Answered step by step

Verified Expert Solution

Question

1 Approved Answer

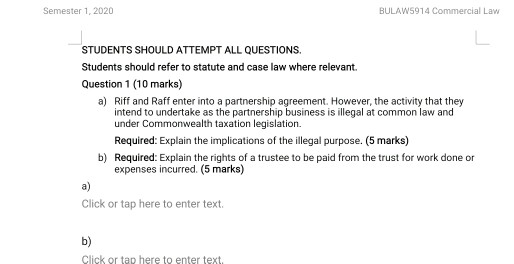

Semester 1, 2020 BULAW5914 Commercial Law L. STUDENTS SHOULD ATTEMPT ALL QUESTIONS. Students should refer to statute and case law where relevant. Question 1 (10

Semester 1, 2020 BULAW5914 Commercial Law L. STUDENTS SHOULD ATTEMPT ALL QUESTIONS. Students should refer to statute and case law where relevant. Question 1 (10 marks) a) Riff and Raff enter into a partnership agreement. However, the activity that they intend to undertake as the partnership business is illegal at common law and under Commonwealth taxation legislation. Required: Explain the implications of the illegal purpose. (5 marks) b) Required: Explain the rights of a trustee to be paid from the trust for work done or expenses incurred (5 marks) Click or tap here to enter text. b) Click or tap here to enter text. Semester 1, 2020 BULAW5914 Commercial Law L. STUDENTS SHOULD ATTEMPT ALL QUESTIONS. Students should refer to statute and case law where relevant. Question 1 (10 marks) a) Riff and Raff enter into a partnership agreement. However, the activity that they intend to undertake as the partnership business is illegal at common law and under Commonwealth taxation legislation. Required: Explain the implications of the illegal purpose. (5 marks) b) Required: Explain the rights of a trustee to be paid from the trust for work done or expenses incurred (5 marks) Click or tap here to enter text. b) Click or tap here to enter text

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started