Answered step by step

Verified Expert Solution

Question

1 Approved Answer

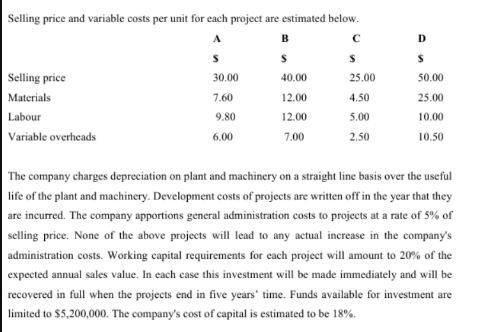

Selling price and variable costs per unit for each project are estimated below. B Selling price Materials Labour Variable overheads 30.00 7.60 9.80 6.00

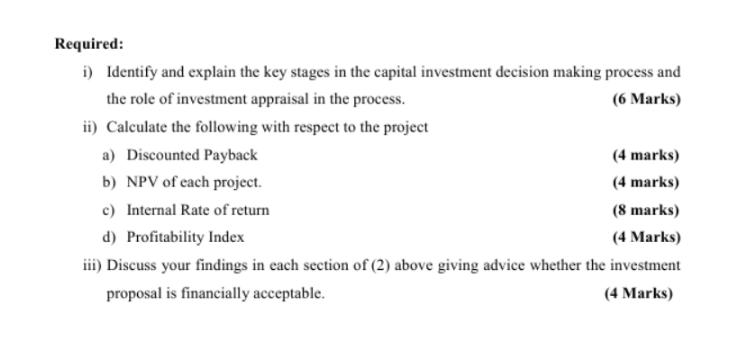

Selling price and variable costs per unit for each project are estimated below. B Selling price Materials Labour Variable overheads 30.00 7.60 9.80 6.00 S 40.00 12.00 12.00 7.00 S 25.00 4.50 5.00 2.50 D S 50.00 25.00 10.00 10.50 The company charges depreciation on plant and machinery on a straight line basis over the useful life of the plant and machinery. Development costs of projects are written off in the year that they are incurred. The company apportions general administration costs to projects at a rate of 5% of selling price. None of the above projects will lead to any actual increase in the company's administration costs. Working capital requirements for each project will amount to 20% of the expected annual sales value. In each case this investment will be made immediately and will be recovered in full when the projects end in five years' time. Funds available for investment are limited to $5,200,000. The company's cost of capital is estimated to be 18%. Required: i) Identify and explain the key stages in the capital investment decision making process and the role of investment appraisal in the process. (6 Marks) ii) Calculate the following with respect to the project a) Discounted Payback b) NPV of each project. (4 marks) (4 marks) c) Internal Rate of return d) Profitability Index iii) Discuss your findings in each section of (2) above giving advice whether the investment proposal is financially acceptable. (4 Marks) (8 marks) (4 Marks)

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER i The key stages in the capital investment decision making process include 1 Problem definition Identifying the need for investment and definin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started