Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Selk Steel Company, which began operations in Year 1, had the following transactions and events in its long-term investments. Year 1 January 5 Selk

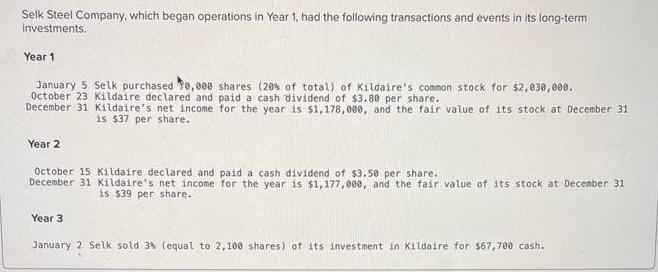

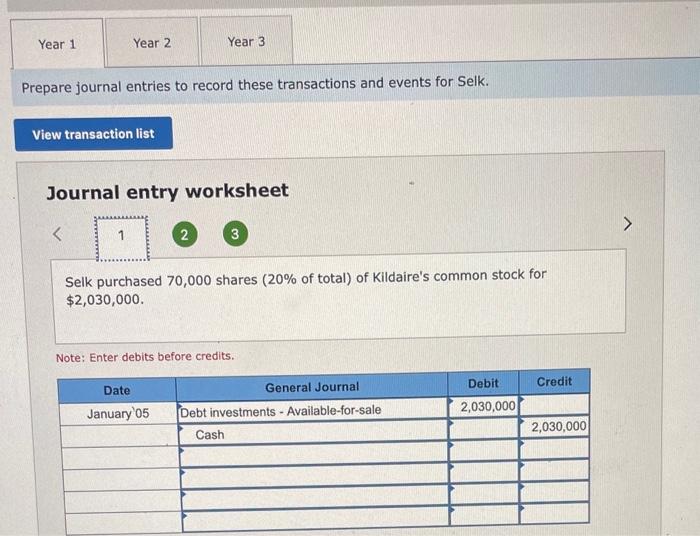

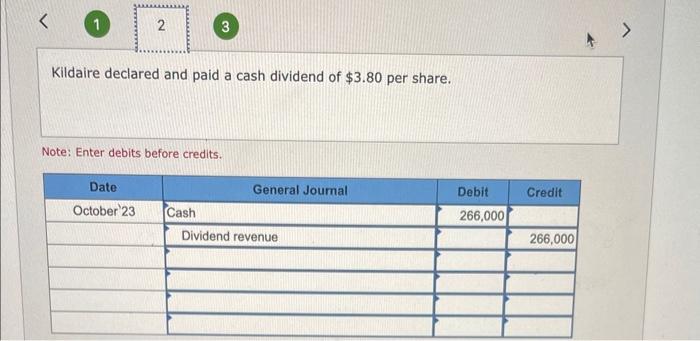

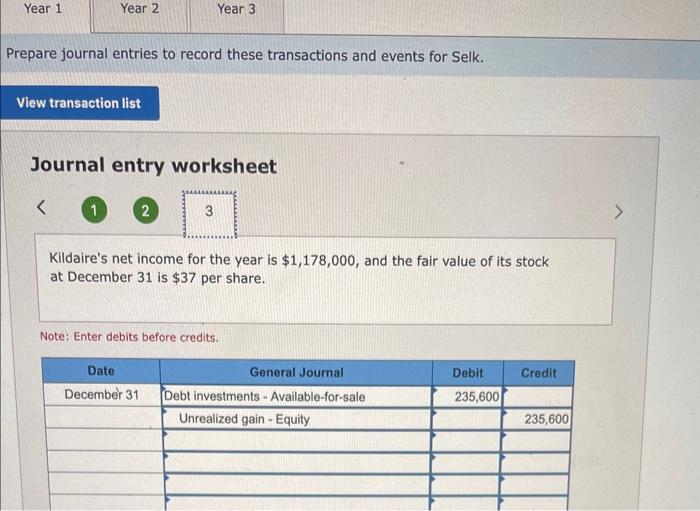

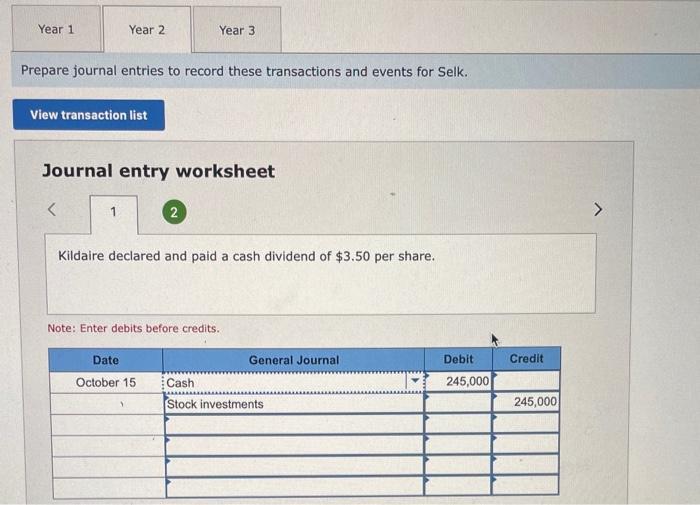

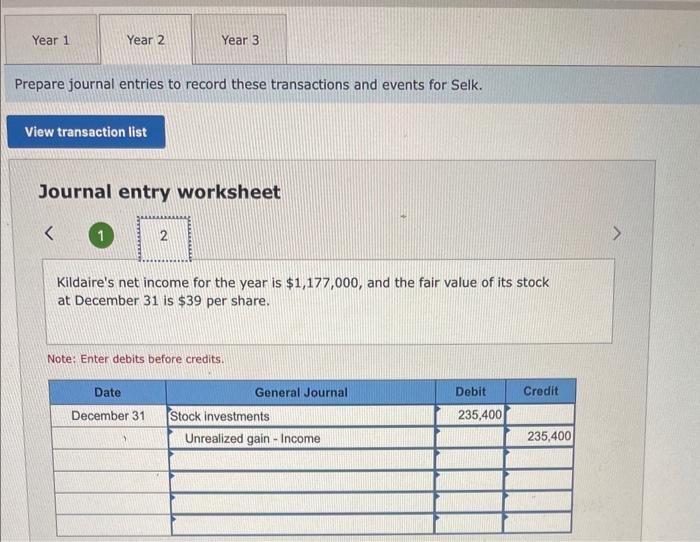

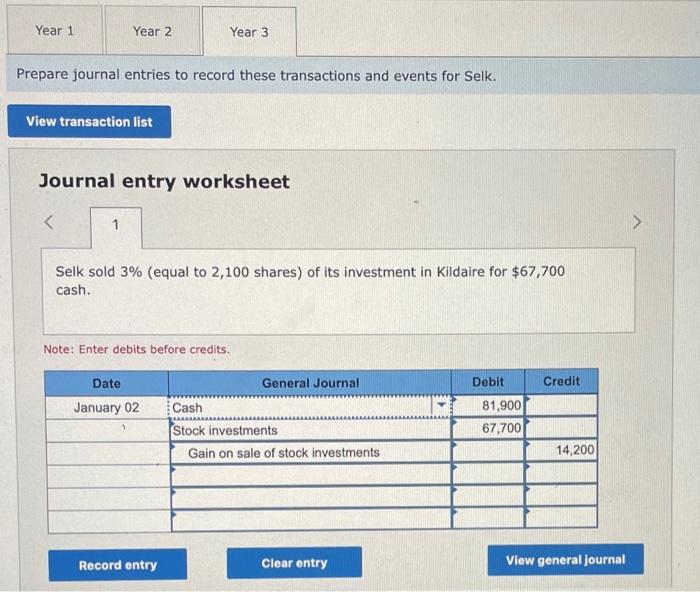

Selk Steel Company, which began operations in Year 1, had the following transactions and events in its long-term investments. Year 1 January 5 Selk purchased 0,000 shares (20% of total) of Kildaire's common stock for $2,830,000. October 23 Kildaire declared and paid a cash dividend of $3.80 per share. December 31 Kildaire's net income for the year is $1,178,000, and the fair value of its stock at December 31 is $37 per share. Year 2 October 15 Kildaire declared and paid a cash dividend of $3.50 per share. December 31 Kildaire's net income for the year is $1,177,000, and the fair value of its stock at December 31 is $39 per share. Year 3 January 2 Selk sold 3% (equal to 2,100 shares) of its investment in Kildaire for $67,700 cash. Year 1 Year 2 Year 3 Prepare journal entries to record these transactions and events for Selk. View transaction list Journal entry worksheet < 2 3 Selk purchased 70,000 shares (20% of total) of Kildaire's common stock for $2,030,000. Note: Enter debits before credits. Date January 05 General Journal Debit Credit Debt investments - Available-for-sale 2,030,000 Cash 2,030,000 < 2 3 Kildaire declared and paid a cash dividend of $3.80 per share. Note: Enter debits before credits. General Journal Debit Credit 266,000 266,000 Date October 23 Cash Dividend revenue Year 1 Year 2 Year 3 Prepare journal entries to record these transactions and events for Selk. View transaction list Journal entry worksheet < 2 3 Kildaire's net income for the year is $1,178,000, and the fair value of its stock at December 31 is $37 per share. Note: Enter debits before credits. Date General Journal Debit Credit December 31 Debt investments - Available-for-sale 235,600 Unrealized gain-Equity 235,600 Year 1 Year 2 Year 3 Prepare journal entries to record these transactions and events for Selk. View transaction list Journal entry worksheet < 1 2 Kildaire declared and paid a cash dividend of $3.50 per share. Note: Enter debits before credits. General Journal Debit Credit 245,000 245,000 Date October 15 Cash Stock investments Year 1 Year 2 Year 3 Prepare journal entries to record these transactions and events for Selk. View transaction list Journal entry worksheet < 2 Kildaire's net income for the year is $1,177,000, and the fair value of its stock at December 31 is $39 per share. Note: Enter debits before credits. Date December 31 General Journal Debit Credit Stock investments 235,400 Unrealized gain - Income 235,400 Year 1 Year 2 Year 3 Prepare journal entries to record these transactions and events for Selk. View transaction list Journal entry worksheet < 1 Selk sold 3% (equal to 2,100 shares) of its investment in Kildaire for $67,700 cash. Note: Enter debits before credits. Date General Journal Debit Credit January 02 Cash 81,900 Stock investments 67,700 Gain on sale of stock investments 14,200 Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started