LaceCo has engaged in activities that it believes qualify for the research activities credit. LaceCo estimates that

Question:

LaceCo has engaged in activities that it believes qualify for the research activities credit. LaceCo estimates that it will reduce its Federal income tax liability by $400,000 as a result of these strategies, but that the IRS is likely to challenge the policies in an audit.

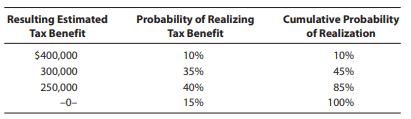

LaceCo estimates that the tax benefit ultimately realized may be less than the current tax savings. The potential benefits and related probabilities are presented in the following table.

LaceCo recorded a book tax provision of $600,000, including the $400,000 tax benefit from this tax uncertainty.

a. Determine the amount that LaceCo should record for the tax benefit from this item under GAAP rules and ASC 740-10.

b. Provide the journal entry that LaceCo should record.

Step by Step Answer:

South-Western Federal Taxation 2022 Essentials Of Taxation Individuals And Business Entities

ISBN: 9780357519431

25th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young, David M. Maloney