Question

SEND YOUR ABSOLUTE BEST EXPERT HERE !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! the question i got answered is not right. Now i have to waste time and a question that

SEND YOUR ABSOLUTE BEST EXPERT HERE !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

the question i got answered is not right. Now i have to waste time and a question that i may need later to ask again. The person who answered DOES NOT give the correct payroll tax. They contradict themselves. 65k would not be any of those amounts so now im even more confused. They didnt subtract those numbers from 98000 either i tried and got a number that was 37k. I need someone who can answer this CORRECTLY and EXPLAIN better. I need someone to show me the journal i cant just read and understand it. again what i was given is completely wrong and they arent even doing operations the way it stands that 65k would be MULTIPLIED to that entire number in parethesis. This is not fair to me at all. AT ALL.

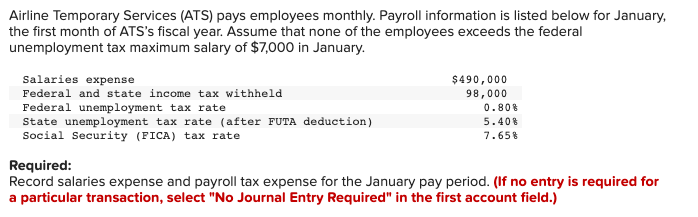

Airline Temporary Services (ATS) pays employees monthly. Payroll information is listed below for January, the first month of ATS's fiscal year. Assume that none of the employees exceeds the federal unemployment tax maximum salary of $7,000 in January. Required: Record salaries expense and payroll tax expense for the January pay period. (If no entry is required for a particular transaction, select "No Journal Entry Required" in the first account field.)

Airline Temporary Services (ATS) pays employees monthly. Payroll information is listed below for January, the first month of ATS's fiscal year. Assume that none of the employees exceeds the federal unemployment tax maximum salary of $7,000 in January. Required: Record salaries expense and payroll tax expense for the January pay period. (If no entry is required for a particular transaction, select "No Journal Entry Required" in the first account field.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started