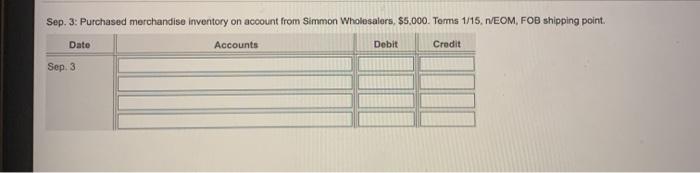

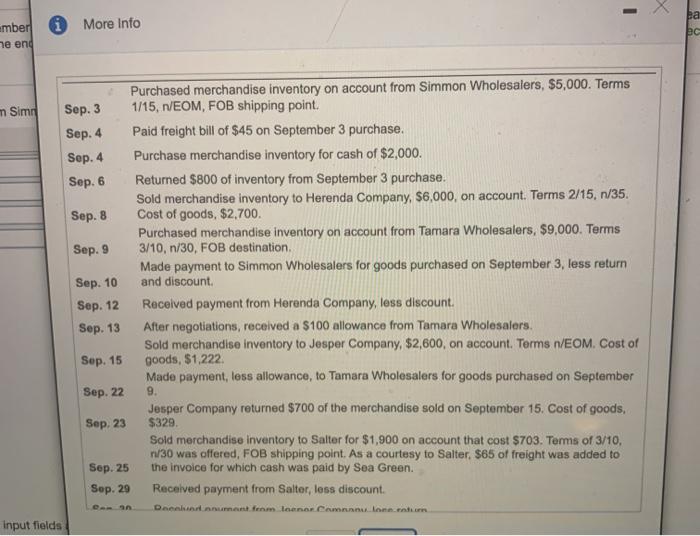

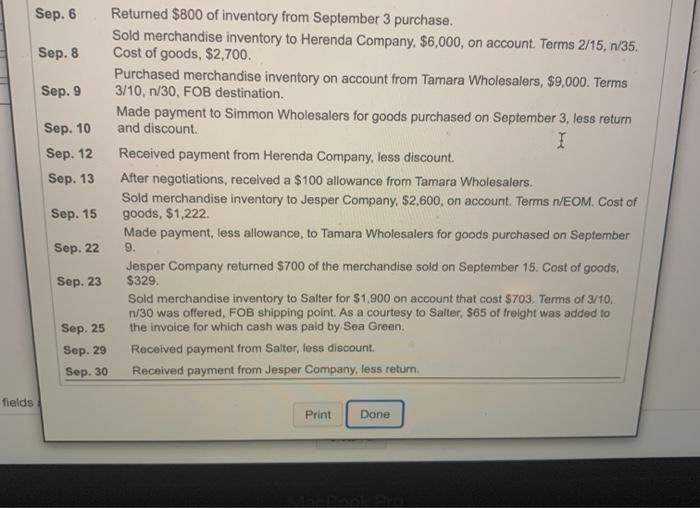

Sep. 3: Purchased merchandise inventory on account from Simmon Wholesalers, $5,000. Torms 1/15, n/EOM, FOB shipping point. Date Accounts Debit Credit Sep 3 i More Info ember he end c m Sim Purchased merchandise inventory on account from Simmon Wholesalers, $5,000. Terms Sep. 3 1/15, n/EOM, FOB shipping point. Sep. 4 Paid freight bill of $45 on September 3 purchase. Sep.4 Purchase merchandise inventory for cash of $2,000. Sep. 6 Returned $800 of inventory from September 3 purchase. Sold merchandise inventory to Herenda Company, $6,000, on account. Terms 2/15, 1/35. Sep. 8 Cost of goods, $2.700. Purchased merchandise inventory on account from Tamara Wholesalers, $9,000. Terms Sep. 9 3/10, n/30, FOB destination Made payment to Simmon Wholesalers for goods purchased on September 3, less return Sep. 10 and discount Sep. 12 Received payment from Herenda Company, less discount. After negotiations, received a $100 allowance from Tamara Wholesalers. Sold merchandise inventory to Jesper Company, $2,600, on account. Terms n/EOM. Cost of Sep. 15 goods, $1.222 Made payment, less allowance, to Tamara Wholesalers for goods purchased on September Sep. 22 9. Jesper Company returned $700 of the merchandise sold on September 15. Cost of goods, Sep. 23 $329 Sold merchandise inventory to Salter for $1,900 on account that cost $703. Terms of 3/10, n/30 was offered, FOB shipping point. As a courtesy to Salter. $65 of freight was added to Sep. 25 the invoice for which cash was paid by Sea Green Sep. 29 Received payment from Salter, less discount. Sep. 13 Dace anuman fem laenor Cannulan Input fields Sep. 6 Returned $800 of inventory from September 3 purchase. Sold merchandise inventory to Herenda Company. $6,000, on account. Terms 2/15, n/35. Sep. 8 Cost of goods, $2,700. Purchased merchandise inventory on account from Tamara Wholesalers, $9,000. Terms Sep. 9 3/10, n/30, FOB destination. Made payment to Simmon Wholesalers for goods purchased on September 3, less return Sep. 10 and discount I Sep. 12 Received payment from Herenda Company, less discount Sep. 13 After negotiations, received a $100 allowance from Tamara Wholesalers. Sold merchandise inventory to Jesper Company, $2,600, on account. Terms nEOM. Cost of Sep. 15 goods, $1,222 Made payment, less allowance, to Tamara Wholesalers for goods purchased on September Sep. 22 9. Jesper Company returned $700 of the merchandise sold on September 15. Cost of goods, Sep. 23 $329. Sold merchandise inventory to Salter for $1,900 on account that cost $703. Terms of 3/10, n/30 was offered, FOB shipping point. As a courtesy to Salter, $65 of freight was added to Sep. 25 the invoice for which cash was paid by Sea Green Sep. 29 Received payment from Salter, loss discount Sep. 30 Received payment from Jesper Company, less retum fields Print Done