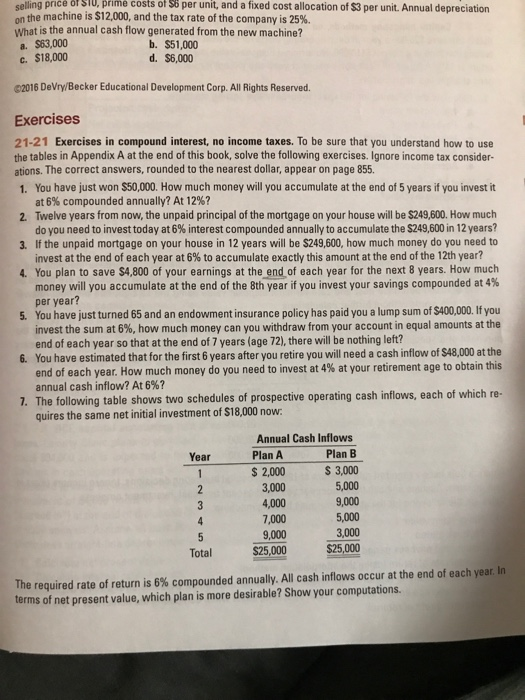

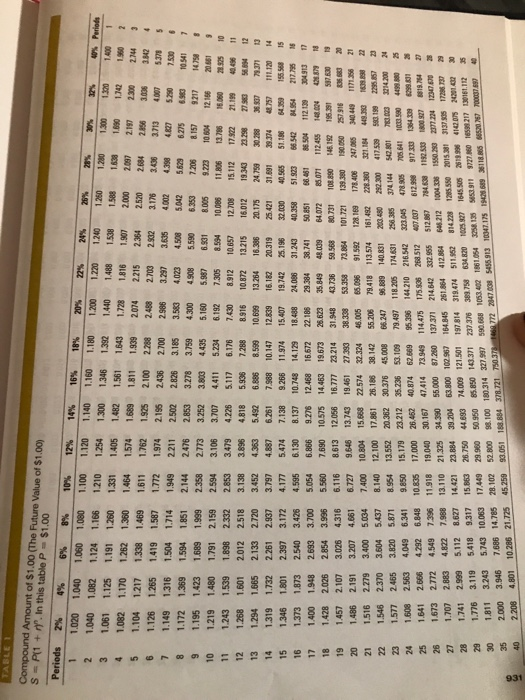

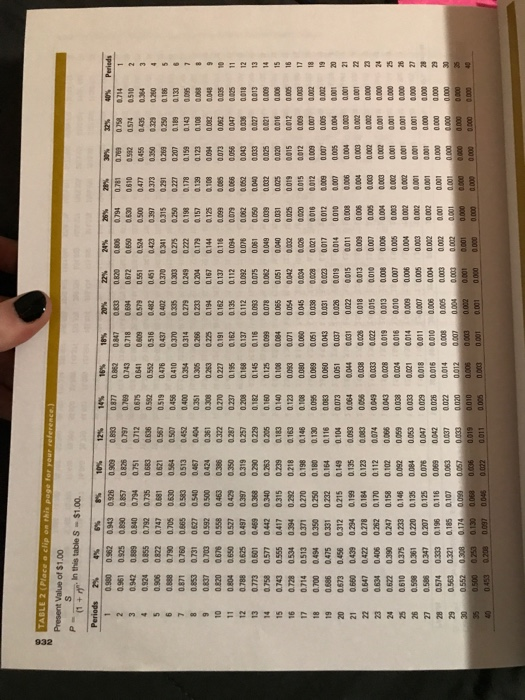

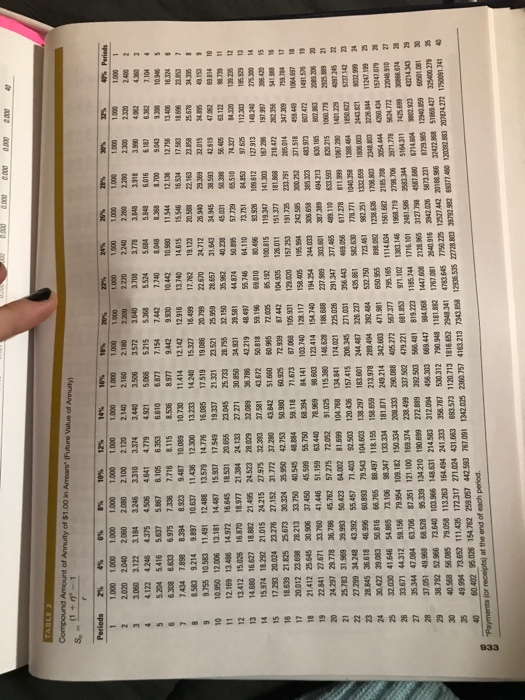

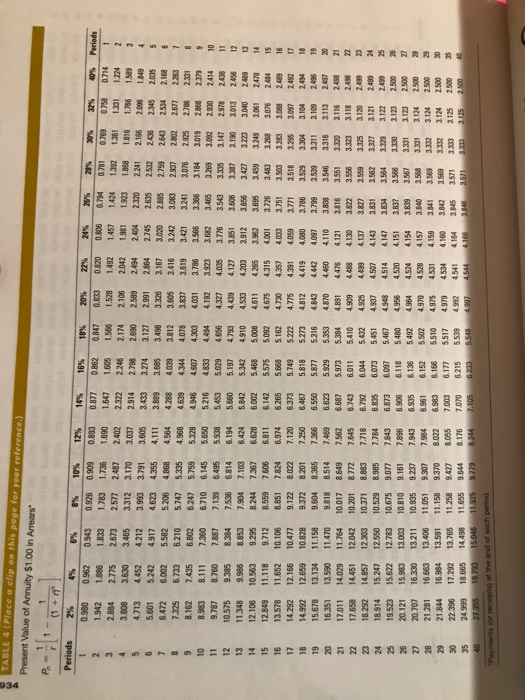

selling price of SIU, prime costs of S8 per unit, and a fixed cost allocation of $3 per unit. Annual depreciation on the machine is $12,000, and the tax rate of the company is 25%. What is the annual cash flow generated from the new machine? a. $63,000 c. $18,000 b. $51,000 d. $6,000 02016 DeVry Becker Educational Development Corp. All Rights Reserved Exercises 21-21 Exercises in compound interest, no income taxes. To be sure that you understand how to use the tables in Appendix A at the end of this book, solve the following exercises. Ignore income tax consider- ations. The correct answers, rounded to the nearest dollar, appear on page 855 1. You have just won $50,000. How much money will you accumulate at the end of 5 years if you invest it at 6% compounded annually? At 12%? do you need to invest today at 6% interest compounded annually to accumulate the S249600 in 12 years? invest at the end of each year at 6% to accumulate exactly this amount at the end of the 12th year? 2. Twelve years from now, the unpaid principal of the mortgage on your house will be $249,600. How much 3. If the unpaid mortgage on your house in 12 years will be $249,600, how much money do you need to 4. You plan to save $4,800 of your earnings at the end of each year for the next 8 years. How much 5. You have just turned 65 and an endowment insurance policy has paid you a lump sum of $400,000.If you money will you accumulate at the end of the 8th year if you invest your savings compounded at 4% per year? invest the sum at 6%, how much money can you withdraw from your account in equal amounts at the end of each year so that at the end of 7 years (age 72), there will be nothing left? You have estimated that for the first 6 years after you retire you will need a cash inflow of $48,000 at the end of each year. How much money do you need to invest at 4% at your retirement age to obtain this annual cash inflow? At 6%? 6. 7. The following table shows two schedules of prospective operating cash inflows, each of which re- quires the same net initial investment of $18,000 now Annual Cash Inflows Plan B S 3,000 5,000 9,000 5,000 3,000 Total $25,000 $25,000 Plan A 2,000 3,000 4,000 7,000 9,000 Year The required rate of return is 6% compounded annually. All cash inflows occur at the end of each year in terms of net present value, which plan is more desirable? Show your computations