Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Semi- annual Periods 1 2 3 Principal Future value Concordia Clubs Corp (CCC) - It has $500,000 investable fund to invest in either BIG

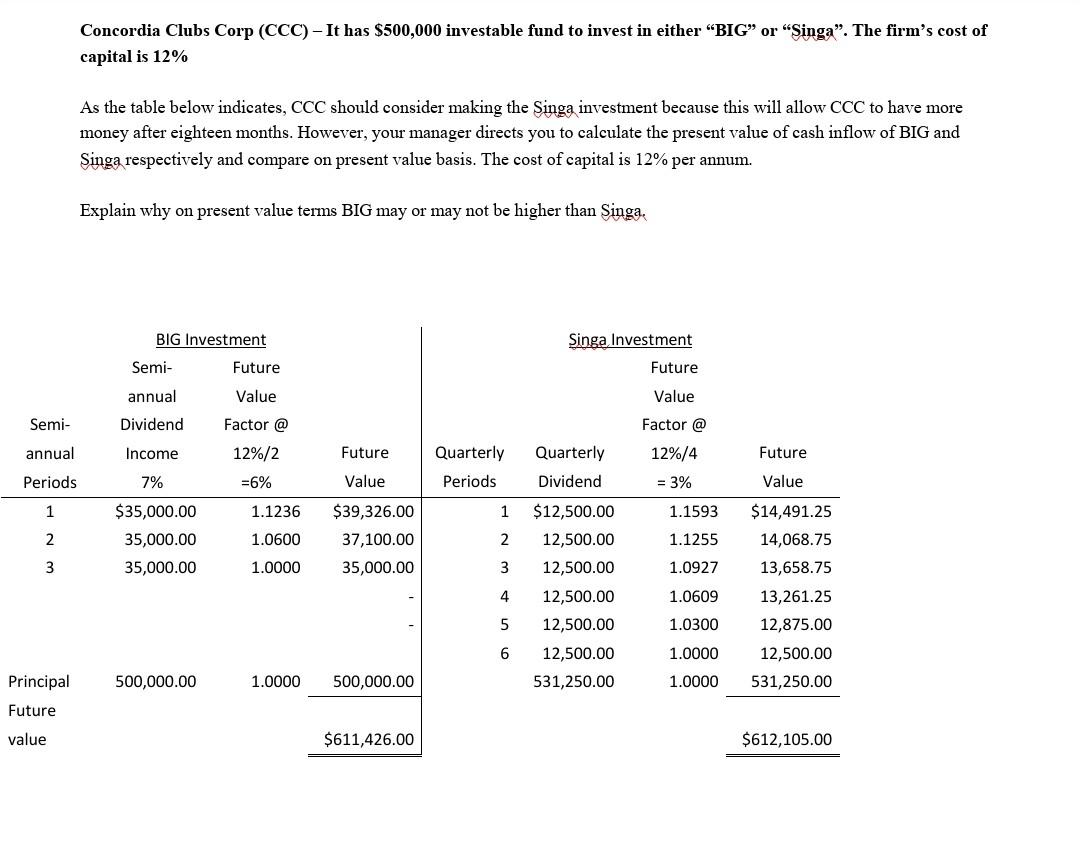

Semi- annual Periods 1 2 3 Principal Future value Concordia Clubs Corp (CCC) - It has $500,000 investable fund to invest in either "BIG" or "Singa". The firm's cost of capital is 12% As the table below indicates, CCC should consider making the Singa investment because this will allow CCC to have more money after eighteen months. However, your manager directs you to calculate the present value of cash inflow of BIG and Singa respectively and compare on present value basis. The cost of capital is 12% per annum. Explain why on present value terms BIG may or may not be higher than Singa, BIG Investment Semi- annual Dividend Income 7% $35,000.00 35,000.00 35,000.00 500,000.00 Future Value Factor @ 12%/2 =6% 1.1236 1.0600 1.0000 1.0000 Future Value $39,326.00 37,100.00 35,000.00 500,000.00 $611,426.00 Quarterly Periods 1 2 3 4 5 6 Singa Investment Future Value Factor @ 12%/4 = 3% Quarterly Dividend $12,500.00 12,500.00 12,500.00 12,500.00 12,500.00 12,500.00 531,250.00 1.1593 1.1255 1.0927 1.0609 1.0300 1.0000 1.0000 Future Value $14,491.25 14,068.75 13,658.75 13,261.25 12,875.00 12,500.00 531,250.00 $612,105.00

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Present value is calculated by using formula C 1 rn Where C is the Cash flow r is the interest rate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started