Answered step by step

Verified Expert Solution

Question

1 Approved Answer

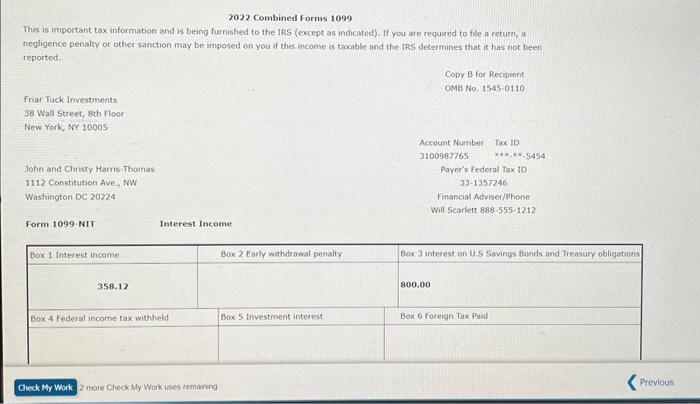

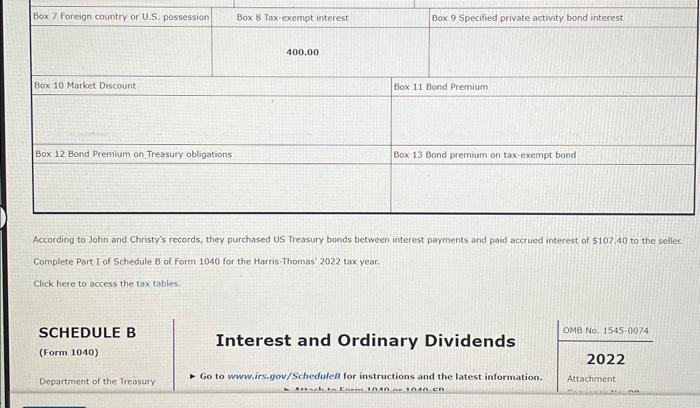

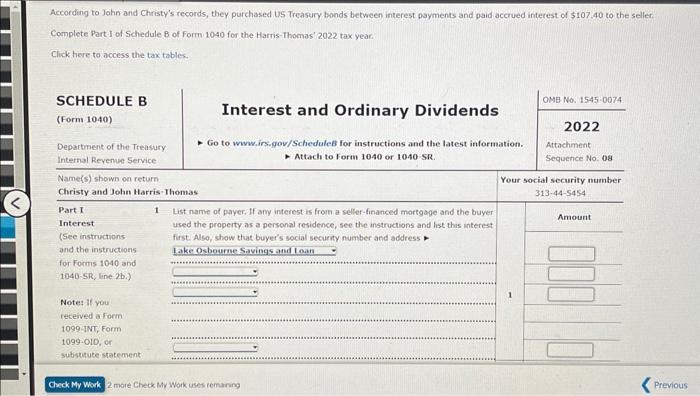

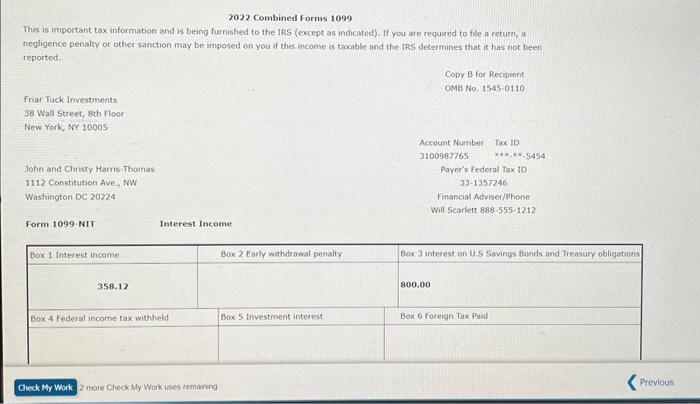

Self study problem 2.9 just have to answer picture #5 According to Johin and Christy's records, they purchased US Treasury bonds between interest payments and

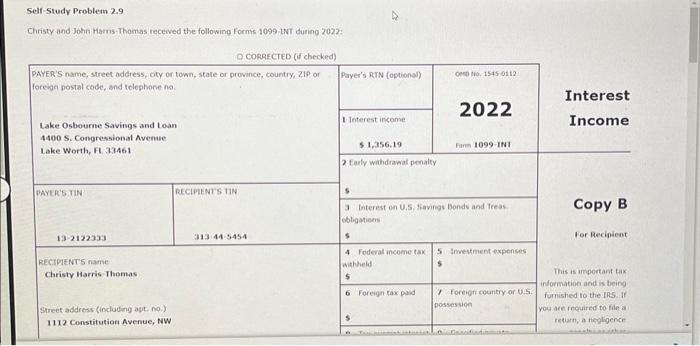

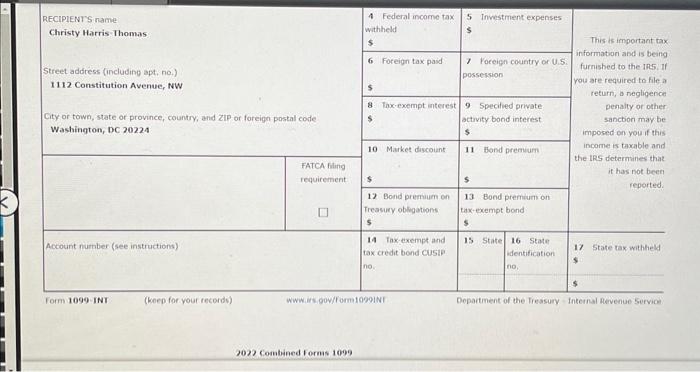

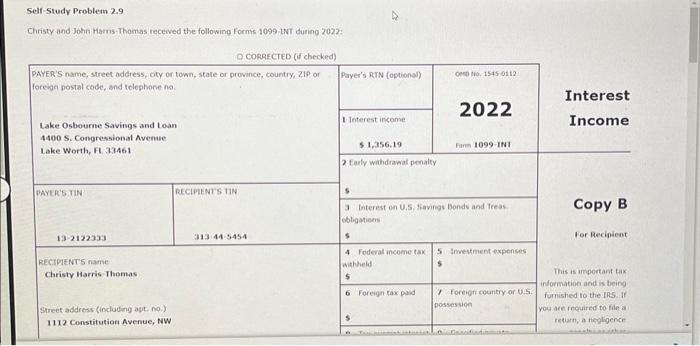

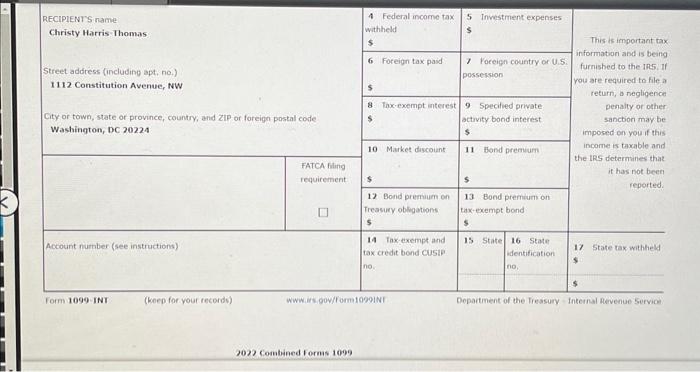

Self study problem 2.9

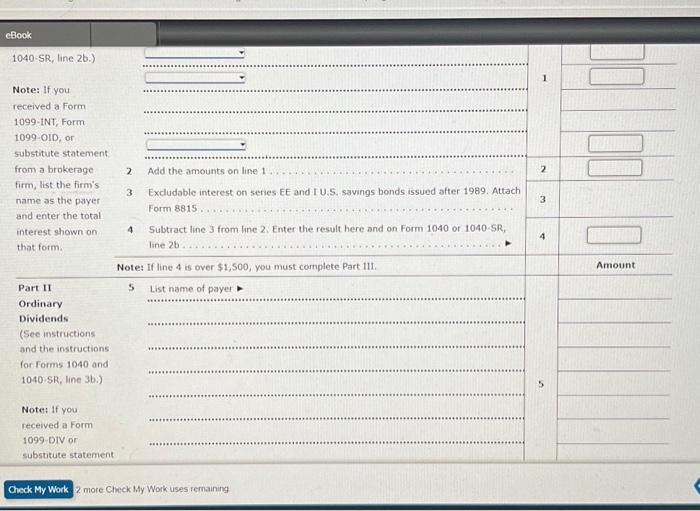

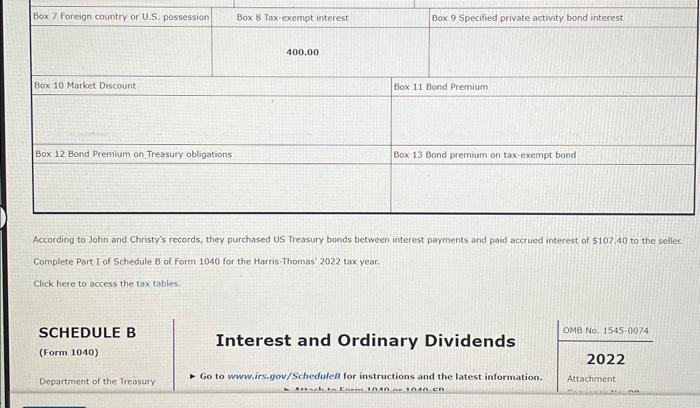

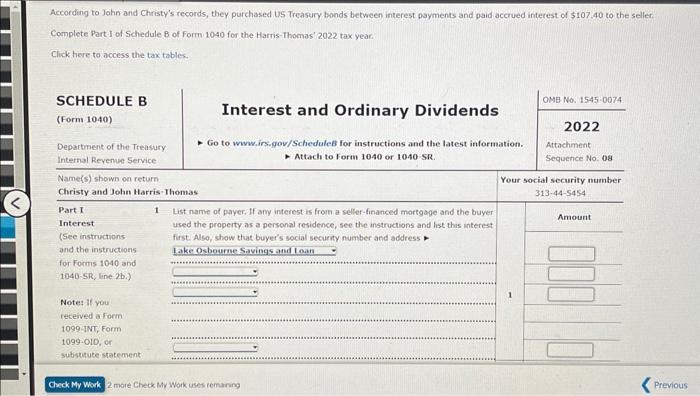

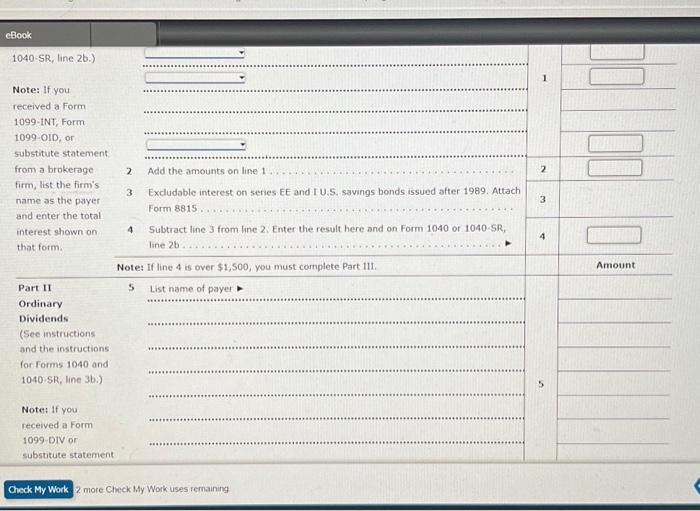

According to Johin and Christy's records, they purchased US Treasury bonds between interest payments and paid accrued interest of $107.40 to the seller Complete Part I of Schedule B of Form 1040 for the Harns-Thomas' 2022 tax year. Click here to access the tax tables. mole Cheok My Work uses remaring 1040-SR, line 2b.) Note: if you received a Form 1099-1NT, Form 1099-OID, or substitute statement. from a brokerage firm, list the firm's name as the payer and enter the total interest shown on that form. 2 Add the amounts on line 1 3 Excludable interest on senes EE and I U.S. savings bonds issued after 1989. Attach Form 8815 4 Subtract line 3 from line 2. Enter the result here and on Form 1040 of 1040-SR, Part II Ordinary Dividends (See instructions and the instructions for Forms 1040 and 1040.5R, line 3b.) Note: If you received a Form 1099-Div or substitute statement Chack My Work 2. more Check My Work uses remaining Christy and John Harns-Thomas receved the following forms 1099-twT during 2022: According to John and Christy's records, they purchased US Treasury bonds between interest payments and paid accrued interest of $107.40 to the seller. Complete Part 1 of Schedule B of Form 1040 for the Harris-Thomas' 2022 tax year: Click here to access the tax tables. SCHEDULE B (Form 1040) Department of the Treasury Internal Revenue Service Interest and Ordinary Dividends - Go to www.irs-gov/ScheduleB for instructions and the latest information. - Attach to form 1040 or 1040 -SR. OMB No. 1545-0074 2022 Attachment Sequence No: 08 2 more Check My Work uses remarng According to Johin and Christy's records, they purchased US Treasury bonds between interest payments and paid accrued interest of $107.40 to the seller Complete Part I of Schedule B of Form 1040 for the Harns-Thomas' 2022 tax year. Click here to access the tax tables. mole Cheok My Work uses remaring 1040-SR, line 2b.) Note: if you received a Form 1099-1NT, Form 1099-OID, or substitute statement. from a brokerage firm, list the firm's name as the payer and enter the total interest shown on that form. 2 Add the amounts on line 1 3 Excludable interest on senes EE and I U.S. savings bonds issued after 1989. Attach Form 8815 4 Subtract line 3 from line 2. Enter the result here and on Form 1040 of 1040-SR, Part II Ordinary Dividends (See instructions and the instructions for Forms 1040 and 1040.5R, line 3b.) Note: If you received a Form 1099-Div or substitute statement Chack My Work 2. more Check My Work uses remaining Christy and John Harns-Thomas receved the following forms 1099-twT during 2022: According to John and Christy's records, they purchased US Treasury bonds between interest payments and paid accrued interest of $107.40 to the seller. Complete Part 1 of Schedule B of Form 1040 for the Harris-Thomas' 2022 tax year: Click here to access the tax tables. SCHEDULE B (Form 1040) Department of the Treasury Internal Revenue Service Interest and Ordinary Dividends - Go to www.irs-gov/ScheduleB for instructions and the latest information. - Attach to form 1040 or 1040 -SR. OMB No. 1545-0074 2022 Attachment Sequence No: 08 2 more Check My Work uses remarng just have to answer picture #5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started