Question

GinnyCo has pretax book and taxable income of $400,000 and reports a $100,000 income tax payable in the current year. GinnyCo has engaged in activities

GinnyCo has pretax book and taxable income of $400,000 and reports a $100,000 income tax payable in the current year. GinnyCo has engaged in activities that it believes qualify for the research activities credit a general business tax credit of $40,000 that it cannot use this year, and its management believes that it is more likely than not that one-fourth of the credit carryforward will expire unused.

a. Compute GinnyCo's income tax provision for the year, expressed as a Microsoft Excel formula.

TAXPROV=TAX PAY-(MAX(DEFTAX,(DEFTAX-VALALL))TAXPROV=TAX PAY-(MAX(VALALL,(DEFTAX-VALALL))TAXPROV=TAX PAY-(MIN(DEFTAX,(DEFTAX-VALALL))TAXPROV=TAX PAY-(MIN(VALALL,(DEFTAX-VALALL))TAXPROV=TAX PAY-(MIN(DEFTAX,(DEFTAX-VALALL))

DEFTAX=VALALL∗UNUSED%DEFTAX=VALALL∕UNUSED%VALALL=DEFTAX∗UNUSED%VALALL=DEFTAX∕UNUSED%VALALL=DEFTAX∗UNUSED%

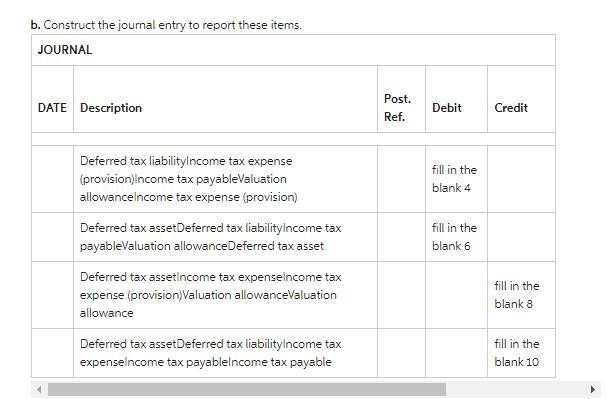

b. Construct the journal entry to report these items. JOURNAL Post. DATE Description Debit Credit Ref. Deferred tax liabilitylncome tax expense fill in the (provision)income tax payablevaluation allowancelncome tax expense (provision) blank 4 fill in the Deferred tax assetDeferred tax liabilityincome tax payableValuation allowanceDeferred tax asset blank 6 Deferred tax assetlincome tax expenselncome tax fill in the expense (provision)Valuation allowanceValuation blank 8 allowance Deferred tax assetDeferred tax liabilitylncome tax fill in the expenselncome tax payablelncome tax payable blank 10

Step by Step Solution

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Solution Given Data 8 100 000 income tux payable in the Cunent year Ginny co urepor...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started