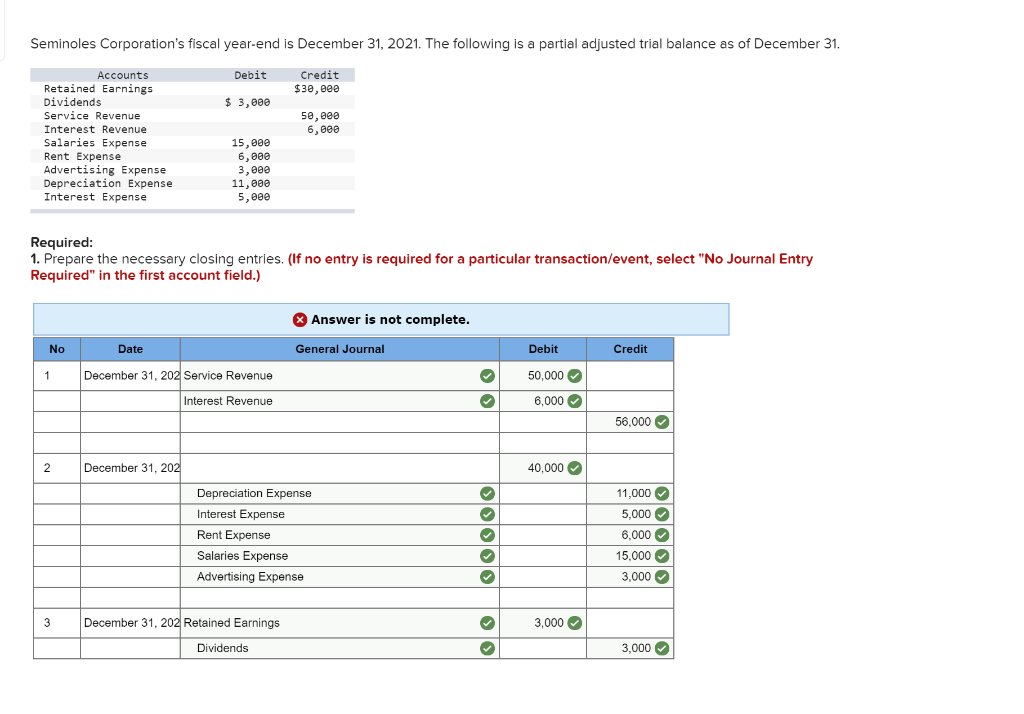

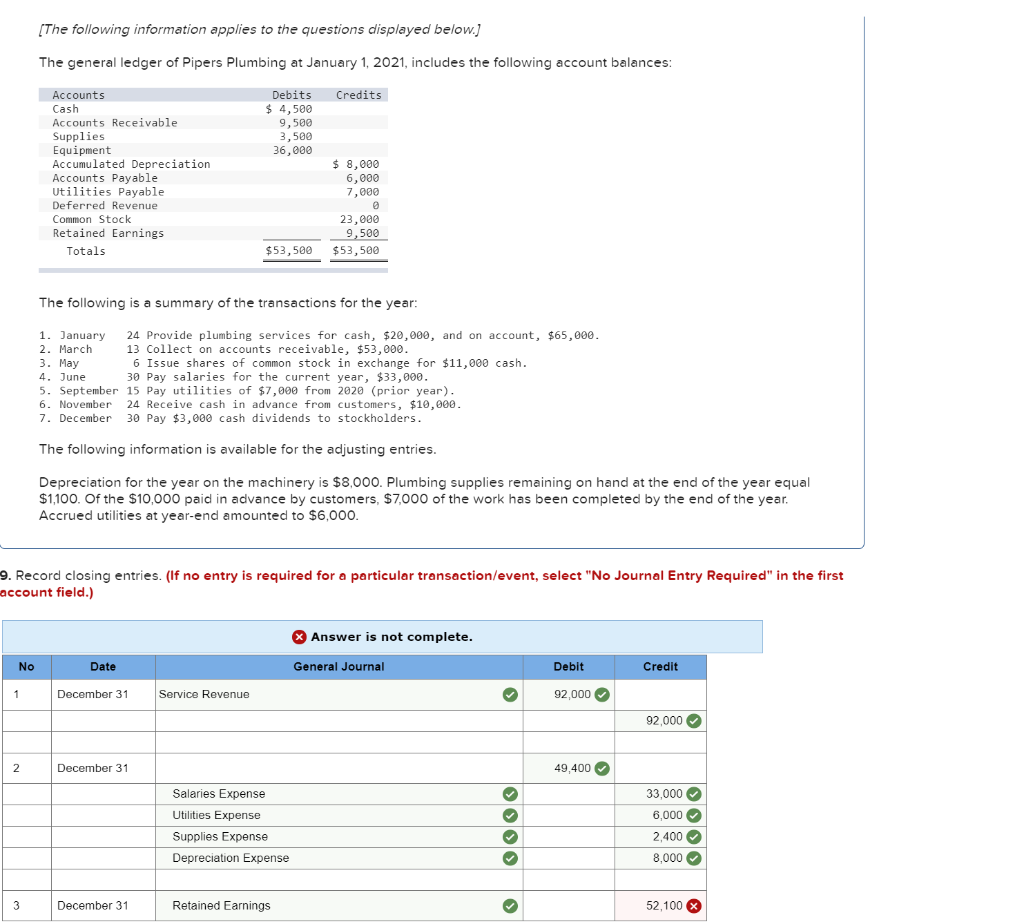

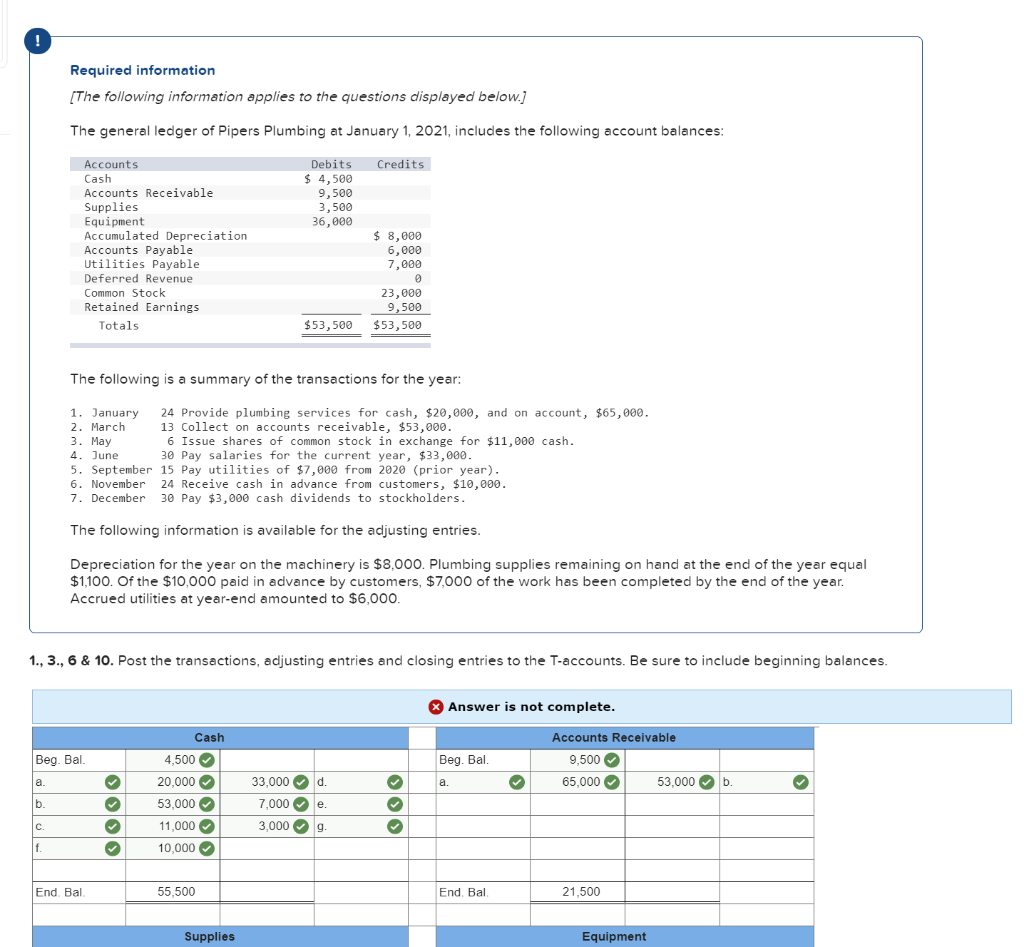

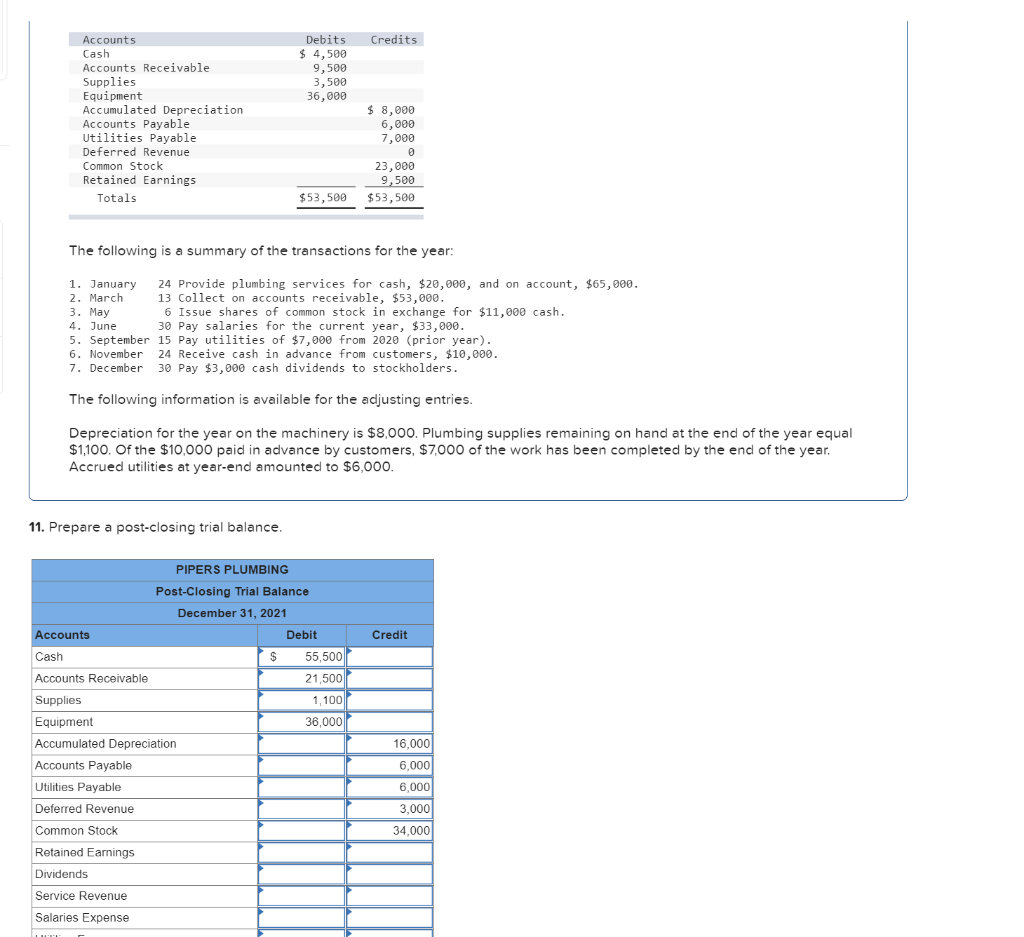

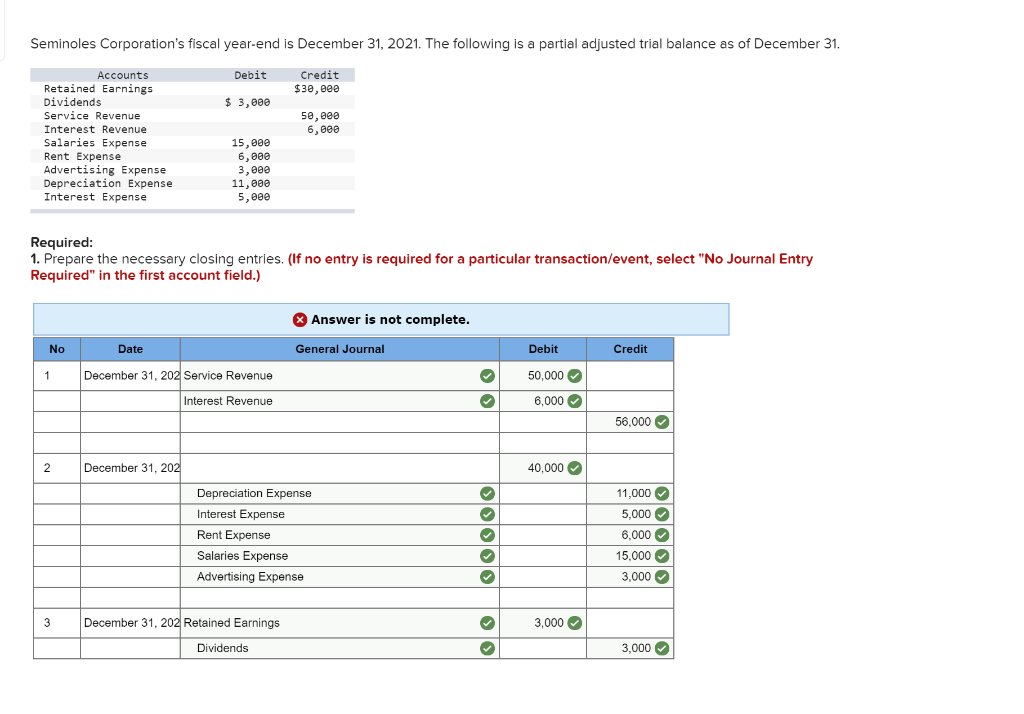

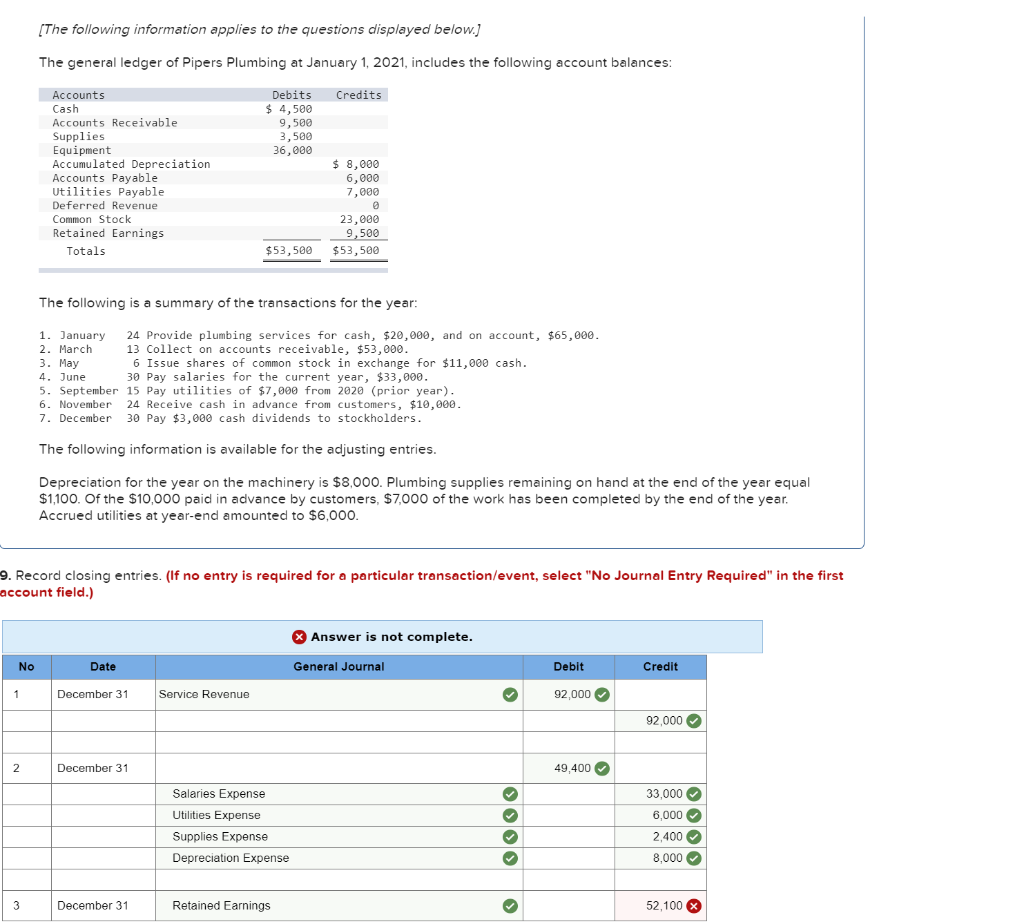

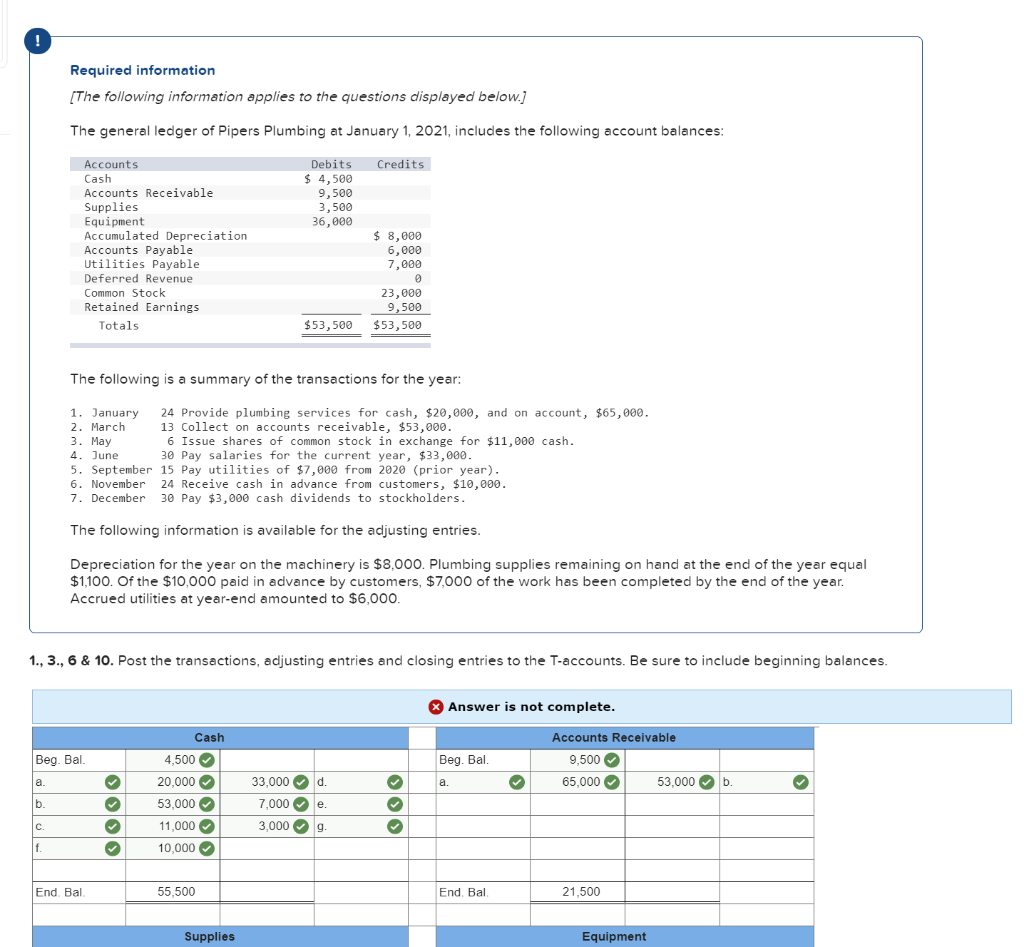

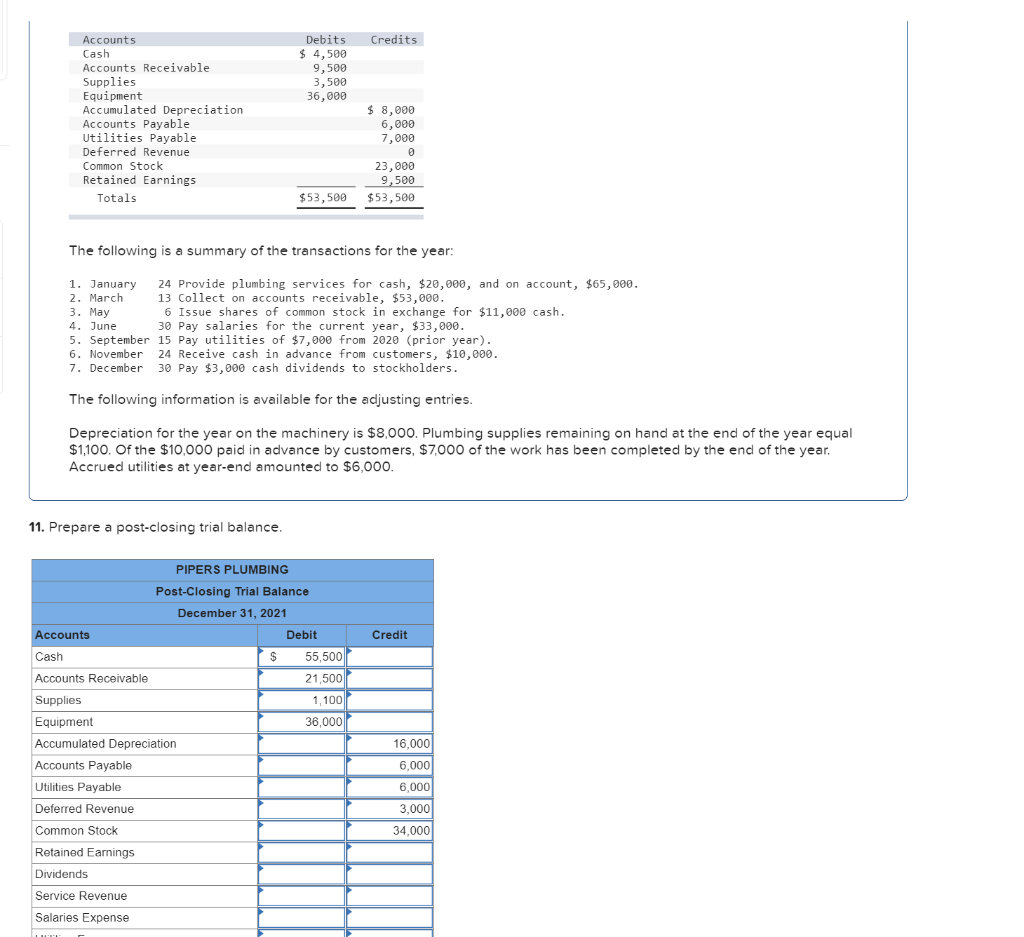

Seminoles Corporation's fiscal year-end is December 31, 2021. The following is a partial adjusted trial balance as of December 31. Debit Credit $30,000 $ 3,080 50, eee 6,000 Accounts Retained Earnings Dividends Service Revenue Interest Revenue Salaries Expense Rent Expense Advertising Expense Depreciation Expense Interest Expense 15,000 6,000 3,000 11,000 5,000 Required: 1. Prepare the necessary closing entries. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) % Answer is not complete. No General Journal Credit Date December 31, 202 Service Revenue Debit 50,000 6,000 Interest Revenue 56,000 2 December 31, 202 40,000 Depreciation Expense 11,000 5,000 6,000 Interest Expense Rent Expense Salaries Expense Advertising Expense OOOOO 15,000 3,000 3,000 December 31, 202 Retained Earnings Dividends 3,000 [The following information applies to the questions displayed below.] The general ledger of Pipers Plumbing at January 1, 2021, includes the following account balances: Credits Debits $ 4,500 9,500 3,500 36,000 Accounts Cash Accounts Receivable Supplies Equipment Accumulated Depreciation Accounts Payable Utilities Payable Deferred Revenue Common Stock Retained Earnings Totals $ 8,000 6,000 7,000 23,000 9,500 $53,500 $53,500 The following is a summary of the transactions for the year: 1. January 24 Provide plumbing services for cash, $20,000, and on account, $65,000. 2. March 13 Collect on accounts receivable, $53,000. 3. May 6 Issue shares of common stock in exchange for $11,000 cash. 4. June 30 Pay salaries for the current year, $33,000. 5. September 15 Pay utilities of $7,000 from 2020 (prior year). 6. November 24 Receive cash in advance from customers, $10,000. 7. December 30 Pay $3,000 cash dividends to stockholders. The following information is available for the adjusting entries. Depreciation for the year on the machinery is $8,000. Plumbing supplies remaining on hand at the end of the year equal $1,100. Of the $10,000 paid in advance by customers, $7,000 of the work has been completed by the end of the year. Accrued utilities at year-end amounted to $6,000. 9. Record closing entries. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) X Answer is not complete. No Date General Journal Credit Debit 92,000 December 31 Service Revenue 92,000 December 31 49,400 Salaries Expense Utilities Expense Supplies Expense Depreciation Expense 33,000 6,000 2,400 8,000 3 December 31 Retained Earnings 52,100 % Required information [The following information applies to the questions displayed below.] The general ledger of Pipers Plumbing at January 1, 2021, includes the following account balances: Credits Debits $ 4,500 9,500 3,500 36,000 Accounts Cash Accounts Receivable Supplies Equipment Accumulated Depreciation Accounts Payable Utilities Payable Deferred Revenue Common Stock Retained Earnings Totals $ 8,000 6,000 7,000 23,000 9,500 $53,500 $53,500 The following is a summary of the transactions for the year: 1. January 24 Provide plumbing services for cash, $20,000, and on account, $65,000. 2. March 13 Collect on accounts receivable, $53,000. 3. May 6 Issue shares of common stock in exchange for $11,000 cash. 4. June 30 Pay salaries for the current year, $33,000. 5. September 15 Pay utilities of $7,000 from 2020 (prior year). 24 Receive cash in advance from customers, $10,000. 7. December 30 Pay $3,000 cash dividends to stockholders. The following information is available for the adjusting entries. Depreciation for the year on the machinery is $8,000. Plumbing supplies remaining on hand at the end of the year equal $1,100. Of the $10,000 paid in advance by customers, $7,000 of the work has been completed by the end of the year. Accrued utilities at year-end amounted to $6,000. 1., 3., 6 & 10. Post the transactions, adjusting entries and closing entries to the T-accounts. Be sure to include beginning balances. Answer is not complete. Beg. Bal. Beg. Bal. Accounts Receivable 9,500 65,000 53,000 Cash 4,500 20,000 53,000 11,000 10,000 33,000 7,000 3,000 d. e. g. End. Bal 55,500 End. Bal. 21,500 Supplies Equipment Credits Debits $ 4,500 9,500 3,500 36,000 Accounts Cash Accounts Receivable Supplies Equipment Accumulated Depreciation Accounts Payable Utilities Payable Deferred Revenue Common Stock Retained Earnings Totals $ 8,000 6,000 7,000 23,000 9,500 $53,500 $53,500 The following is a summary of the transactions for the year: 1. January 24 Provide plumbing services for cash, $20,000, and on account, $65,000. 2. March 13 Collect on accounts receivable, $53,000. 3. May 6 Issue shares of common stock in exchange for $11,000 cash. 4. June 30 Pay salaries for the current year, $33,000. 5. September 15 Pay utilities of $7,000 from 2020 (prior year). 6. November 24 Receive cash in advance from customers, $10,000. 7. December 30 Pay $3,000 cash dividends to stockholders. The following information is available for the adjusting entries. Depreciation for the year on the machinery is $8,000. Plumbing supplies remaining on hand at the end of the year equal $1,100. Of the $10,000 paid in advance by customers, $7,000 of the work has been completed by the end of the year. Accrued utilities at year-end amounted to $6,000. 11. Prepare a post-closing trial balance. Credit PIPERS PLUMBING Post-Closing Trial Balance December 31, 2021 Accounts Debit Cash $ 55,500 Accounts Receivable 21,500 Supplies 1,100 Equipment 36,000 Accumulated Depreciation Accounts Payable Utilities Payable 16,000 6,000 6,000 3,000 34,000 Deferred Revenue Common Stock Retained Earnings Dividends Service Revenue Salaries Expense