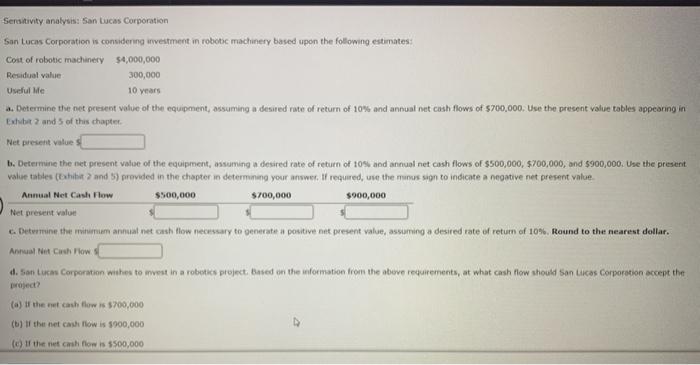

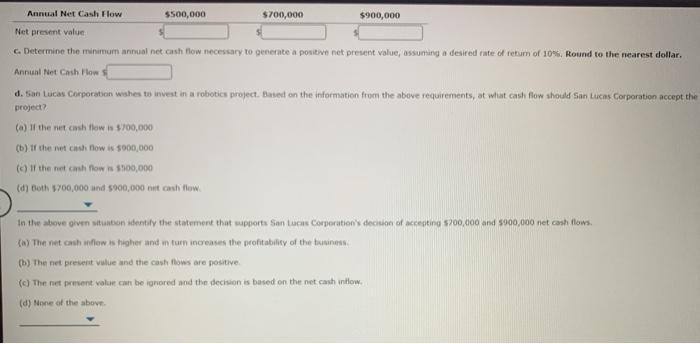

Sensitivity analysis: San Lucas Corporation San Lucas Corporation is considering investment in robotic machinery based upon the following estimates: Cost of robotic machinery $4,000,000 Residual value 300,000 Useful Me 10 years a. Determine the net present value of the equipment, assuming a desired rate of return of 10% and annual net cash flows of $700,000. Use the present value tables appearing in Exhibit 2 and 5 of this chapter Net present value b. Determine the net present value of the equipment, assuming a desired rate of return of 105 and animal net cash flows of $500,000, $700,000, and $900,000. Use the present value tables (hohe 7 and ) provided in the chapter in determining your answer. It required, use the massion to indicate a negative net present value Annual Net Cash Flow $500,000 $700,000 $900,000 Net present value c. Determine the minimum annual net cash flow necessary to generate a positive not present value, assuming a desired rate of return of 10% Reund to the nearest dollar. Annual i Cushow 4. San Luc Corporation withes to svest in a robotics project. Based on the formation from the above requirements, at what cash flow should Son Licas Corporation accept the project? (a) the net cash flow $700,000 (b) If the net show is 900,000 of the net cash flow is 5500,000 Annual Net Cash Flow $500,000 $700,000 $900,000 Net present value c. Determine the minimum annual net cash flow necessary to generate a positive not present value, assuming a desired rate of retum of 10% Round to the nearest dollar. Annual Meet Cath How d. Son Luca Corporation wahes to invest in a robotics project. Based on the information from the above requirements, at what cash flow should San Lucas Corporation accept the project? (a) of the methow is $700,000 (b) of the net cash flow is 5000,000 (If the net cash flow is $300,000 (d) Both $700,000 und 5000,000 tash flow In the above given situation identify the statement that supports San Luc Corporation decision of accepting $200,000 and $900,000 net cash flows. The net orth iowas higher and in turn increases the profitabilny of the business (b) The net present value and the cash flows are positive The net present value can be ignored and the decision is based on the net cash intlow. (d) None of the above