Answered step by step

Verified Expert Solution

Question

1 Approved Answer

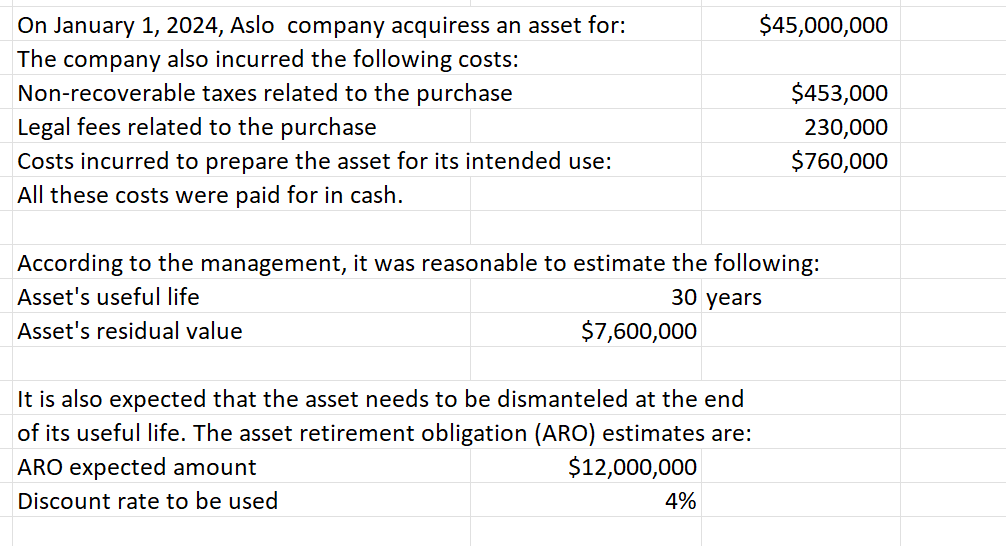

send it to expert The straight - line method of depreciation is used for depreciation. The company applies IFRS. Round numbers to the nearest dollar.

send it to expert The straightline method of depreciation is used for depreciation. The company applies IFRS.

Round numbers to the nearest dollar.

Required

a Prepare the journal entry to record the acquisition of the asset on January

b Prepare the required adjusting entries on December and December

c Assume that on January the asset's retirement costs are re

The discount rate remains the same.

Prepare the journal entry to record this change on January and calculate the depreciation expense to be recorded on December no journal entry required for the depreciation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started