Answered step by step

Verified Expert Solution

Question

1 Approved Answer

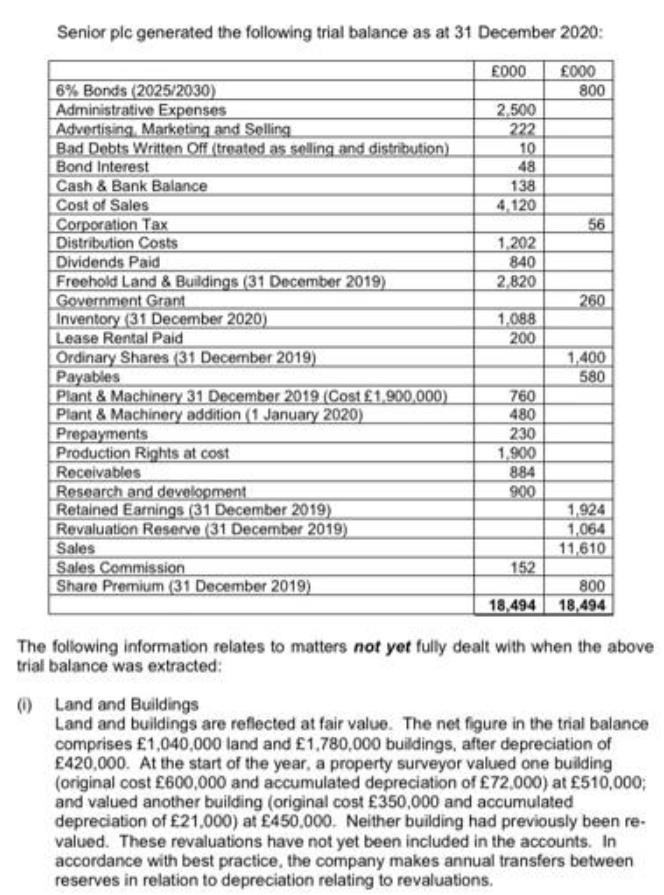

Senior plc generated the following trial balance as at 31 December 2020: 000 6% Bonds (2025/2030) Administrative Expenses Advertising Marketing and Selling Bad Debts

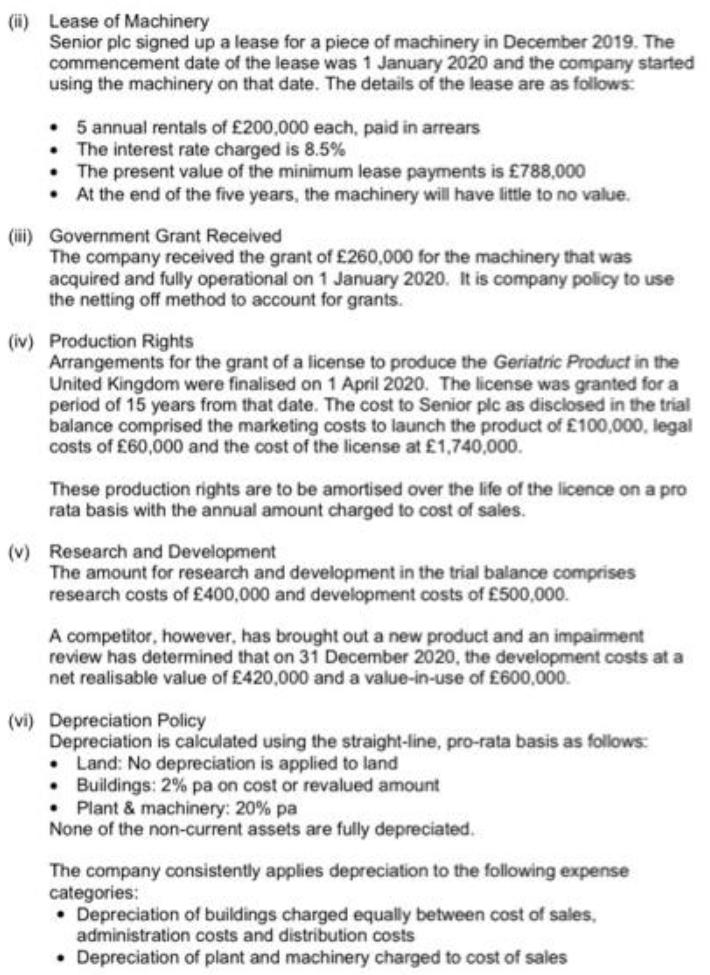

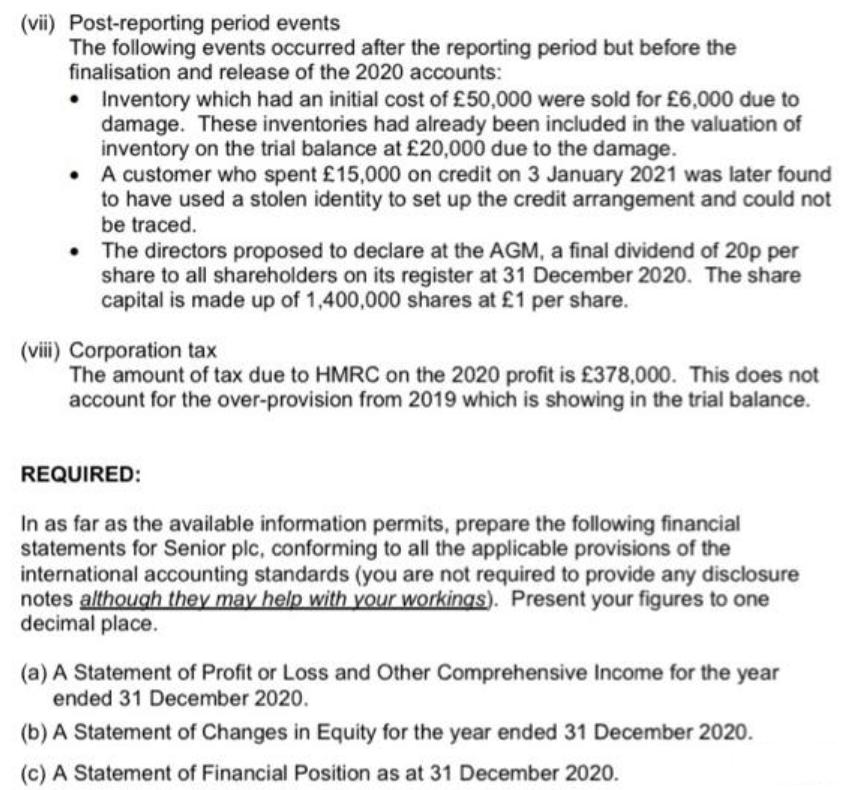

Senior plc generated the following trial balance as at 31 December 2020: 000 6% Bonds (2025/2030) Administrative Expenses Advertising Marketing and Selling Bad Debts Written Off (treated as selling and distribution) Bond Interest Cash & Bank Balance Cost of Sales Corporation Tax Distribution Costs Dividends Paid Freehold Land & Buildings (31 December 2019) Government Grant Inventory (31 December 2020) Lease Rental Paid Ordinary Shares (31 December 2019) Payables Plant & Machinery 31 December 2019 (Cost 1,900,000) Plant & Machinery addition (1 January 2020) Prepayments Production Rights at cost Receivables Research and development Retained Earnings (31 December 2019) Revaluation Reserve (31 December 2019) Sales Sales Commission Share Premium (31 December 2019) 2,500 222 10 48 138 4,120 1,202 840 2,820 1,088 200 760 480 230 1,900 884 900 152 18,494 000 800 56 260 1,400 580 1,924 1,064 11,610 800 18,494 The following information relates to matters not yet fully dealt with when the above trial balance was extracted: (1) Land and Buildings Land and buildings are reflected at fair value. The net figure in the trial balance comprises 1,040,000 land and 1,780,000 buildings, after depreciation of 420,000. At the start of the year, a property surveyor valued one building (original cost 600,000 and accumulated depreciation of 72,000) at 510,000; and valued another building (original cost 350,000 and accumulated depreciation of 21,000) at 450,000. Neither building had previously been re- valued. These revaluations have not yet been included in the accounts. In accordance with best practice, the company makes annual transfers between reserves in relation to depreciation relating to revaluations. (ii) Lease of Machinery Senior plc signed up a lease for a piece of machinery in December 2019. The commencement date of the lease was 1 January 2020 and the company started using the machinery on that date. The details of the lease are as follows: 5 annual rentals of 200,000 each, paid in arrears . The interest rate charged is 8.5% . The present value of the minimum lease payments is 788,000 At the end of the five years, the machinery will have little to no value. (iii) Government Grant Received The company received the grant of 260,000 for the machinery that was acquired and fully operational on 1 January 2020. It is company policy to use the netting off method to account for grants. (iv) Production Rights Arrangements for the grant of a license to produce the Geriatric Product in the United Kingdom were finalised on 1 April 2020. The license was granted for a period of 15 years from that date. The cost to Senior plc as disclosed in the trial balance comprised the marketing costs to launch the product of 100,000, legal costs of 60,000 and the cost of the license at 1,740,000. These production rights are to be amortised over the life of the licence on a pro rata basis with the annual amount charged to cost of sales. (v) Research and Development The amount for research and development in the trial balance comprises research costs of 400,000 and development costs of 500,000. A competitor, however, has brought out a new product and an impairment review has determined that on 31 December 2020, the development costs at a net realisable value of 420,000 and a value-in-use of 600,000. (vi) Depreciation Policy Depreciation is calculated using the straight-line, pro-rata basis as follows: Land: No depreciation is applied to land Buildings: 2% pa on cost or revalued amount Plant & machinery: 20% pa None of the non-current assets are fully depreciated. The company consistently applies depreciation to the following expense categories: Depreciation of buildings charged equally between cost of sales, administration costs and distribution costs Depreciation of plant and machinery charged to cost of sales (vii) Post-reporting period events The following events occurred after the reporting period but before the finalisation and release of the 2020 accounts: Inventory which had an initial cost of 50,000 were sold for 6,000 due to damage. These inventories had already been included in the valuation of inventory on the trial balance at 20,000 due to the damage. A customer who spent 15,000 on credit on 3 January 2021 was later found to have used a stolen identity to set up the credit arrangement and could not be traced. The directors proposed to declare at the AGM, a final dividend of 20p per share to all shareholders on its register at 31 December 2020. The share capital is made up of 1,400,000 shares at 1 per share. (viii) Corporation tax The amount of tax due to HMRC on the 2020 profit is 378,000. This does not account for the over-provision from 2019 which is showing in the trial balance. REQUIRED: In as far as the available information permits, prepare the following financial statements for Senior plc, conforming to all the applicable provisions of the international accounting standards (you are not required to provide any disclosure notes although they may help with your workings). Present your figures to one decimal place. (a) A Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2020. (b) A Statement of Changes in Equity for the year ended 31 December 2020. (c) A Statement of Financial Position as at 31 December 2020.

Step by Step Solution

★★★★★

3.53 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the financial statements for Senior plc we will start with the trial balance and incorporate the additional information provided Well follo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started