Answered step by step

Verified Expert Solution

Question

1 Approved Answer

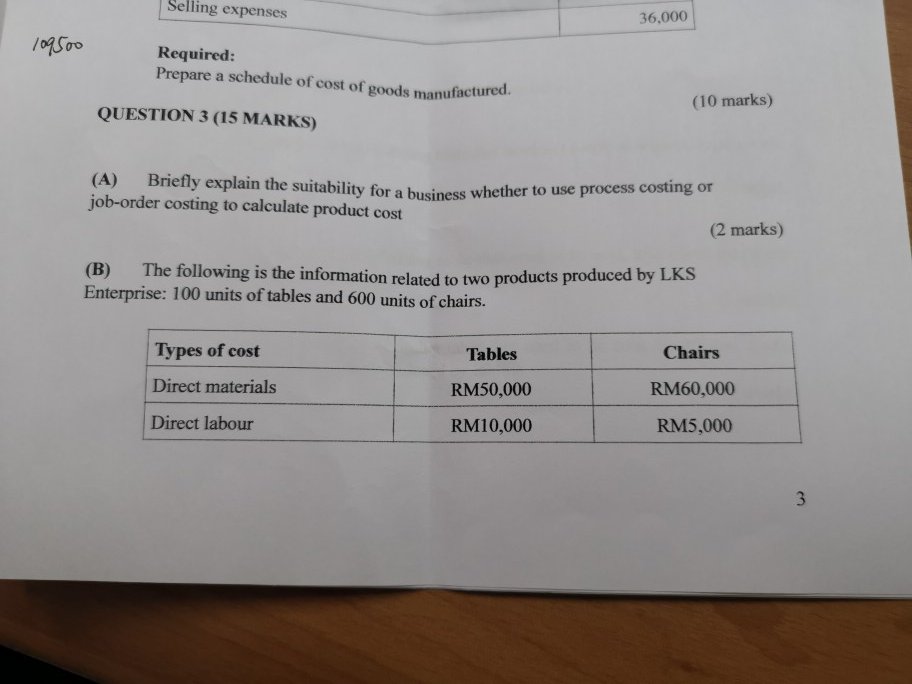

Selling expenses 36,000 /09500 Required: Prepare a schedule of cost of goods manufactured. (10 marks) QUESTION 3 (15 MARKS) (A) Briefly explain the suitability for

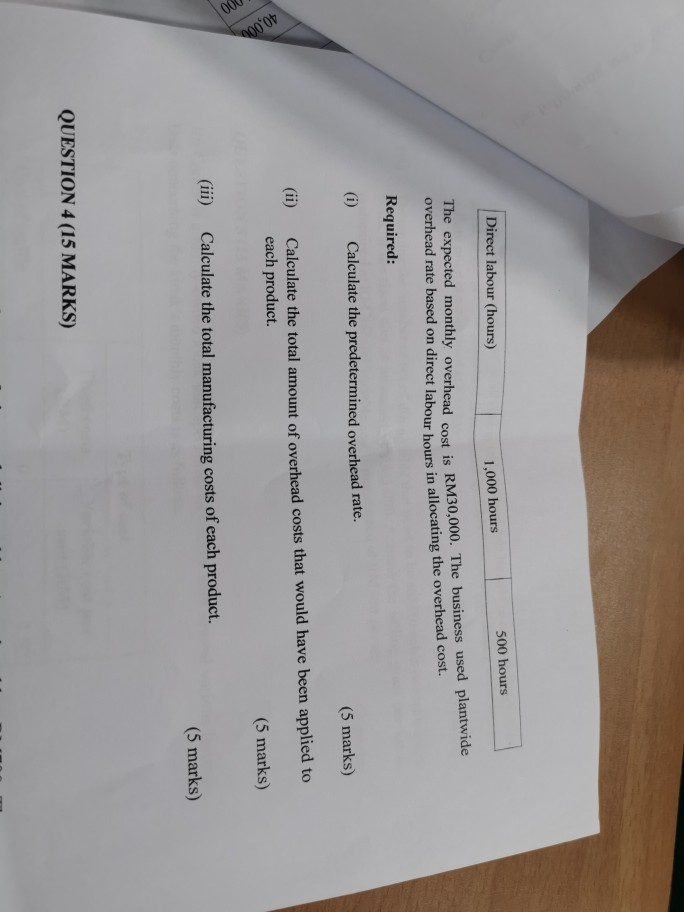

Selling expenses 36,000 /09500 Required: Prepare a schedule of cost of goods manufactured. (10 marks) QUESTION 3 (15 MARKS) (A) Briefly explain the suitability for a business whether to use process costing or job-order costing to calculate product cost (2 marks) (B) Enterprise: 100 units of tables and 600 units of chairs. The following is the information related to two products produced by LKS Types of cost Chairs Tables Direct materials RM60,000 RM50,000 Direct labour RM5,000 RM10,000 3 40,000 00 Direct labour (hours) 500 hours 1,000 hours The expected monthly overhead cost is RM30,000. The business used plantwide overhead rate based on direct labour hours in allocating the overhead cost. Required: (i) Calculate the predetermined overhead rate. (5 marks) Calculate the total amount of overhead costs that would have been applied to each product. (ii) (5 marks) (iii) Calculate the total manufacturing costs of each product. (5 marks) QUESTION 4 (15 MARKS)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started