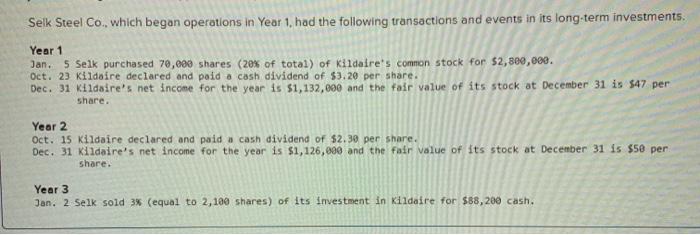

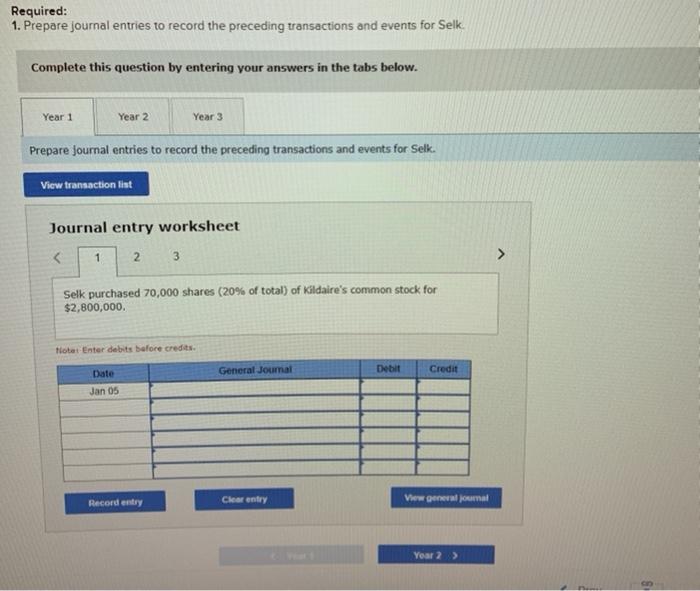

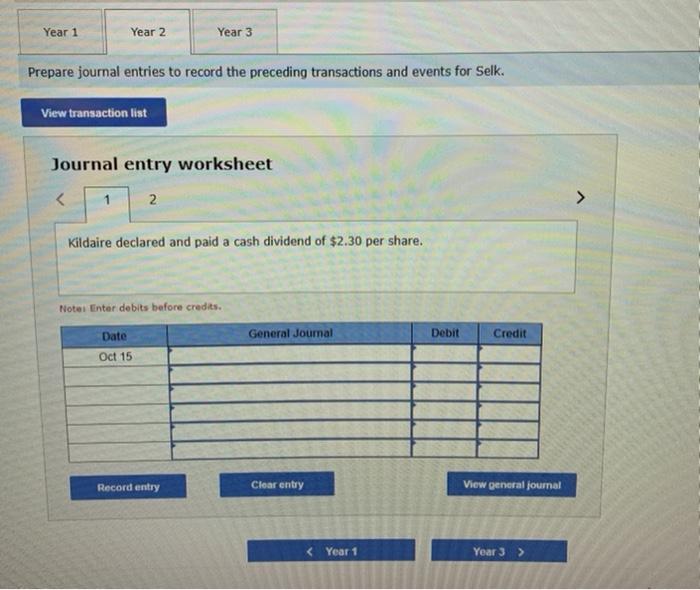

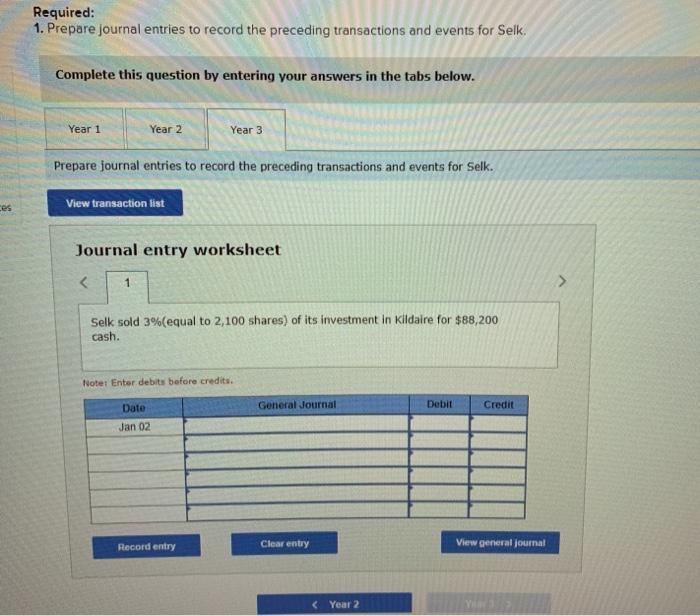

Selk Steel Co., which began operations in Year 1, had the following transactions and events in its long-term investments. Year 1 Jan. 5 Selk purchased 78,080 shares (20% of total) of Kildatre's common stock for $2,800,000. Oct. 23 Kildaire declared and paid a cash dividend of $3.20 per share. Dec. 31 Kildaire's net income for the year is $1,132,000 and the fair value of its stock at December 31 is 547 per share. Year 2 Oct. 15 Kildaire declared and paid a cash dividend of $2.30 per share. Dec. 31 Kildaire's net income for the year is $1,126,800 and the fair value of its stock at December 31 is $50 per share. Year 3 Jan. 2 Selk sold 3% (equal to 2,100 shares) of its investment in Kildaire for $88,200 cash. Required: 1. Prepare journal entries to record the preceding transactions and events for Selk. Complete this question by entering your answers in the tabs below. Year 1 Year 2 Year 3 Prepare Journal entries to record the preceding transactions and events for Selk. View transaction list Journal entry worksheet 1 2 3 Selk purchased 70,000 shares (20% of total) of Kildaire's common stock for $2,800,000 totes Enter debits before credits General Journal Debit Credit Date Jan 05 Record entry Clear entry View generala Year 2 > Year 1 Year 2 Year 3 Prepare journal entries to record the preceding transactions and events for Selk. View transaction list Journal entry worksheet Kildaire declared and paid a cash dividend of $2.30 per share. Notel Enter debits before credits. General Journal Debit Credit Date Oct 15 Record entry Clear entry View general journal Required: 1. Prepare journal entries to record the preceding transactions and events for Selk. Complete this question by entering your answers in the tabs below. Year 1 Year 2 Year 3 Prepare journal entries to record the preceding transactions and events for Selk. ces View transaction list Journal entry worksheet Selk sold 3%(equal to 2,100 shares) of its investment in Kildaire for $88,200 cash. Noter Enter debits before credits General Journal Debit Credit Date Jan 02 Record entry Clear entry View general journal