SENTENCE CONTINUES ON BELOW:

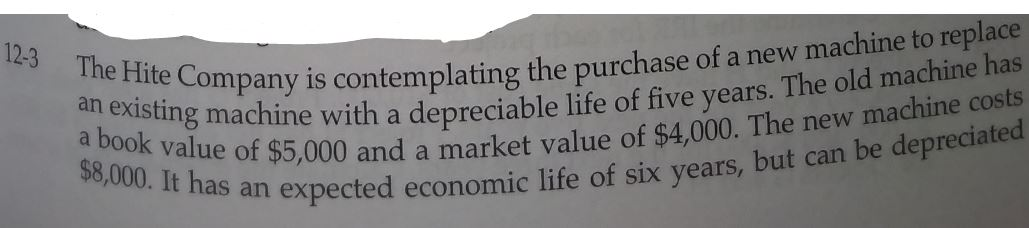

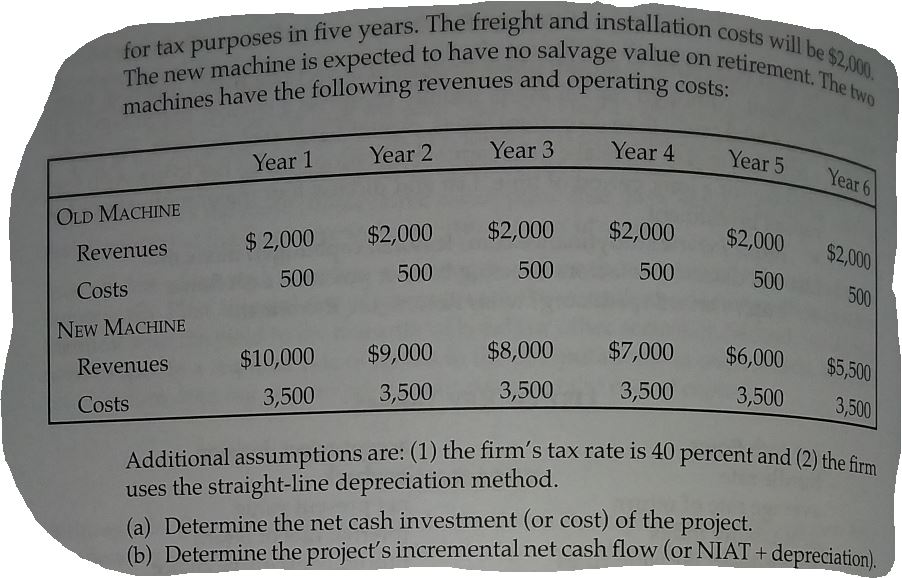

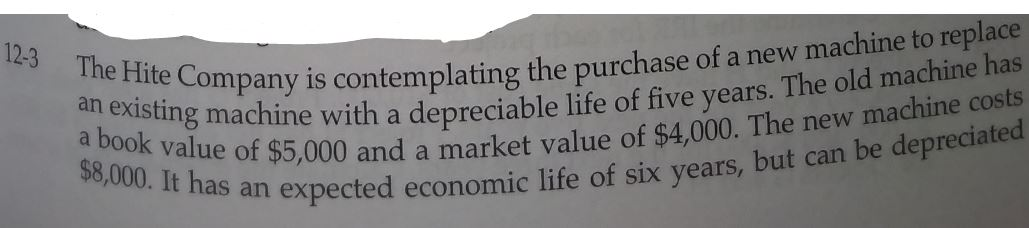

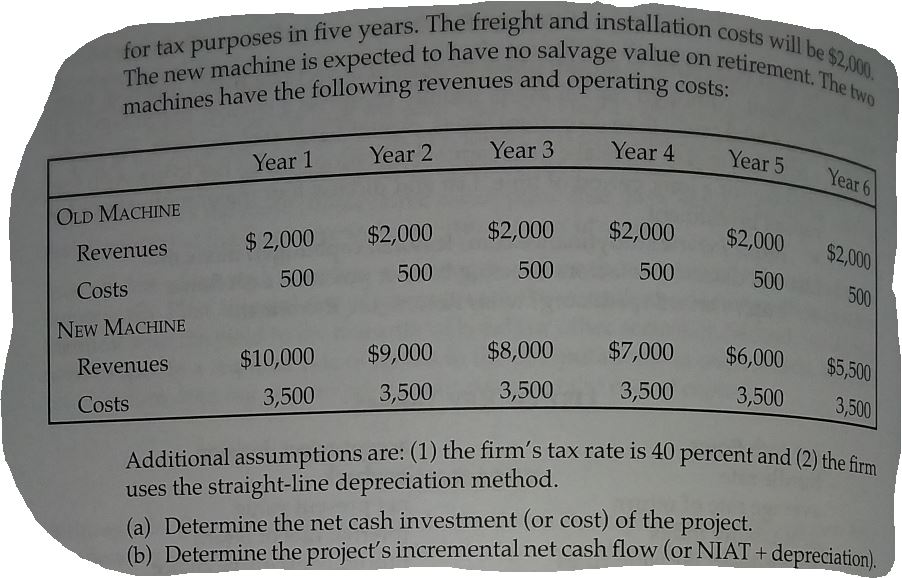

12-3 The Hite Company an existing machine with a a book value of $5,000 and $8,000. It has an expected eco Company is contemplating the purchase of a new machine to replace Inachine with a depreciable life of five years. The old machine has e of $5,000 and a market value of $4,000. The new machine costs I expected economic life of six years, but can be depreciated freight and installation costs wil vage value on retirement. Th n costs will be $2,000. irement. The two for tax purposes in five years. The freight and The new machine is expected to have no salvage va machines have the following revenues and operati ues and operating costs: ar Year 3 Year 1 Year 4 25 Year 6) Year 5 OLD MACHINE $2,000 Revenues $2,000 500 $2,000 500 $2,000 $2,000 500 500 500 $2,000 500 Costs NEw MACHINE Revenues $8,000 $6,000 $10,000 3,500 $ $9,000 3,500 $7,000 3,500 3,500 3,500 $5,500 3,500 Costs Additional assumptions are: (1) the firm's tax rate is 40 percent and (2) the uses the straight-line depreciation method. (a) Determine the net cash investment (or cost) of the project. (b) Determine the project's incremental net cash flow (or NIAT + denracia 12-3 The Hite Company an existing machine with a a book value of $5,000 and $8,000. It has an expected eco Company is contemplating the purchase of a new machine to replace Inachine with a depreciable life of five years. The old machine has e of $5,000 and a market value of $4,000. The new machine costs I expected economic life of six years, but can be depreciated freight and installation costs wil vage value on retirement. Th n costs will be $2,000. irement. The two for tax purposes in five years. The freight and The new machine is expected to have no salvage va machines have the following revenues and operati ues and operating costs: ar Year 3 Year 1 Year 4 25 Year 6) Year 5 OLD MACHINE $2,000 Revenues $2,000 500 $2,000 500 $2,000 $2,000 500 500 500 $2,000 500 Costs NEw MACHINE Revenues $8,000 $6,000 $10,000 3,500 $ $9,000 3,500 $7,000 3,500 3,500 3,500 $5,500 3,500 Costs Additional assumptions are: (1) the firm's tax rate is 40 percent and (2) the uses the straight-line depreciation method. (a) Determine the net cash investment (or cost) of the project. (b) Determine the project's incremental net cash flow (or NIAT + denracia