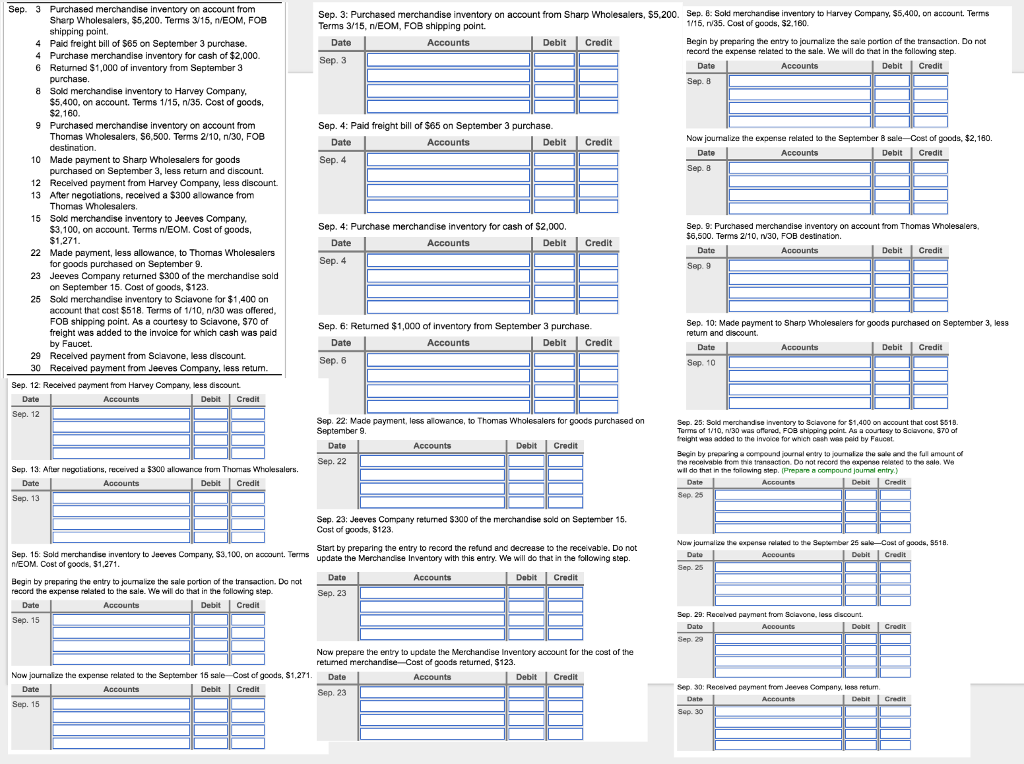

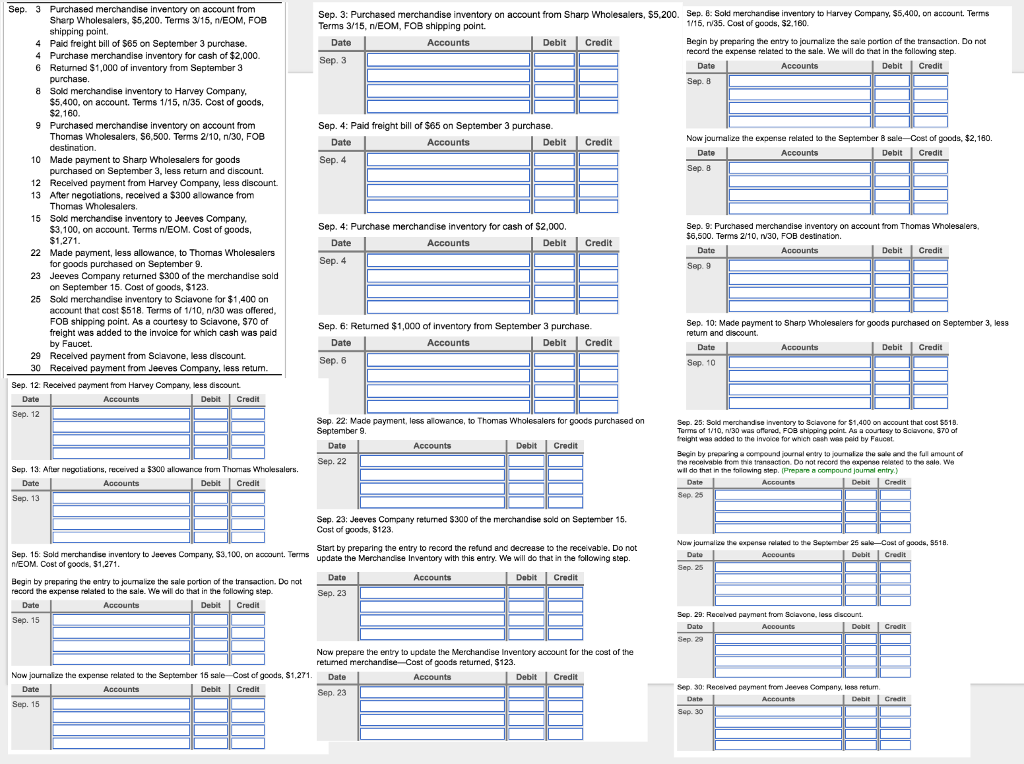

Sep. 3 Purchased merchandise inventory on account from Sharp Wholesalers, $5,200. Terms 315, n/EOM, FOB shipping point Paid freight bill of $65 on September 3 purchase. Purchase merchandise inventory for cash of $2,000. Returned $1,000 of inventory from September 3 Sep. 3: Purchased merchandise inventory on account from Sharp Wholesalers, $5,200. Sep 8 Sold merchandise inventory to Harvey Compamy, 95,400, on account. Terms Terms 3'15, n/EOM, FOB shipping point. 116, v35. Cost of goods, S2,160. Begin by preparing the entry to journalize the sale portion of the transaction. Do not record the expense related to the sale. We will do that in the following step. Date Accounts Debit Credit 4 4 6 Date Debit Credit 8 Sold merchand se inventory to Harvey Company, $5,400, on account. Terms 1/1, n/35. Cost of goods, 9 Purchased merchandise inventory on account from Thomas Wholesalers, S6.500. Terms 2/10. n/30. FOB Sep. 4: Paid freight bill of $65 on September 3 purchase. Accounts DebitCredit Now journalize the expense related to the September 8 sale Ccst of goods, $2,160. Debit Credit 10 Made payment to Sharp Wholesalers for goods purchased on September 3, less retrn and discount. 12 Received payment from Harvey Company, less discount. 13 After negotiations, received a $300 allowance from Thomas Wholesalers. 15 Sold merchand se inventory to Jeeves Company, Sep. 4: Purchase merchandise inventory for cash of $2,000 Sep. 9: Purchased merchandise invetory on account from Thomas wholesalers, 56,500. Terms 2/10, n30, FOB destination. 3,100, on account. Terms nEOM. Cost of goods, Date Debit Credit 22 Made payment, less allowance, to Thomas Wholesalers for goods purchased on September . Jeeves Company returned $300 of the merchandise sold on September 15. Cost of goods, $123. Sold merchandise inventory to Sciavone for $1,400 on account that cost $518 Terms of 1/10, n/30 was offered FOB shipping point. As a courtesy to Sciavone, $70 of freight was added to the invoice for which cash was paid 23 25 Sep. 6: Returned $1,000 of inventory from September 3 purchase. Sep. 10: Made payment to Sharp wholeselers for goods purchased on September 3, less retum and discount. Date Accounts Debit Credit Date Debit Credit 29 Receved payment from Sclavone, less discount 30 Received payment from Jeeves less retum Sep. 12: Received payment frem Harvey Company, less discount Debit Credit Sep. 22: Made payment, less allowance, to Thomas Wholesalers for goods purchased on Sep. 25: Sold merch??dse inventory to Sciavone for S1.400 on account that cost S518. Tonma of 1/10, n/30 was offared, FOB shipping point As a courteay to Sciavene, $70 af reignt waa added to the invoice for which cash was peid by Faucet Begin by preparing a compound journal enry to journalze the sale and he ful amount of ne recerable from ts transation Donat recerd tne experse relatec to the sale. We wil do that in 1h to?owing step. [Prepare ? compound jourmel entry.) Sep. 13. After negatiations, received a $300 allawance from Thomas Wholesalers. Debit Credit Sep. 23: Jeeves Company returned $300 of the merchandise sold an September 15 Cost of goods, S123. Now joumalize the expense related to the Sepembar 25 sale Cost af goods, S518. Start by preparing the entry to record the refund and decrease to the receivable. Do not update the Merchandise Inventory with this entry. We will do that in the following step Sep. 15: Sold merchandise inventory to Jeeves Company, S3,100, on aocount. Terms EOM. Cost of goocs, $1,271 Begin by preparing the entry to journalize the sale portion of the transaction. Do nat record the expense related to the sale. We will do that in the follawing step. Debit Credit Debit Credit Sop. 29: Recolved payment from Sciavone, less dscount Now prepere the entry to update the Merchandise Inventcry account for the cost of the retumed merchandise Cost ef gcods returned, $123. Naw jaurnalze the expense related to the September 15 sale Coet cf gcods, $1,271. Date Debit Credit Debit Credit Sep. 30: Receved payment from Jeeve8 Company, less retun