Answered step by step

Verified Expert Solution

Question

1 Approved Answer

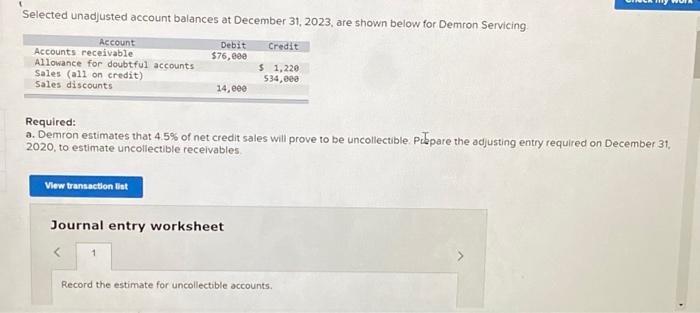

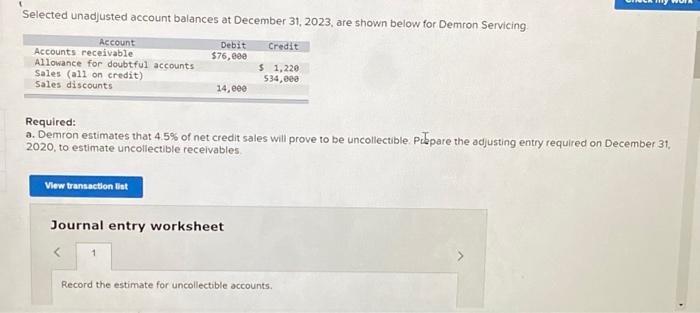

( Selected unadjusted account balances at December 31, 2023, are shown below for Demron Servicing. Debit $76,000 Account Accounts receivable Allowance for doubtful accounts Sales

( Selected unadjusted account balances at December 31, 2023, are shown below for Demron Servicing. Debit $76,000 Account Accounts receivable Allowance for doubtful accounts Sales (all on credit) Sales discounts View transaction list 14,000 Required: a. Demron estimates that 4.5% of net credit sales will prove to be uncollectible. Prepare the adjusting entry required on December 31, 2020, to estimate uncollectible receivables. Journal entry worksheet

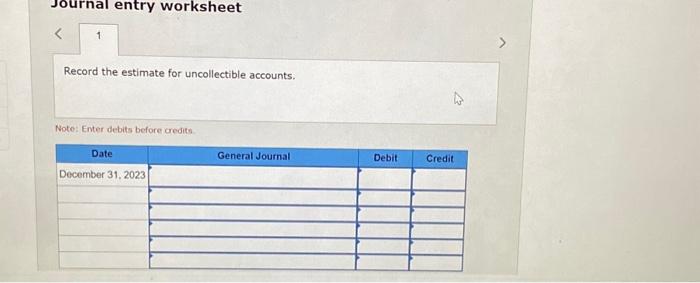

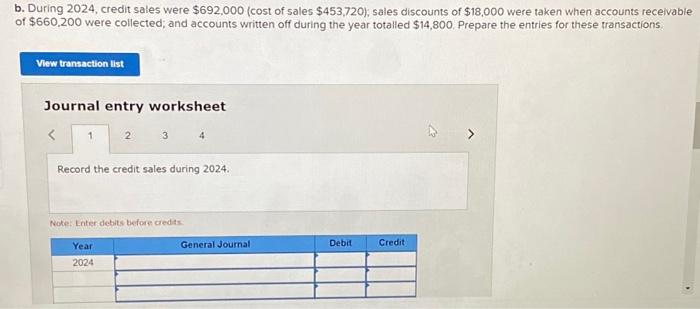

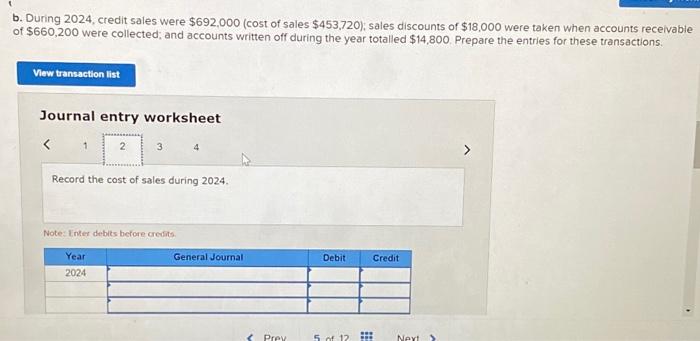

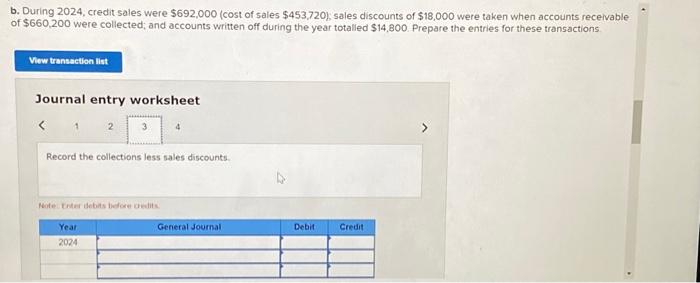

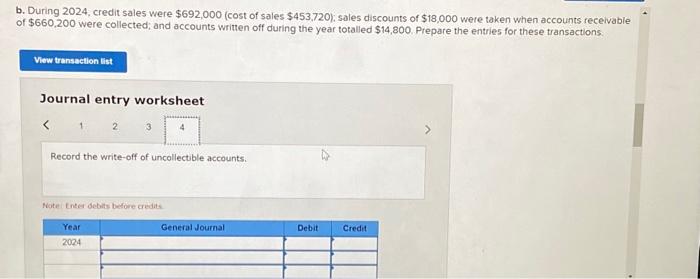

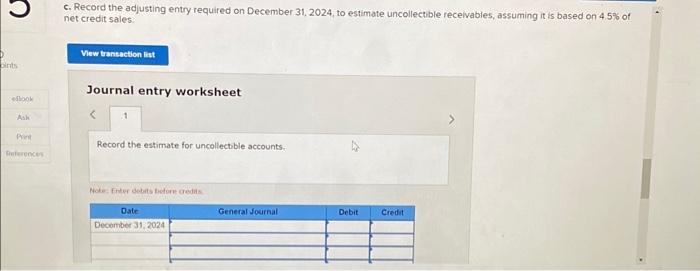

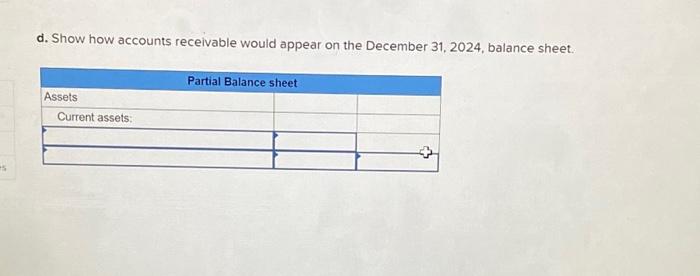

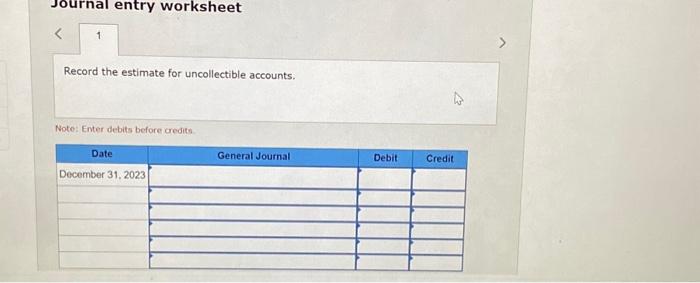

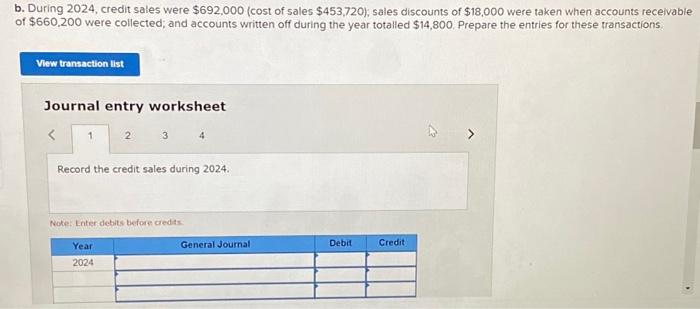

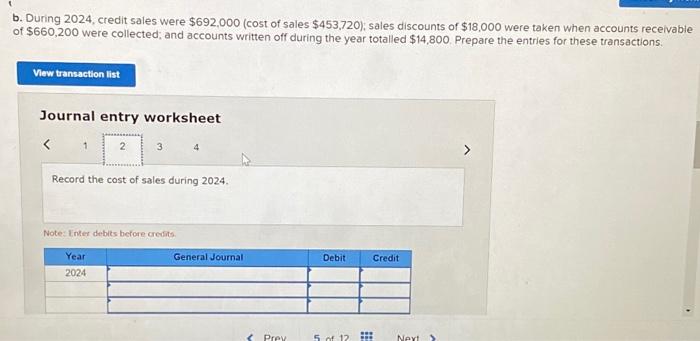

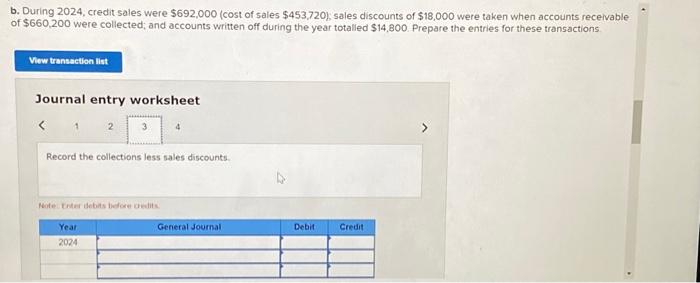

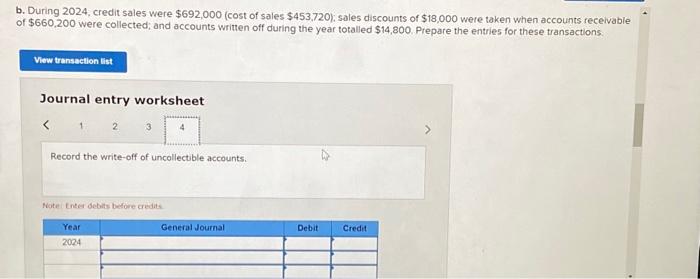

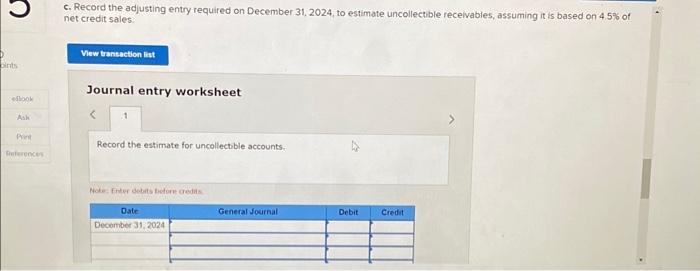

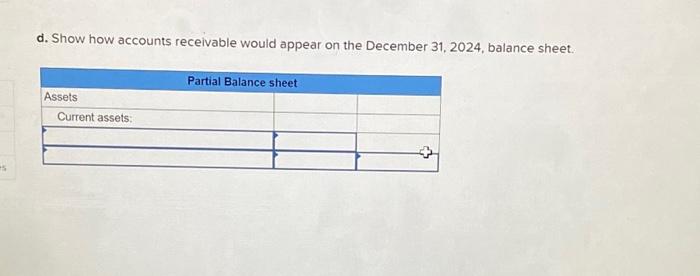

Selected unadjusted account balances at December 31,2023 , are shown below for Demron Servicing. Required: a. Demron estimates that 4.5% of net credit sales will prove to be uncollectible. Pibpare the adjusting entry required on December 31 , 2020 , to estimate uncollectible receivables. Journal entry worksheet Record the estimate for uncollectible accounts. Note: Enter debits before credits b. During 2024 , credit sales were $692,000 (cost of sales $453,720 ), sales discounts of $18,000 were taken when accounts receivable of $660,200 were collected; and accounts written off during the year totalled $14,800. Prepare the entries for these transactions Journal entry worksheet b. During 2024, credit sales were $692,000 (cost of sales $453,720 ); sales discounts of $18,000 were taken when accounts receivable of $660,200 were collected; and accounts written off during the year totalled $14,800. Prepare the entries for these transactions. Journal entry worksheet b. During 2024 , credit sales were $692,000 (cost of sales $453,720 ), sales discounts of $18,000 were taken when accounts receivable of $660,200 were collected; and accounts written off during the year totalled $14,800. Prepare the entrles for these transactions Journal entry worksheet b. During 2024, credit sales were $692,000 (cost of sales $453,720 ); sales discounts of $18,000 were taken when accounts recelvable of $660,200 were collected; and accounts written off during the year totalled $14,800. Prepare the entries for these transactions. Journal entry worksheet c. Record the adjusting entry required on December 31,2024 , to estimate uncollectble recelvables, assuming it is based on 4.5% of net credit sales: d. Show how accounts receivable would appear on the December 31, 2024, balance sheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started