Question

SELLING PRICE/PROFIT One of the most important estimates in the preparation of annual cash flow projections for a mining project is the selling price of

SELLING PRICE/PROFIT

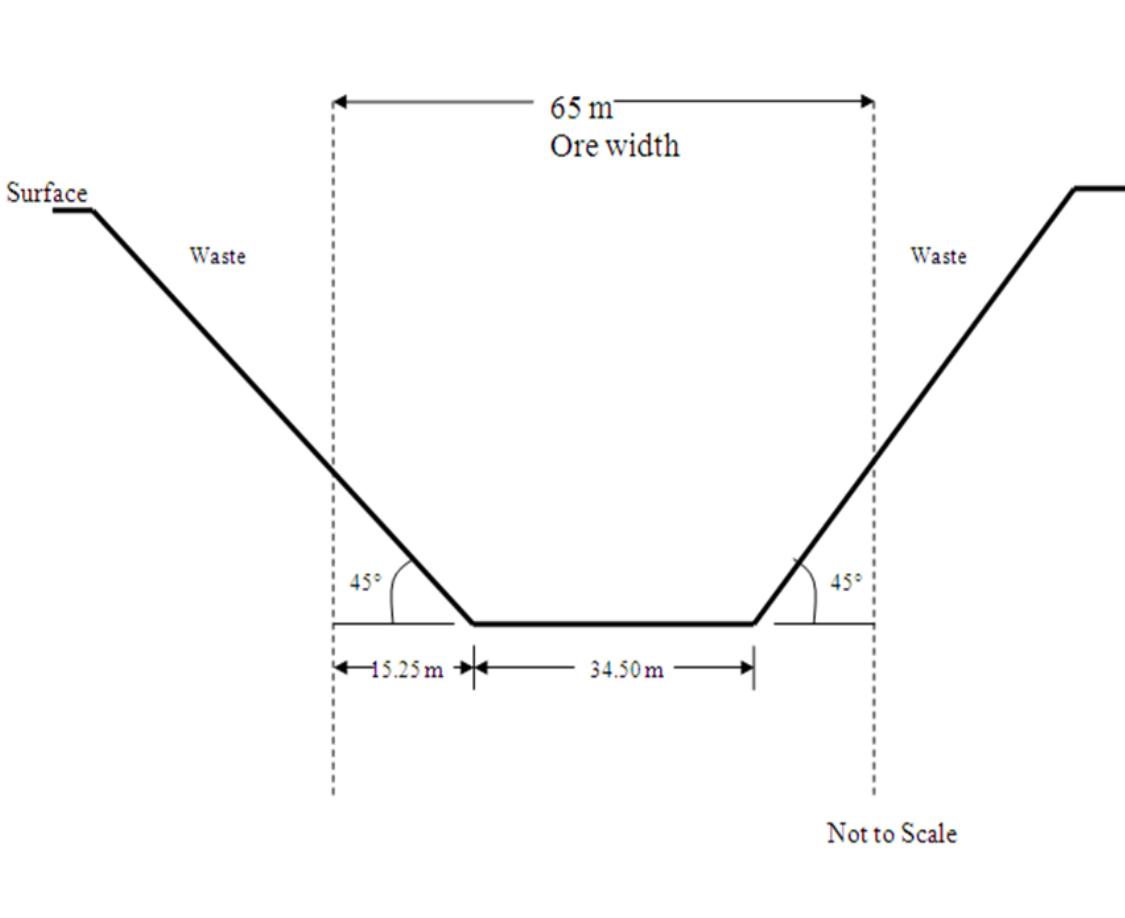

One of the most important estimates in the preparation of annual cash flow projections for a mining project is the selling price of the mine final product(s). Fey Copper Inc. is contemplating deepening an existing open pit operation. Given the following information and pit section, calculate the minimum copper selling price required to ensure the Company makes a profit equal to 25% of revenues from this project. Assuming a copper price of $2.20 /lb, is this an attractive project? Ignore taxes and any other expenses.

Depth of existing pit: 47.7 m

Width of deepened pit bottom: 34.5 m

Depth of cut: 8 m

Overall Slope Angle of pushback: 45 degrees

S.G. of waste: 2

Density of ore: 2700 kg/m3

Mining Cost of removing waste: $2.75/tonne

Mining Cost of removing ore: $9.50 /tonne

Milling Cost: $6:00/tonne

Smelting (includes penalties etc) cost: $10 /tonne

Transportation cost of Cu Concentrate: $12/tonne

Strike length of pit section (into the page): 475 m

Average grade of copper ore: 2.7%

Average grade of Cu concentrate: 50%

Mill recovery: 91.5%

Smelter recovery: 96%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started