Answered step by step

Verified Expert Solution

Question

1 Approved Answer

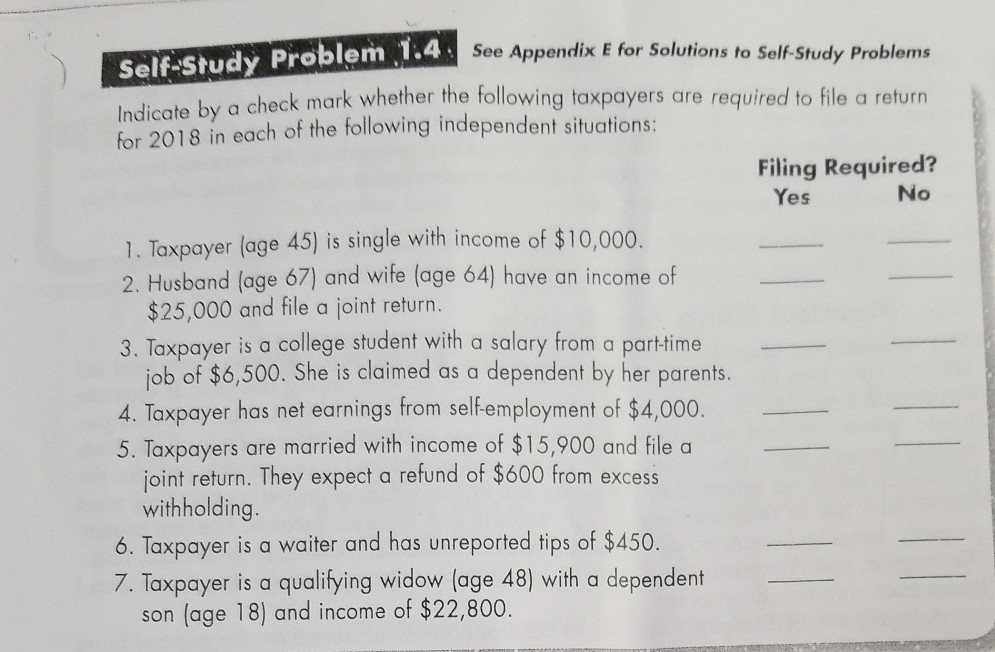

Self-Study Problem 1.4 Indicate by for 2018 in each of the following independent siftuations: See Appendix E for Solutions to Self-Study Problems a check mark

Self-Study Problem 1.4 Indicate by for 2018 in each of the following independent siftuations: See Appendix E for Solutions to Self-Study Problems a check mark whether the following taxpayers are required to file a return Filing Required? Yes No 1. Taxpayer (age 45) is single with income of $10,000. 2. Husband (age 67) and wife (age 64) have an income of $25,000 and file a joint return. 3. Taxpayer is a college student with a salary from a parttime job of $6,500. She is claimed as a dependent by her parents. 4. Taxpayer has net earnings from self-employment of $4,000. 5Taxpayers are married with income of $15,900 and file a joint return. They expect a refund of $600 from excess withholding 6. Taxpayer is a waiter and has unreported tips of $450. 7. Taxpayer is a qualifying widow (age 48) with a dependent son (age 18) and income of $22,800

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started