Answered step by step

Verified Expert Solution

Question

1 Approved Answer

send me only final answer no need explanation ok Financial statement values for each ABC Company are summarized below. Item (KD) Total assets 4,000,000 Total

send me only final answer no need explanation ok

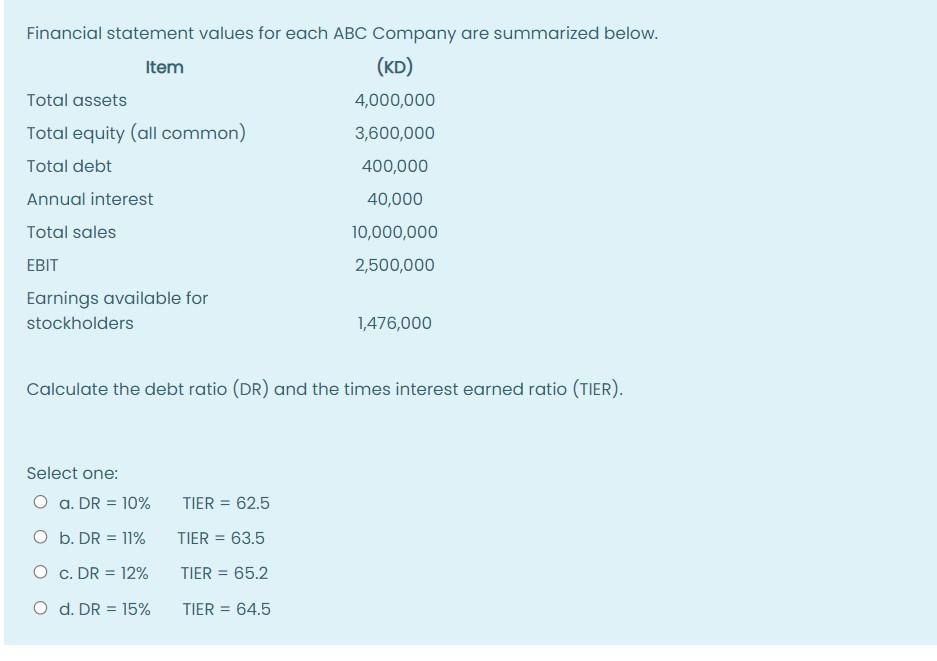

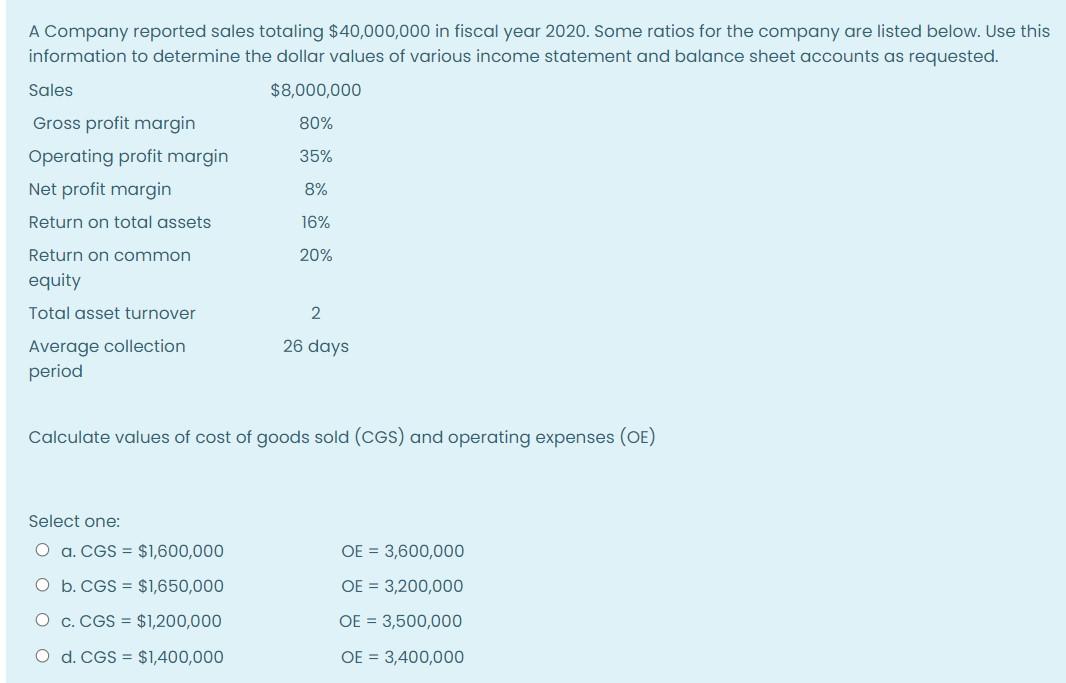

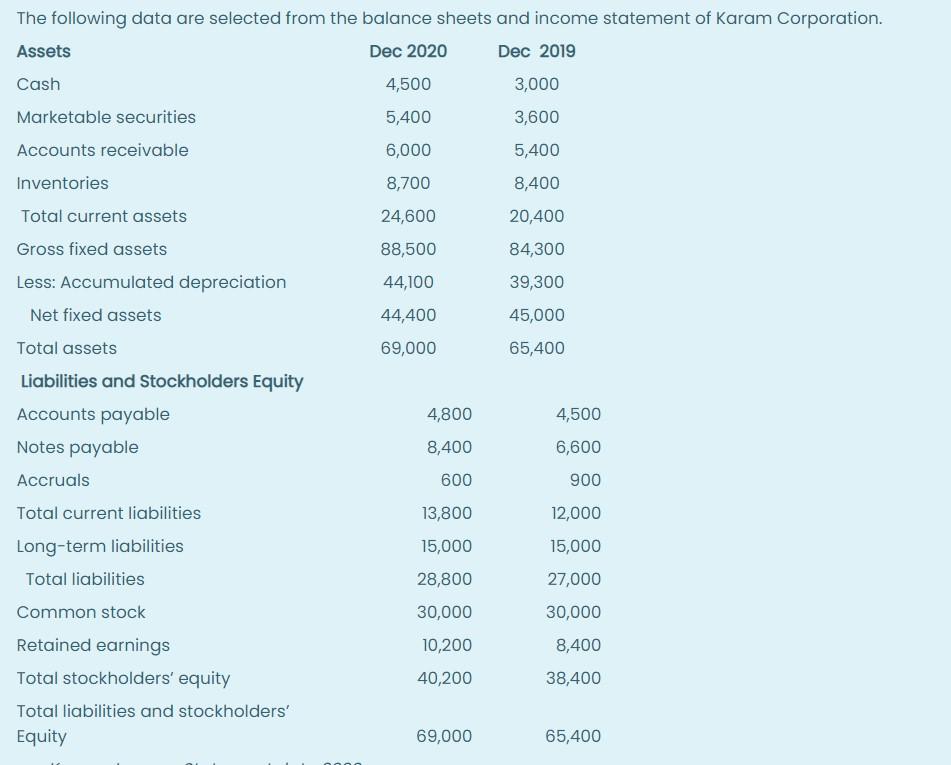

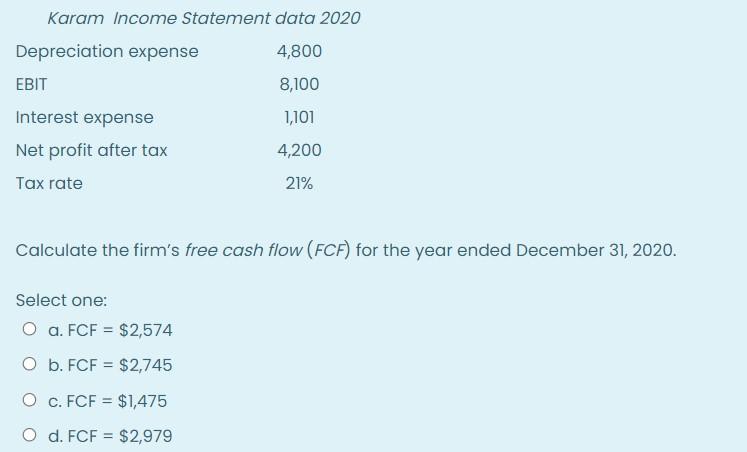

Financial statement values for each ABC Company are summarized below. Item (KD) Total assets 4,000,000 Total equity (all common) 3,600,000 Total debt 400,000 Annual interest 40,000 Total sales 10,000,000 EBIT 2,500,000 Earnings available for stockholders 1,476,000 Calculate the debt ratio (DR) and the times interest earned ratio (TIER). Select one: O a. DR = 10% TIER = 62.5 O b. DR = 11% TIER = 63.5 O C. DR = 12% TIER = 65.2 O d. DR = 15% TIER = 64.5 A Company reported sales totaling $40,000,000 in fiscal year 2020. Some ratios for the company are listed below. Use this information to determine the dollar values of various income statement and balance sheet accounts as requested. Sales $8,000,000 Gross profit margin 80% Operating profit margin 35% Net profit margin 8% Return on total assets 16% 20% Return on common equity Total asset turnover 2. 26 days Average collection period Calculate values of cost of goods sold (CGS) and operating expenses (OE) Select one: O a. CGS = $1,600,000 OE = 3,600,000 O b. CGS = $1,650,000 OE = 3,200,000 O c. CGS = $1,200,000 OE = 3,500,000 O d. CGS = $1,400,000 OE = 3,400,000 The following data are selected from the balance sheets and income statement of Karam Corporation. Assets Dec 2020 Dec 2019 Cash 4,500 3,000 Marketable securities 5,400 3,600 Accounts receivable 6,000 5,400 Inventories 8,700 8,400 Total current assets 24,600 20,400 Gross fixed assets 88,500 84,300 Less: Accumulated depreciation 44,100 39,300 Net fixed assets 44,400 45,000 Total assets 69,000 65,400 Liabilities and Stockholders Equity Accounts payable 4,800 4,500 Notes payable 6,600 Accruals 600 900 Total current liabilities 13,800 12,000 Long-term liabilities 15,000 15,000 Total liabilities 28,800 27,000 Common stock 30,000 30,000 Retained earnings 10,200 8,400 Total stockholders' equity 40,200 38,400 Total liabilities and stockholders' Equity 69,000 65,400 8,400 an Karam Income Statement data 2020 Depreciation expense 4,800 EBIT 8,100 1,101 Interest expense Net profit after tax Tax rate 4,200 21% Calculate the firm's free cash flow (FCF) for the year ended December 31, 2020. Select one: O a. FCF = $2,574 O b. FCF = $2,745 O c. FCF = $1,475 O d. FCF = $2,979Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started