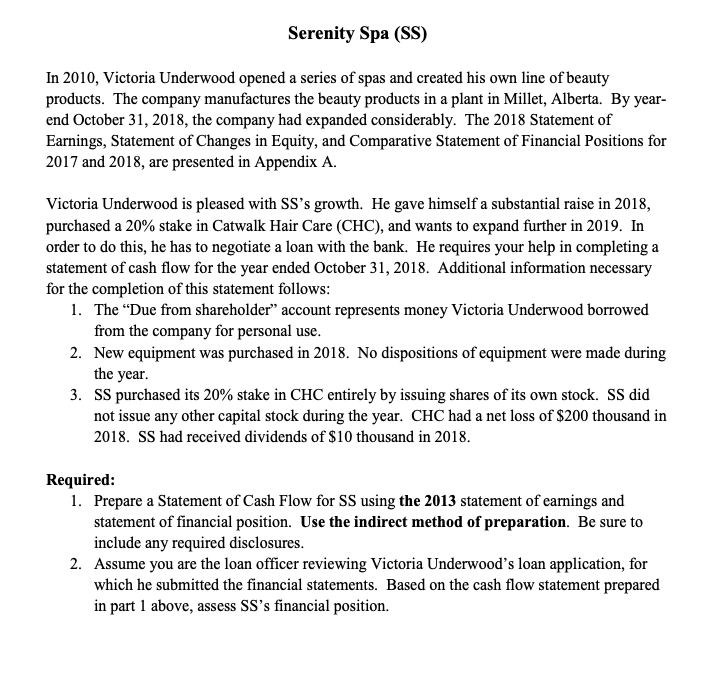

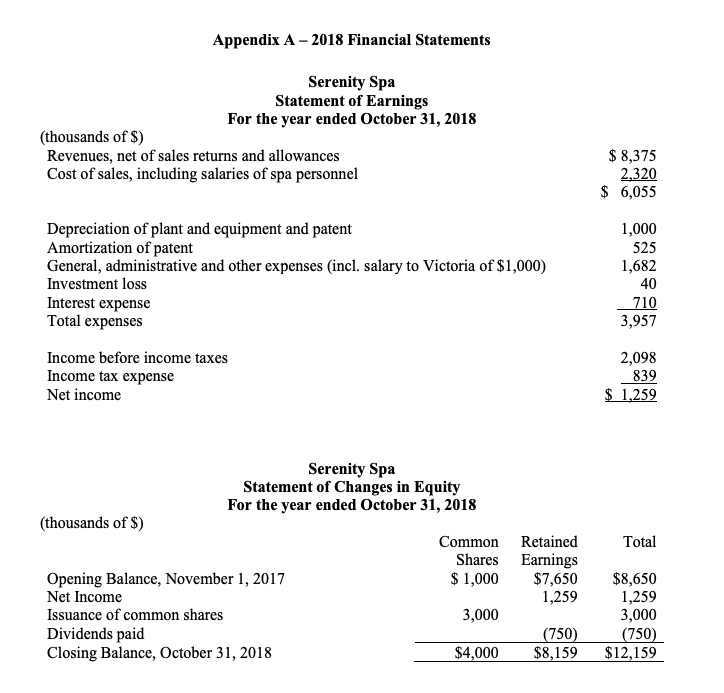

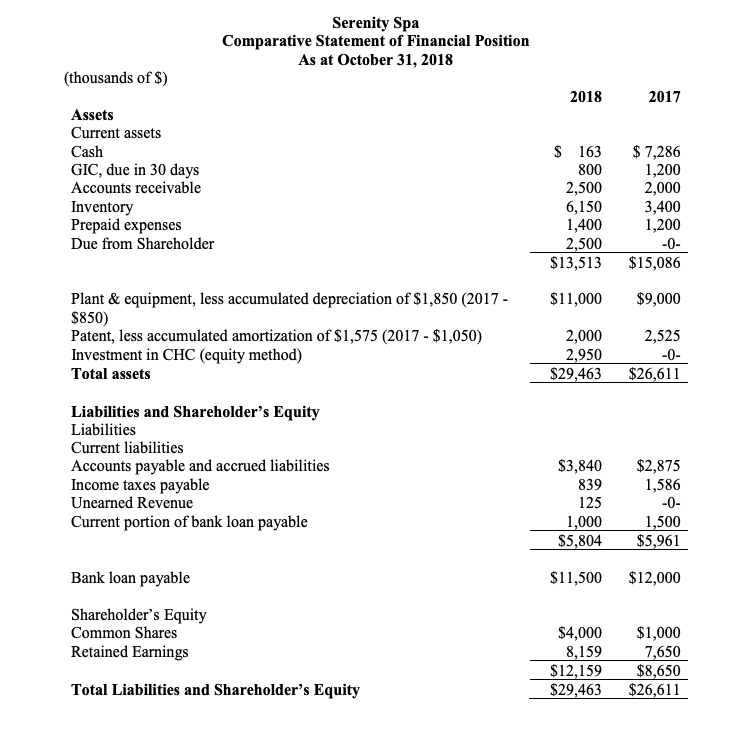

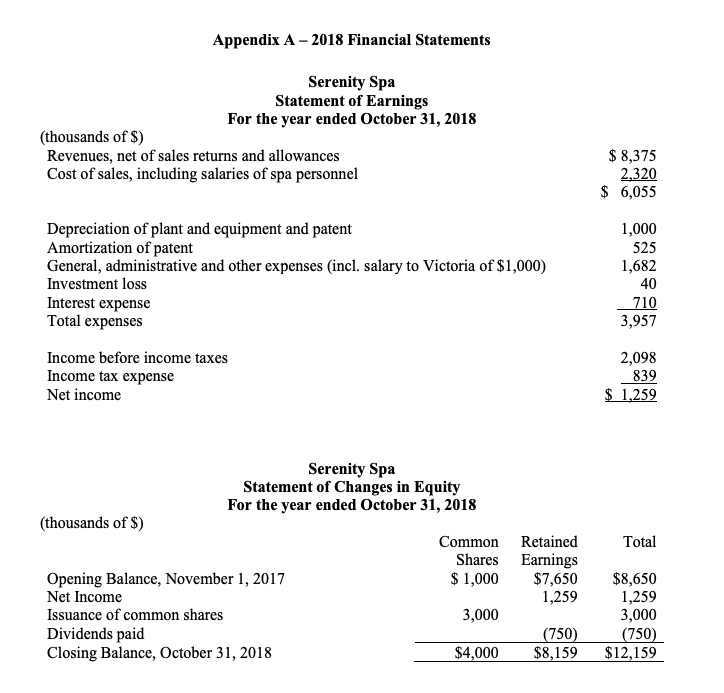

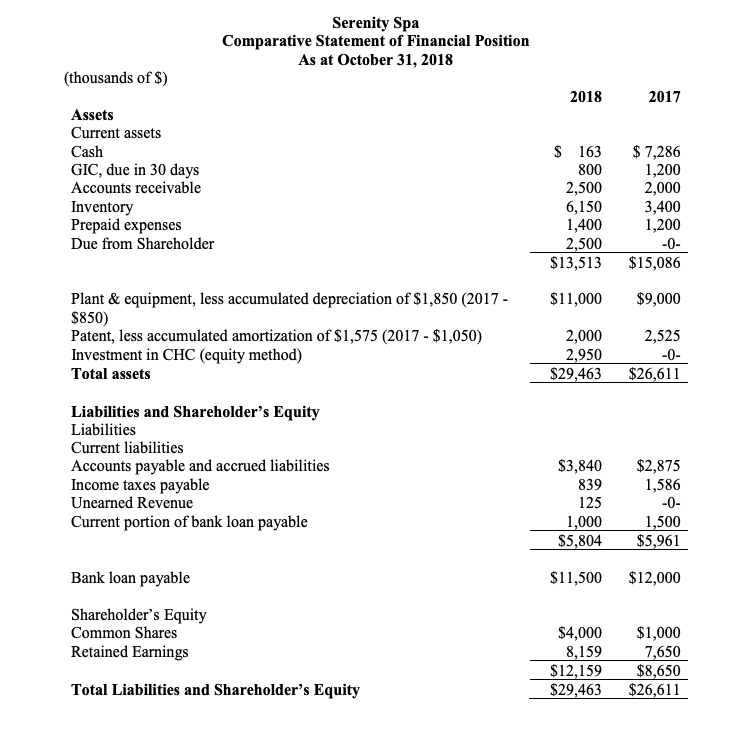

Serenity Spa (SS) In 2010, Victoria Underwood opened a series of spas and created his own line of beauty products. The company manufactures the beauty products in a plant in Millet, Alberta. By year- end October 31,2018, the company had expanded considerably. The 2018 Statement of Earnings, Statement of Changes in Equity, and Comparative Statement of Financial Positions for 2017 and 2018, are presented in Appendix A. Victoria Underwood is pleased with SS's growth. He gave himself a substantial raise in 2018, purchased a 20% stake in Catwalk Hair Care (CHC), and wants to expand further in 2019 . In order to do this, he has to negotiate a loan with the bank. He requires your help in completing a statement of cash flow for the year ended October 31,2018. Additional information necessary for the completion of this statement follows 1. The "Due from shareholder" account represents money Victoria Underwood borrowed from the company for personal use 2. New equipment was purchased in 2018. No dispositions of equipment were made during the year SS purchased its 20% stake in CHC entirely by issuing shares of its own stock. SS did not issue any other capital stock during the year. CHC had a net loss of $200 thousand in 2018. SS had received dividends of $10 thousand in 2018 3. Required: 1. Prepare a Statement of Cash Flow for SS using the 2013 statement of earnings and statement of financial position. Use the indirect method of preparation. Be sure to include any required disclosures Assume you are the loan officer reviewing Victoria Underwood's loan application, for which he submitted the financial statements. Based on the cash flow statement prepared in part 1 above, assess SS's financial position. 2. Appendix A - 2018 Financial Statements Serenity Spa Statement of Earnings For the year ended October 31,2018 (thousands of S) Revenues, net of sales returns and allowances Cost of sales, including salaries of spa personnel $ 8,375 2.320 $ 6,055 Depreciation of plant and equipment and patent Amortization of patent General, administrative and other expenses (incl. salary to Victoria of $1,000) Investment loss Interest expense Total expenses 1,000 525 1,682 40 710 3,957 Income before income taxes Income tax expense Net income 2,098 839 1259 Serenity Spa Statement of Changes in Equity For the year ended October 31,2018 (thousands of S) Common Retained Shares Earnings Total Opening Balance, November 1, 2017 Net Income Issuance of common shares Dividends paid Closing Balance, October 31, 2018 $ 1,000$7,650$8,650 1,259 ,259 3,000 750 $4,000 $8,159 $12,159 3,000 750 Serenity Spa Comparative Statement of Financial Position As at October 31, 2018 (thousands of S) 2018 2017 Assets Current assets Cash GIC, due in 30 days Accounts receivable Inventory Prepaid expenses Due from Shareholder S 163 $7,286 800 1,200 2,5002,000 3,400 1,400 1,200 6,150 2,500 Plant & equipment, less accumulated depreciation of $1,850 (2017 - $850) Patent, less accumulated amortization of S1,575 (2017 $1,050) Investment in CHC (equity method) Total assets $13,513$15,086 $11,000 $9,000 2,525 $29,463$26,611 2,000 2,950 Liabilities and Shareholder's Equity Liabilities Current liabilities Accounts payable and accrued liabilities Income taxes payabl