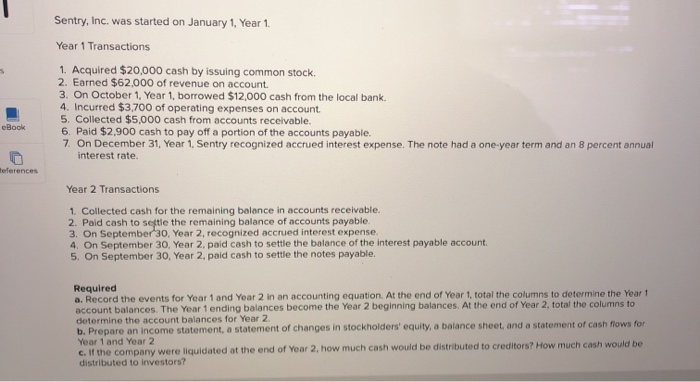

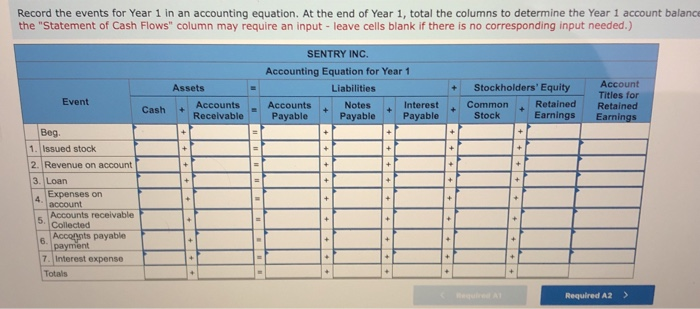

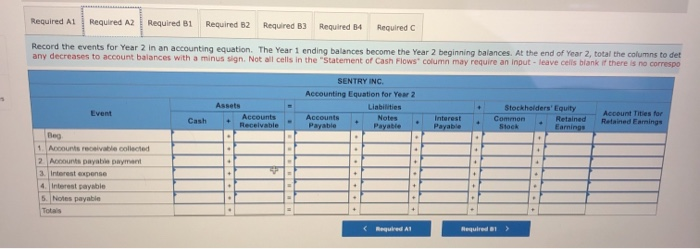

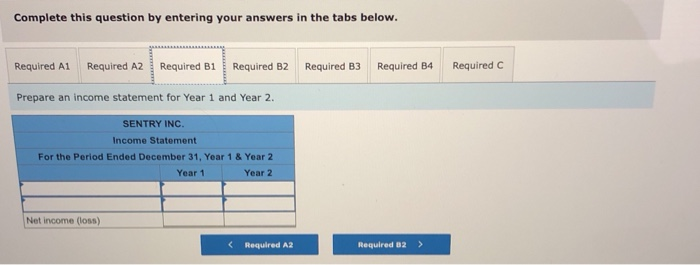

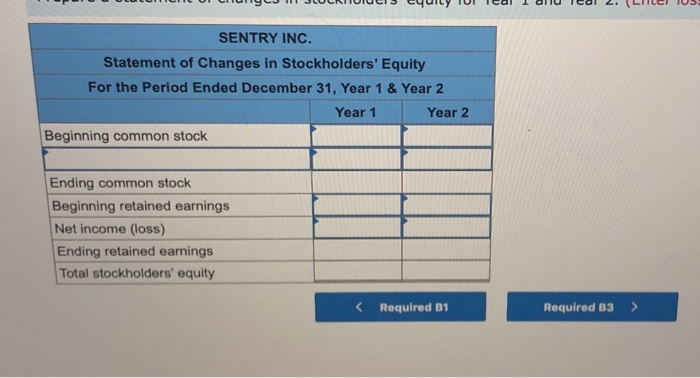

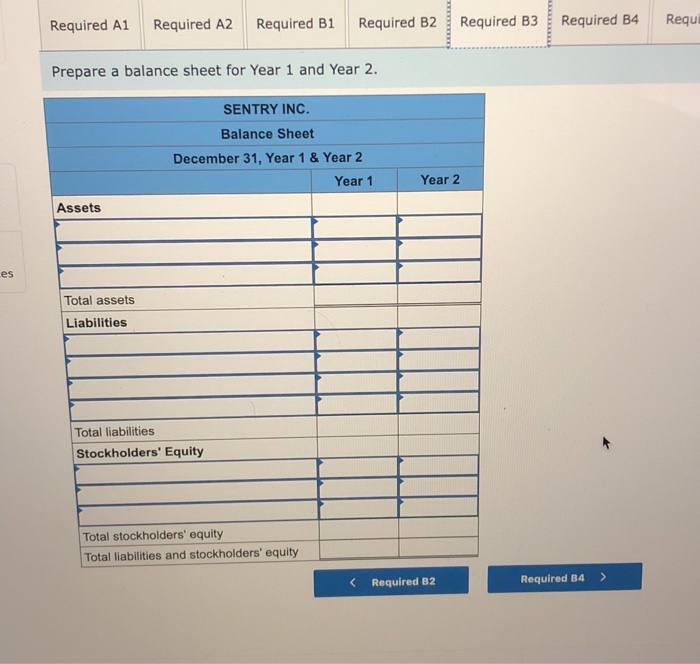

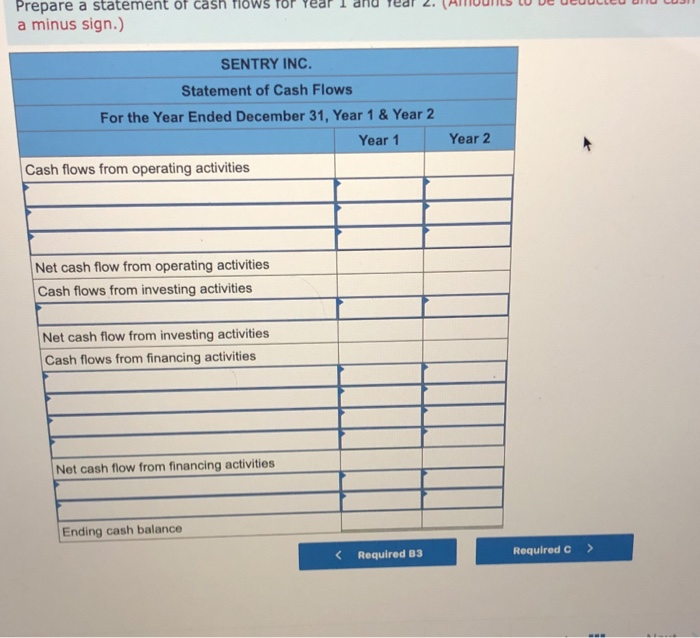

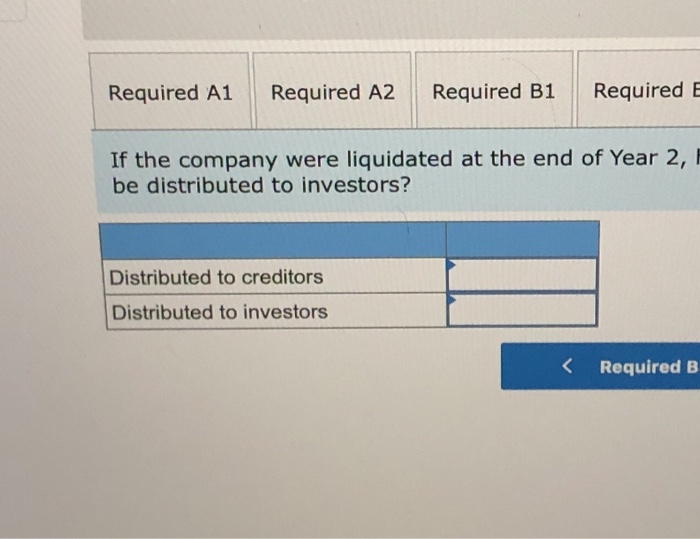

Sentry, Inc. was started on January 1, Year 1 Year 1 Transactions 1. Acquired $20.000 cash by issuing common stock 2. Earned $62,000 of revenue on account 3. On October 1 Year 1, borrowed $12,000 cash from the local bank 4. Incurred $3,700 of operating expenses on account 5. Collected $5,000 cash from accounts receivable. 6. Paid $2,900 cash to pay off a portion of the accounts payable. 7 On December 31, Year 1. Sentry recognized accrued interest expense. The note had a one-year term and an 8 percent annual interest rate ferences Year 2 Transactions 1. Collected cash for the remaining balance in accounts receivable. 2. Paid cash to setle the remaining balance of accounts payable. 3. On September 30, Year 2, recognized accrued interest expense. 4. On September 30, Year 2. paid cash to settle the balance of the interest payable account 5. On September 30, Year 2, paid cash to settle the notes payable. Required a. Record the events for Year 1 and Year 2 in an accounting equation. At the end of Year 1 total the columns to determine the Year 1 account balances. The Year 1 ending balances become the Year 2 beginning balances. At the end of Year 2, total the columns to determine the account balances for Year 2 b. Prepare an income statement, a statement of changes in stockholders' equity, a balance sheet, and a statement of cash flows for Year 1 and Year 2 c. If the company were liquidated at the end of Year 2, how much cash would be distributed to creditors? How much cash would be distributed to investors? Record the events for Year 1 in an accounting equation. At the end of Year 1, total the columns to determine the Year 1 account balance the "Statement of Cash Flows" column may require an input - leave cells blank if there is no corresponding input needed.) Assets SENTRY INC. Accounting Equation for Year 1 Liabilities Accounts Notes Interest Payable Payable Payable + Event Account Titles for Retained Earnings Cash Accounts Receivable Stockholders' Equity Common Retained Stock Earnings Beg 1. Issued stock 2. Revenue on account 3. Loan Expenses on 4. account Accounts receivable 5. Collected Accounts payable payment 7. Interest expense Totals Required A2 > Required Al Required A2 Required 81 Required B2 Required 83 Required B4 Required Record the events for Year 2 in an accounting equation. The Year 1 ending balances become the Year 2 beginning balances. At the end of Year 2, total the columns to det any decreases to account balances with a minus sign. Not all cells in the "Statement of Cash Flows column may require an input - leave cells blank if there is no correspo SENTRY INC. Accounting Equation for Year 2 Liabilities Event Cash Accounts Receivable Stockholders' Equity Retained Earnings Account Tities for Retained Earnings 1. Accounts receivable collected 2 Accounts payahie pamant 3 Interest expense 4. Interest payable 5. Notes payable Totals Complete this question by entering your answers in the tabs below. Required A1 Required A2 Required B1 Required B2 Required B3 Required B4 Required C Prepare an income statement for Year 1 and Year 2. SENTRY INC. Income Statement For the Period Ended December 31, Year 1 & Year 2 Year 1 Year 2 Net income (los) wt L UI LIUnYCJI JULRIIUIUeis equily TUI Teal Idu ledl 2. (Liler 105 SENTRY INC. Statement of Changes in Stockholders' Equity For the Period Ended December 31, Year 1 & Year 2 Year 1 Year 2 Beginning common stock Ending common stock Beginning retained earnings Net income (loss) Ending retained earnings Total stockholders' equity Required A1 Required A2 Required B1 Required B3 Required B4 Requ Prepare a balance sheet for Year 1 and Year 2. SENTRY INC. Balance Sheet December 31, Year 1 & Year 2 Year 1 Year 2 Assets Total assets Liabilities Total liabilities Stockholders' Equity Total stockholders' equity Total liabilities and stockholders' equity Tipure u salernelle UI LASIT HUWS IUF Tear I and Team 2. a minus sign.) TOUT U SENTRY INC. Statement of Cash Flows For the Year Ended December 31, Year 1 & Year 2 Year 1 Cash flows from operating activities Year 2 Net cash flow from operating activities Cash flows from investing activities Net cash flow from investing activities Cash flows from financing activities Net cash flow from financing activities Ending cash balance Required A1 Required A2 Required B1 Required E If the company were liquidated at the end of Year 2, be distributed to investors? Distributed to creditors Distributed to investors