Debit 21,900 9.320 011000 18,500 1.770 2,990 Credit 1.77 110 21,9 18.50 2.91 2.74 6.85 Sept. 8 V Sept. 14 v Sept. 25 Sept. 30 Accounts Payable Accounts Receivable Service Revenue Salaries and Wages Expense Cash Accounts Payable Cash Dividends Cash eTextbook and Media List of Accounts 18,500 1.770 2.990 510 Assistance Used 0,05 18,50 1.77 2.91 Your answer is partially correct. Post the transactions to T-accounts and determine month-end balances. (Post entries in the order of Ja previous part.) 9/1 9/5 Bal 21,900 9,320 Accounts Receivable 18.500 Cash 18.500 Equipment 9.330 9/8 Bal. 9/5 Bal. < 9/25 - Bal 18,500 18,500 Equipment 9,320 9,320 Accounts Payable 2.990 2,990 9/5 Bal. Common Stock 9/1 Bal Dividends 9/30 - EN 6,850 6,850 21,900 21.900 930 9/14 V Bal V eTextbook and Media List of Accounts Dividends 9/30 Service Revenue 1,700 Bal 1.700 9/8 Bal Salaries and Wages Expense V 930 930 18,500 18,500 E Selected transactions for Pharoah Corporation during its first month in business are presented below. Issued common stock in exchange for $21,900 cash received from investors. Purchased equipment for $9,320, paying $2,740 in cash and the balance on account. Performed services on account for $18,500. Paid salaries of $1,700. Paid $2,990 cash on balance owed for equipment. Paid $510 cash dividend. Sept. 1 5 8 14 25 30 Your answer is partially correct. Complete a tabular analysis of the September transactions. For transactions affecting stockholders equity, provide in the far-right column. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sigr parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Liabilitie he far right entheses) In front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Sept. 1 Sept. 5 Sept. 8 Sept. 14 Sept. 25 Sept. 30 Cash eTextbook and Media List of Accounts 21.900 -2740 -1770 -2990 -510 13.890 Assets Accounts Receivable 18,500 18,500 Equipment 9,320 JULE 9,320 Ac muneta night comum transaction causes a decrease PSSELS, RIDE ers cquity, procen parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) A Liabilities Accounts Payable S 2990 List of Accounte 2990 eTextbook and Media Common Stock 21,900 21.900 SA Revenues 18,500 100 18,500 The Tal arentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) enues 18.500 18.500 Stockholders' Equity Expenses eTextbook and Media List of Accounts I Retained Earnings 1.700 1,700 i Dividends 510 510 0 Issued Stock Service Revenue Salaries and Wages Expense Issued Stock Dividends trues are automatically indented when amount is entered. Do not indent manuairy. Recora journar entries in the order presented in the problem. List all debit entries before credit entries.) Date Sept. 1 Sept. 5 V Sept. B Account Titles and Explanation Cash Common Stock Equipment Cash Accounts Payable Accounts Receivable Service Revenue Salaries and Wages Expense Cash Debit 21,900 9.320 011000 18,500 1.770 2,990 Credit 1.77 110 21,9 18.50 2.91 2.74 6.85 Sept. 8 V Sept. 14 v Sept. 25 Sept. 30 Accounts Payable Accounts Receivable Service Revenue Salaries and Wages Expense Cash Accounts Payable Cash Dividends Cash eTextbook and Media List of Accounts 18,500 1.770 2.990 510 Assistance Used 0,05 18,50 1.77 2.91 Your answer is partially correct. Post the transactions to T-accounts and determine month-end balances. (Post entries in the order of Ja previous part.) 9/1 9/5 Bal 21,900 9,320 Accounts Receivable 18.500 Cash 18.500 Equipment 9.330 9/8 Bal. 9/5 Bal. < 9/25 - Bal 18,500 18,500 Equipment 9,320 9,320 Accounts Payable 2.990 2,990 9/5 Bal. Common Stock 9/1 Bal Dividends 9/30 - EN 6,850 6,850 21,900 21.900 930 9/14 V Bal V eTextbook and Media List of Accounts Dividends 9/30 Service Revenue 1,700 Bal 1.700 9/8 Bal Salaries and Wages Expense V 930 930 18,500 18,500 E Selected transactions for Pharoah Corporation during its first month in business are presented below. Issued common stock in exchange for $21,900 cash received from investors. Purchased equipment for $9,320, paying $2,740 in cash and the balance on account. Performed services on account for $18,500. Paid salaries of $1,700. Paid $2,990 cash on balance owed for equipment. Paid $510 cash dividend. Sept. 1 5 8 14 25 30 Your answer is partially correct. Complete a tabular analysis of the September transactions. For transactions affecting stockholders equity, provide in the far-right column. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sigr parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Liabilitie he far right entheses) In front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Sept. 1 Sept. 5 Sept. 8 Sept. 14 Sept. 25 Sept. 30 Cash eTextbook and Media List of Accounts 21.900 -2740 -1770 -2990 -510 13.890 Assets Accounts Receivable 18,500 18,500 Equipment 9,320 JULE 9,320 Ac muneta night comum transaction causes a decrease PSSELS, RIDE ers cquity, procen parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) A Liabilities Accounts Payable S 2990 List of Accounte 2990 eTextbook and Media Common Stock 21,900 21.900 SA Revenues 18,500 100 18,500 The Tal arentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) enues 18.500 18.500 Stockholders' Equity Expenses eTextbook and Media List of Accounts I Retained Earnings 1.700 1,700 i Dividends 510 510 0 Issued Stock Service Revenue Salaries and Wages Expense Issued Stock Dividends trues are automatically indented when amount is entered. Do not indent manuairy. Recora journar entries in the order presented in the problem. List all debit entries before credit entries.) Date Sept. 1 Sept. 5 V Sept. B Account Titles and Explanation Cash Common Stock Equipment Cash Accounts Payable Accounts Receivable Service Revenue Salaries and Wages Expense Cash Debit 21,900 9.320 011000 18,500 1.770 2,990 Credit 1.77 110 21,9 18.50 2.91 2.74 6.85 Sept. 8 V Sept. 14 v Sept. 25 Sept. 30 Accounts Payable Accounts Receivable Service Revenue Salaries and Wages Expense Cash Accounts Payable Cash Dividends Cash eTextbook and Media List of Accounts 18,500 1.770 2.990 510 Assistance Used 0,05 18,50 1.77 2.91 Your answer is partially correct. Post the transactions to T-accounts and determine month-end balances. (Post entries in the order of Ja previous part.) 9/1 9/5 Bal 21,900 9,320 Accounts Receivable 18.500 Cash 18.500 Equipment 9.330 9/8 Bal. 9/5 Bal. < 9/25 - Bal 18,500 18,500 Equipment 9,320 9,320 Accounts Payable 2.990 2,990 9/5 Bal. Common Stock 9/1 Bal Dividends 9/30 - EN 6,850 6,850 21,900 21.900 930 9/14 V Bal V eTextbook and Media List of Accounts Dividends 9/30 Service Revenue 1,700 Bal 1.700 9/8 Bal Salaries and Wages Expense V 930 930 18,500 18,500 E Selected transactions for Pharoah Corporation during its first month in business are presented below. Issued common stock in exchange for $21,900 cash received from investors. Purchased equipment for $9,320, paying $2,740 in cash and the balance on account. Performed services on account for $18,500. Paid salaries of $1,700. Paid $2,990 cash on balance owed for equipment. Paid $510 cash dividend. Sept. 1 5 8 14 25 30 Your answer is partially correct. Complete a tabular analysis of the September transactions. For transactions affecting stockholders equity, provide in the far-right column. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sigr parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Liabilitie he far right entheses) In front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Sept. 1 Sept. 5 Sept. 8 Sept. 14 Sept. 25 Sept. 30 Cash eTextbook and Media List of Accounts 21.900 -2740 -1770 -2990 -510 13.890 Assets Accounts Receivable 18,500 18,500 Equipment 9,320 JULE 9,320 Ac muneta night comum transaction causes a decrease PSSELS, RIDE ers cquity, procen parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) A Liabilities Accounts Payable S 2990 List of Accounte 2990 eTextbook and Media Common Stock 21,900 21.900 SA Revenues 18,500 100 18,500 The Tal arentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) enues 18.500 18.500 Stockholders' Equity Expenses eTextbook and Media List of Accounts I Retained Earnings 1.700 1,700 i Dividends 510 510 0 Issued Stock Service Revenue Salaries and Wages Expense Issued Stock Dividends trues are automatically indented when amount is entered. Do not indent manuairy. Recora journar entries in the order presented in the problem. List all debit entries before credit entries.) Date Sept. 1 Sept. 5 V Sept. B Account Titles and Explanation Cash Common Stock Equipment Cash Accounts Payable Accounts Receivable Service Revenue Salaries and Wages Expense Cash Debit 21,900 9.320 011000 18,500 1.770 2,990 Credit 1.77 110 21,9 18.50 2.91 2.74 6.85 Sept. 8 V Sept. 14 v Sept. 25 Sept. 30 Accounts Payable Accounts Receivable Service Revenue Salaries and Wages Expense Cash Accounts Payable Cash Dividends Cash eTextbook and Media List of Accounts 18,500 1.770 2.990 510 Assistance Used 0,05 18,50 1.77 2.91 Your answer is partially correct. Post the transactions to T-accounts and determine month-end balances. (Post entries in the order of Ja previous part.) 9/1 9/5 Bal 21,900 9,320 Accounts Receivable 18.500 Cash 18.500 Equipment 9.330 9/8 Bal. 9/5 Bal. < 9/25 - Bal 18,500 18,500 Equipment 9,320 9,320 Accounts Payable 2.990 2,990 9/5 Bal. Common Stock 9/1 Bal Dividends 9/30 - EN 6,850 6,850 21,900 21.900 930 9/14 V Bal V eTextbook and Media List of Accounts Dividends 9/30 Service Revenue 1,700 Bal 1.700 9/8 Bal Salaries and Wages Expense V 930 930 18,500 18,500 E

Step by Step Solution

★★★★★

3.34 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

1 Tabular analysis Assets Liabilities Stockholders equity Cash Accounts recievable Equipment Account ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started