Answered step by step

Verified Expert Solution

Question

1 Approved Answer

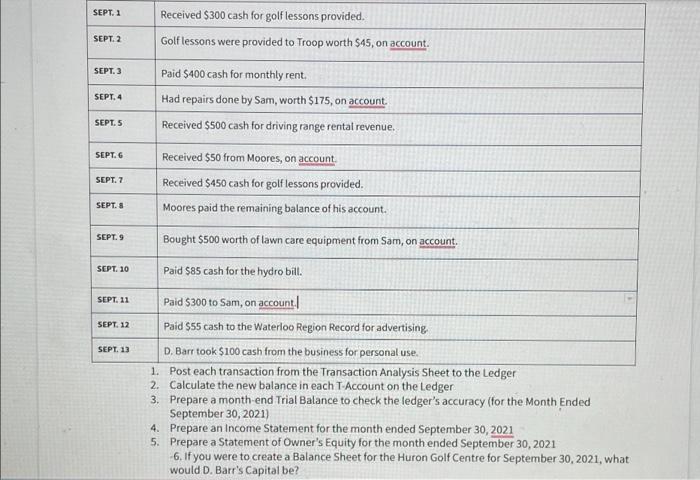

SEPT. 1 SEPT. 2 SEPT.3 SEPT.4 SEPT. 5 SEPT. 6 SEPT. 7 SEPT. 8 SEPT. 9 SEPT. 10 SEPT. 11 SEPT. 12 SEPT. 13

SEPT. 1 SEPT. 2 SEPT.3 SEPT.4 SEPT. 5 SEPT. 6 SEPT. 7 SEPT. 8 SEPT. 9 SEPT. 10 SEPT. 11 SEPT. 12 SEPT. 13 Received $300 cash for golf lessons provided. Golf lessons were provided to Troop worth $45, on account. Paid $400 cash for monthly rent. Had repairs done by Sam, worth $175, on account. Received $500 cash for driving range rental revenue. Received $50 from Moores, on account. Received $450 cash for golf lessons provided. Moores paid the remaining balance of his account. Bought $500 worth of lawn care equipment from Sam, on account. Paid $85 cash for the hydro bill. Paid $300 to Sam, on account. Paid $55 cash to the Waterloo Region Record for advertising D. Barr took $100 cash from the business for personal use. 1. Post each transaction from the Transaction Analysis Sheet to the Ledger 2. Calculate the new balance in each T-Account on the Ledger 3. Prepare a month-end Trial Balance to check the ledger's accuracy (for the Month Ended September 30, 2021) 4. Prepare an Income Statement for the month ended September 30, 2021 5. Prepare a Statement of Owner's Equity for the month ended September 30, 2021 6. If you were to create a Balance Sheet for the Huron Golf Centre for September 30, 2021, what would D. Barr's Capital be?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started