Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Selim Osmanoglu has been working as a Director at Helvetic Water SA an unlisted trading company in Switzerland which has an issued share capital

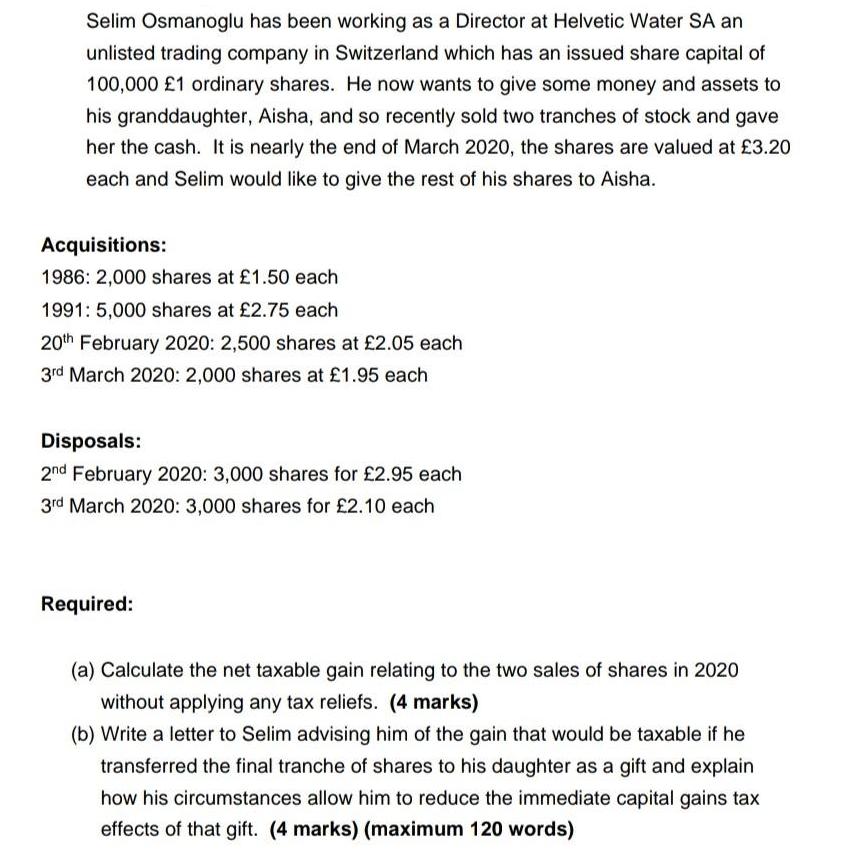

Selim Osmanoglu has been working as a Director at Helvetic Water SA an unlisted trading company in Switzerland which has an issued share capital of 100,000 1 ordinary shares. He now wants to give some money and assets to his granddaughter, Aisha, and so recently sold two tranches of stock and gave her the cash. It is nearly the end of March 2020, the shares are valued at 3.20 each and Selim would like to give the rest of his shares to Aisha. Acquisitions: 1986: 2,000 shares at 1.50 each 1991: 5,000 shares at 2.75 each 20th February 2020: 2,500 shares at 2.05 each 3rd March 2020: 2,000 shares at 1.95 each Disposals: 2nd February 2020: 3,000 shares for 2.95 each 3rd March 2020: 3,000 shares for 2.10 each Required: (a) Calculate the net taxable gain relating to the two sales of shares in 2020 without applying any tax reliefs. (4 marks) (b) Write a letter to Selim advising him of the gain that would be taxable if he transferred the final tranche of shares to his daughter as a gift and explain how his circumstances allow him to reduce the immediate capital gains tax effects of that gift. (4 marks) (maximum 120 words)

Step by Step Solution

★★★★★

3.43 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

a The net taxable gain on the shares disposed of in 2020 is 3000 b Dear Selim ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started