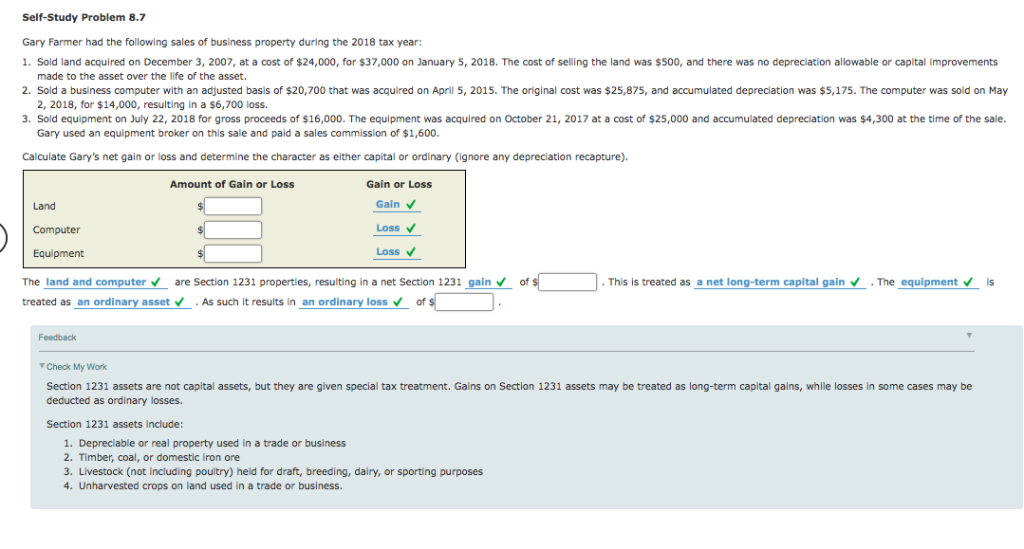

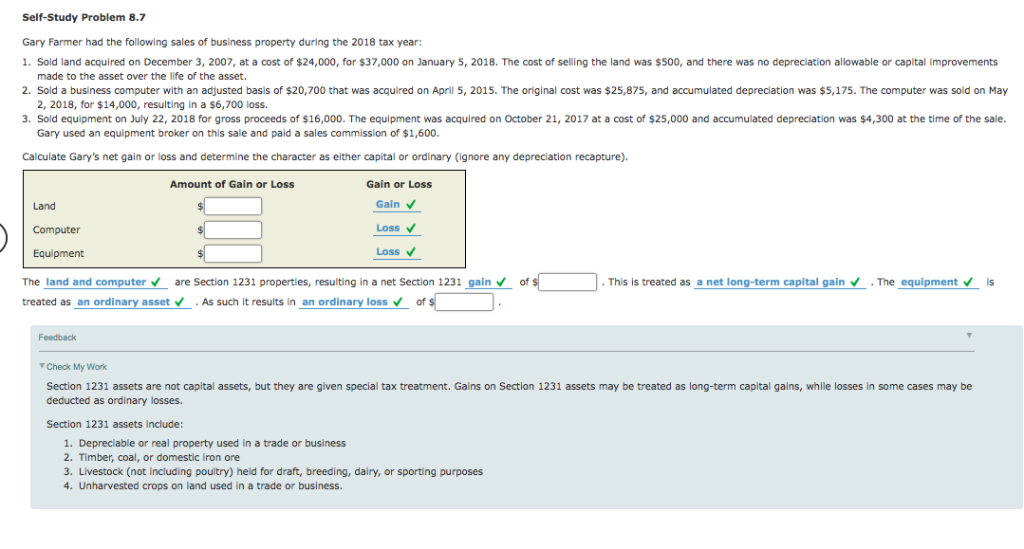

Self-Study Problem 8.7 Gary Farmer had the following sales of business property during the 2018 tax year: 1. Sold land acquired on December 3, 2007, at a cost of $24,000, for $37,000 on January 5, 2018. The cost of selling the land was $500, and there was no depreciation allowable or capital improvements made to the asset over the life of the asset. 2. Sold a business computer with an adjusted basis of $20,700 that was acquired on April 5, 2015. The original cost was $25,875, and accumulated depreciation was $5,175. The computer was sold on May 2, 2018, for $14,000, resulting in a $6,700 loss. 3. Sold equipment on July 22, 2018 for gross proceeds of $16,000. The equipment was acquired on October 21, 2017 at a cost of $25,000 and accumulated depreciation was $4,300 at the time of the sale Gary used an equipment broker on this sale and paid a sales commission of $1,600 Calculate Gary's net gain or loss and determine the character as either capital or ordinary (ignore any depreciation recapture). Amount of Gain or Loss Gain or Loss Gain Loss Loss Land Computer Equipment The land and computer are Section 1231 properties, resulting in a net Section 1231 gain of treated asan ordinary assetAs such it results in an ordinary loss of This is treated as a net long-term capital gain . The equipment is Feedback Check My Work Section 1231 assets are not capital assets, but they are given special tax treatment. Gains on Section 1231 assets may be treated as long-term capital gains, while losses in some cases may be deducted as ordinary losses. Section 1231 assets include: 1. Depreciable or real property used in a trade or business 2. Timber, coal, or domestic iron ore 3. Livestock (not including poultry) held for draft, breeding, dairy, or sporting purposes 4. Unharvested crops on land used in a trade or business. Self-Study Problem 8.7 Gary Farmer had the following sales of business property during the 2018 tax year: 1. Sold land acquired on December 3, 2007, at a cost of $24,000, for $37,000 on January 5, 2018. The cost of selling the land was $500, and there was no depreciation allowable or capital improvements made to the asset over the life of the asset. 2. Sold a business computer with an adjusted basis of $20,700 that was acquired on April 5, 2015. The original cost was $25,875, and accumulated depreciation was $5,175. The computer was sold on May 2, 2018, for $14,000, resulting in a $6,700 loss. 3. Sold equipment on July 22, 2018 for gross proceeds of $16,000. The equipment was acquired on October 21, 2017 at a cost of $25,000 and accumulated depreciation was $4,300 at the time of the sale Gary used an equipment broker on this sale and paid a sales commission of $1,600 Calculate Gary's net gain or loss and determine the character as either capital or ordinary (ignore any depreciation recapture). Amount of Gain or Loss Gain or Loss Gain Loss Loss Land Computer Equipment The land and computer are Section 1231 properties, resulting in a net Section 1231 gain of treated asan ordinary assetAs such it results in an ordinary loss of This is treated as a net long-term capital gain . The equipment is Feedback Check My Work Section 1231 assets are not capital assets, but they are given special tax treatment. Gains on Section 1231 assets may be treated as long-term capital gains, while losses in some cases may be deducted as ordinary losses. Section 1231 assets include: 1. Depreciable or real property used in a trade or business 2. Timber, coal, or domestic iron ore 3. Livestock (not including poultry) held for draft, breeding, dairy, or sporting purposes 4. Unharvested crops on land used in a trade or business