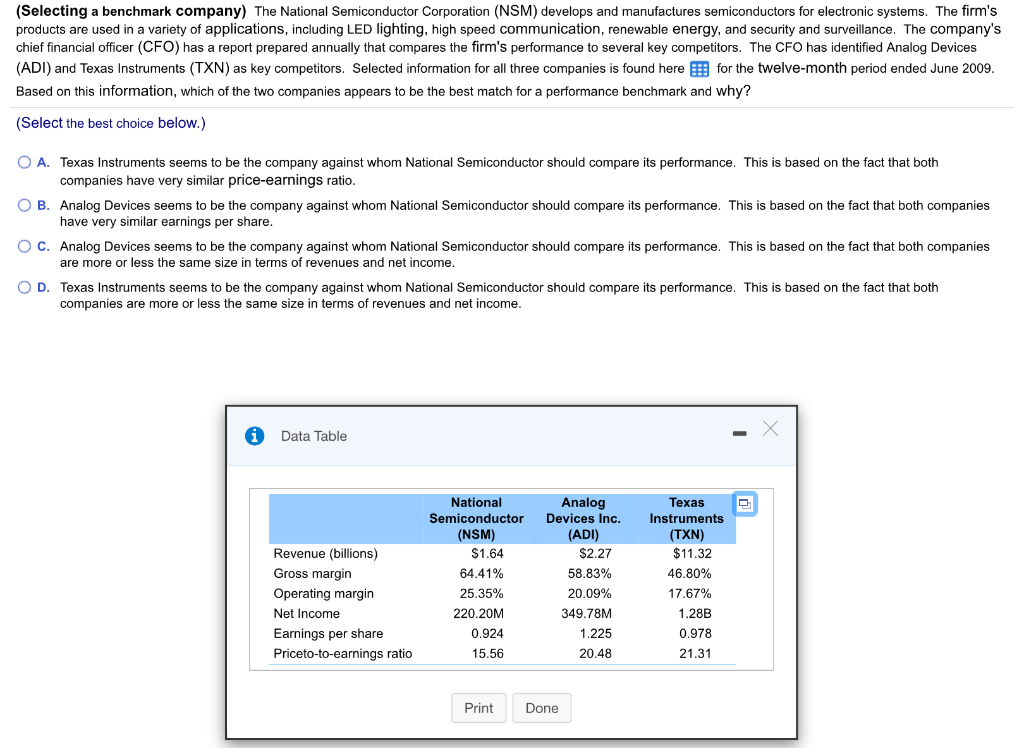

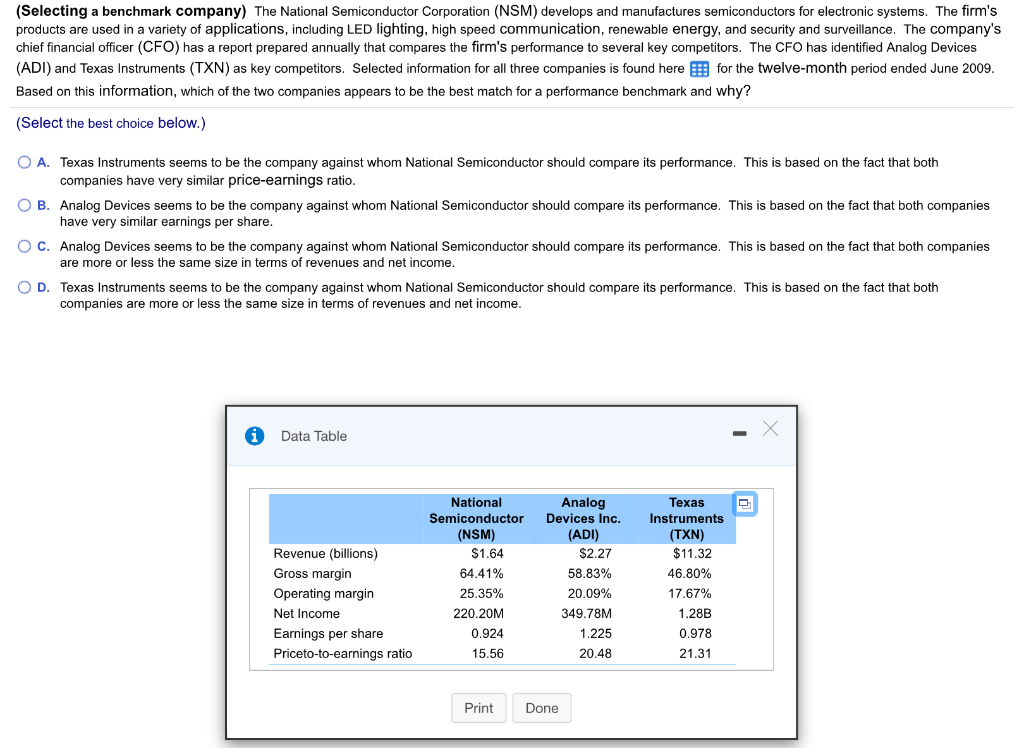

(Selecting a benchmark company) The National Semiconductor Corporation (NSM) develops and manufactures semiconductors for electronic systems. The firm's products are used in a variety of applications, including LED lighting, high speed communication, renewable energy, and security and surveillance. The company's chief financial officer (CFO) has a report prepared annually that compares the firm's performance to several key competitors. The CFO has identified Analog Devices (ADI) and Texas Instruments (TXN) as key competitors. Selected information for all three companies is found here for the twelve-month period ended June 2009. Based on this information, which of the two companies appears to be the best match for a performance benchmark and why? (Select the best choice below.) O A. Texas Instruments seems to be the company against whom National Semiconductor should compare its performance. This is based on the fact that both companies have very similar price-earnings ratio. O B. Analog Devices seems to be the company against whom National Semiconductor should compare its performance. This is based on the fact that both companies have very similar earnings per share. OC. Analog Devices seems to be the company against whom National Semiconductor should compare its performance. This is based on the fact that both companies are more or less the same size in terms of revenues and net income. OD. Texas Instruments seems to be the company against whom National Semiconductor should compare its performance. This is based on the fact that both companies are more or less the same size in terms of revenues and net income. 0 Data Table Revenue (billions) Gross margin Operating margin Net Income Earnings per share Priceto-to-earnings ratio National Semiconductor (NSM) $1.64 64.41% 25.35% 220.20M 0.924 Analog Devices Inc. (ADI) $2.27 58.83% 20.09% 349.78M 1.225 20.48 Texas Instruments (TXN) $11.32 46.80% 17.67% 1.28B 0.978 21.31 15.56 Print Done (Selecting a benchmark company) The National Semiconductor Corporation (NSM) develops and manufactures semiconductors for electronic systems. The firm's products are used in a variety of applications, including LED lighting, high speed communication, renewable energy, and security and surveillance. The company's chief financial officer (CFO) has a report prepared annually that compares the firm's performance to several key competitors. The CFO has identified Analog Devices (ADI) and Texas Instruments (TXN) as key competitors. Selected information for all three companies is found here for the twelve-month period ended June 2009. Based on this information, which of the two companies appears to be the best match for a performance benchmark and why? (Select the best choice below.) O A. Texas Instruments seems to be the company against whom National Semiconductor should compare its performance. This is based on the fact that both companies have very similar price-earnings ratio. O B. Analog Devices seems to be the company against whom National Semiconductor should compare its performance. This is based on the fact that both companies have very similar earnings per share. OC. Analog Devices seems to be the company against whom National Semiconductor should compare its performance. This is based on the fact that both companies are more or less the same size in terms of revenues and net income. OD. Texas Instruments seems to be the company against whom National Semiconductor should compare its performance. This is based on the fact that both companies are more or less the same size in terms of revenues and net income. 0 Data Table Revenue (billions) Gross margin Operating margin Net Income Earnings per share Priceto-to-earnings ratio National Semiconductor (NSM) $1.64 64.41% 25.35% 220.20M 0.924 Analog Devices Inc. (ADI) $2.27 58.83% 20.09% 349.78M 1.225 20.48 Texas Instruments (TXN) $11.32 46.80% 17.67% 1.28B 0.978 21.31 15.56 Print Done