Answered step by step

Verified Expert Solution

Question

1 Approved Answer

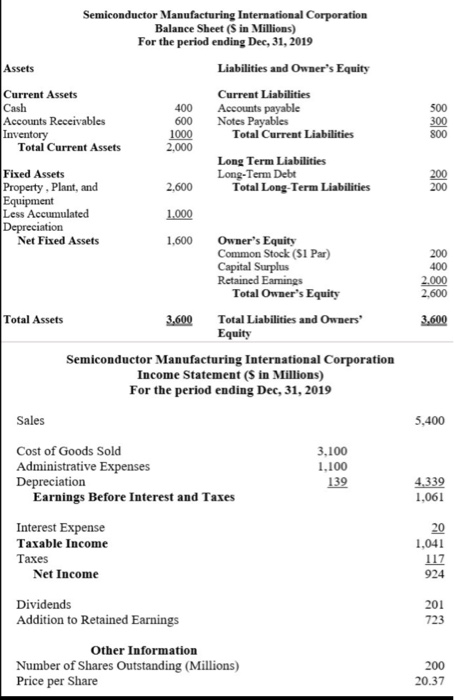

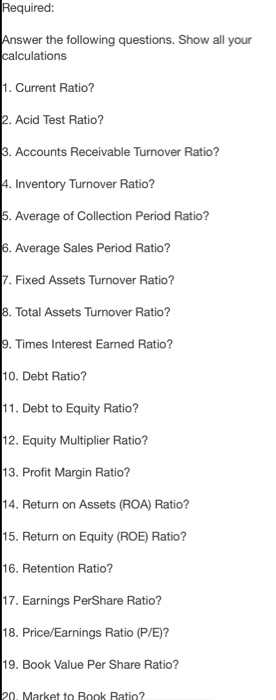

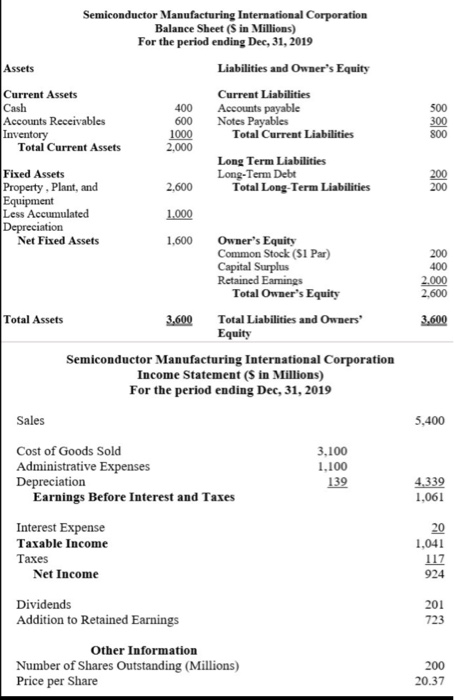

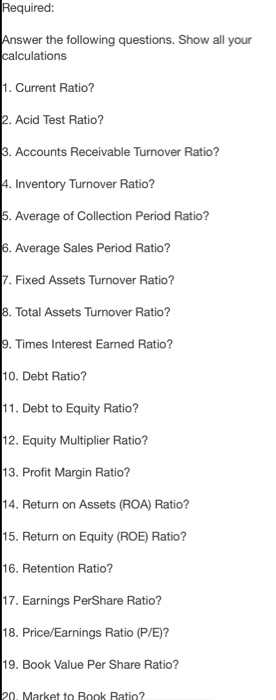

Semiconductor Manufacturing International Corporation Balance Sheet (S in Millions) For the period ending Dec 31, 2019 Assets Liabilities and Owner's Equity Current Assets Cash Accounts

Semiconductor Manufacturing International Corporation Balance Sheet (S in Millions) For the period ending Dec 31, 2019 Assets Liabilities and Owner's Equity Current Assets Cash Accounts Receivables Inventory Total Current Assets 400 600 1000 2,000 Current Liabilities Accounts payable Notes Payables Total Current Liabilities Long Term Liabilities Long-Term Debt Total Long-Term Liabilities 2,600 Fixed Assets Property, Plant, and Equipment Less Accumulated Depreciation Net Fixed Assets 1.000 1,600 Owner's Equity Common Stock (51 Par) Capital Surplus Retained Earnings Total Owner's Equity 200 400 2.000 2.600 Total Assets 3,600 Total Liabilities and Owners' Equity 3.600 Semiconductor Manufacturing International Corporation Income Statement ($ in Millions) For the period ending Dec, 31, 2019 Sales 5,400 Cost of Goods Sold Administrative Expenses Depreciation Earnings Before Interest and Taxes 3,100 1,100 139 4,339 1,061 Interest Expense Taxable Income Taxes Net Income 1,041 117 924 201 Dividends Addition to Retained Earnings 723 Other Information Number of Shares Outstanding (Millions) Price per Share 200 20.37 Required: Answer the following questions. Show all your calculations 1. Current Ratio? 2. Acid Test Ratio? 3. Accounts Receivable Turnover Ratio? 4. Inventory Turnover Ratio? 5. Average of Collection Period Ratio? 6. Average Sales Period Ratio? 7. Fixed Assets Turnover Ratio? 8. Total Assets Turnover Ratio? 9. Times Interest Earned Ratio? 10. Debt Ratio? 11. Debt to Equity Ratio? 12. Equity Multiplier Ratio? 13. Profit Margin Ratio? 14. Return on Assets (ROA) Ratio? 15. Return on Equity (ROE) Ratio? 16. Retention Ratio? 17. Earnings PerShare Ratio? 18. Price/Earnings Ratio (P/E)? 19. Book Value Per Share Ratio? 20. Market to Rook Ratin

Semiconductor Manufacturing International Corporation Balance Sheet (S in Millions) For the period ending Dec 31, 2019 Assets Liabilities and Owner's Equity Current Assets Cash Accounts Receivables Inventory Total Current Assets 400 600 1000 2,000 Current Liabilities Accounts payable Notes Payables Total Current Liabilities Long Term Liabilities Long-Term Debt Total Long-Term Liabilities 2,600 Fixed Assets Property, Plant, and Equipment Less Accumulated Depreciation Net Fixed Assets 1.000 1,600 Owner's Equity Common Stock (51 Par) Capital Surplus Retained Earnings Total Owner's Equity 200 400 2.000 2.600 Total Assets 3,600 Total Liabilities and Owners' Equity 3.600 Semiconductor Manufacturing International Corporation Income Statement ($ in Millions) For the period ending Dec, 31, 2019 Sales 5,400 Cost of Goods Sold Administrative Expenses Depreciation Earnings Before Interest and Taxes 3,100 1,100 139 4,339 1,061 Interest Expense Taxable Income Taxes Net Income 1,041 117 924 201 Dividends Addition to Retained Earnings 723 Other Information Number of Shares Outstanding (Millions) Price per Share 200 20.37 Required: Answer the following questions. Show all your calculations 1. Current Ratio? 2. Acid Test Ratio? 3. Accounts Receivable Turnover Ratio? 4. Inventory Turnover Ratio? 5. Average of Collection Period Ratio? 6. Average Sales Period Ratio? 7. Fixed Assets Turnover Ratio? 8. Total Assets Turnover Ratio? 9. Times Interest Earned Ratio? 10. Debt Ratio? 11. Debt to Equity Ratio? 12. Equity Multiplier Ratio? 13. Profit Margin Ratio? 14. Return on Assets (ROA) Ratio? 15. Return on Equity (ROE) Ratio? 16. Retention Ratio? 17. Earnings PerShare Ratio? 18. Price/Earnings Ratio (P/E)? 19. Book Value Per Share Ratio? 20. Market to Rook Ratin

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started