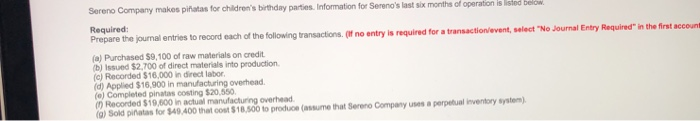

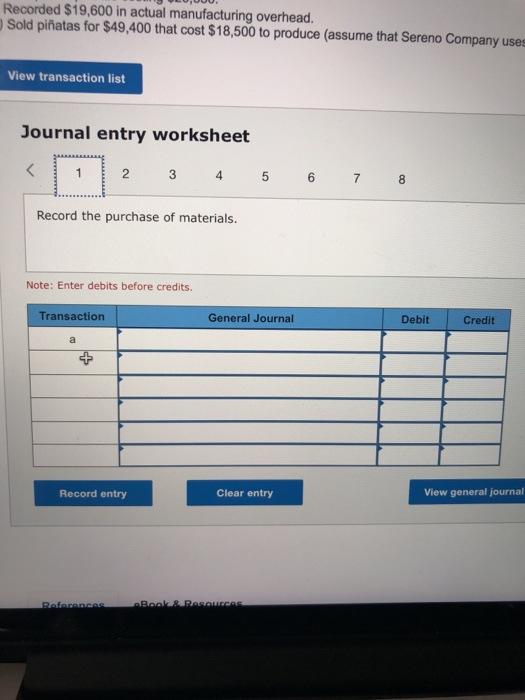

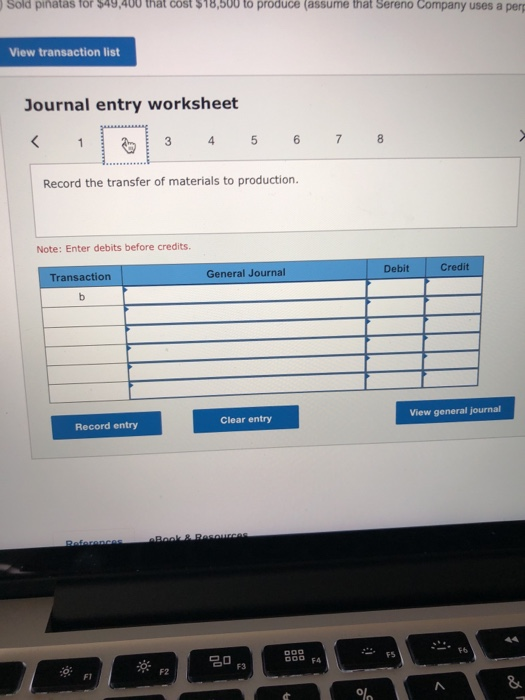

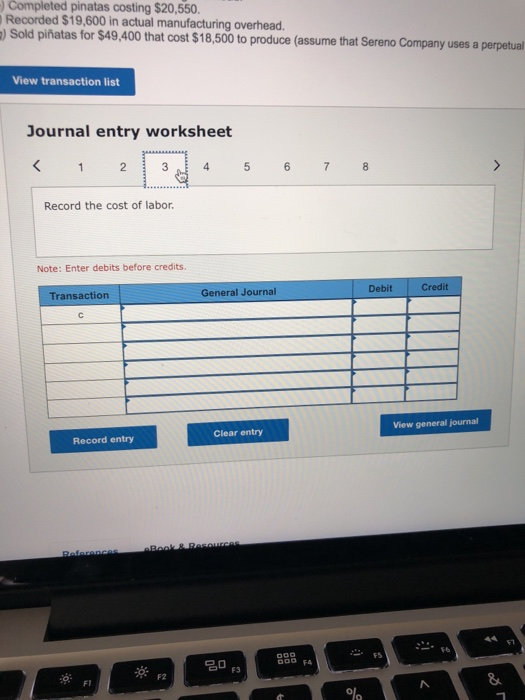

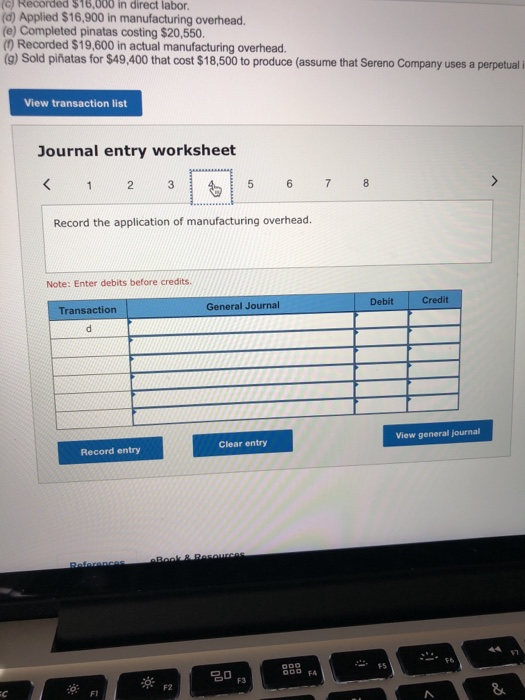

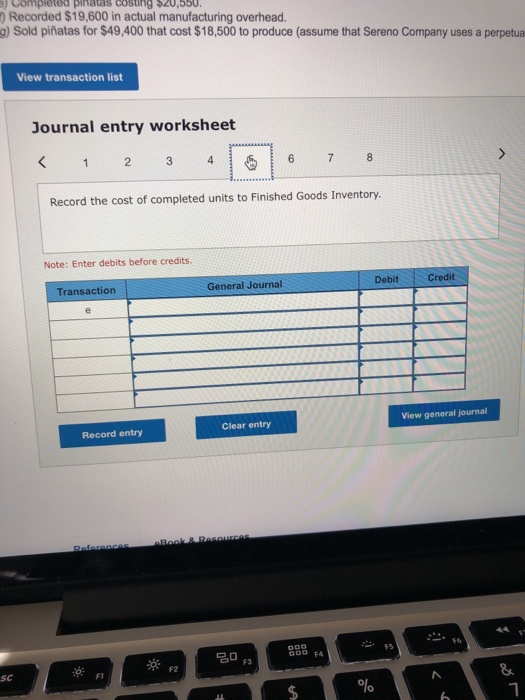

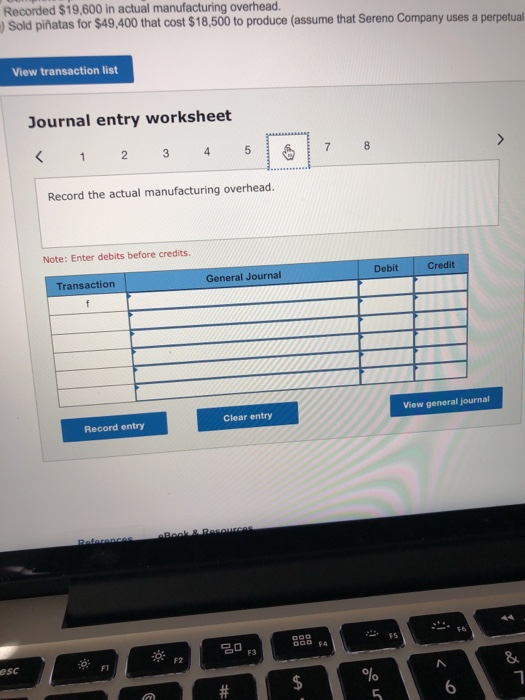

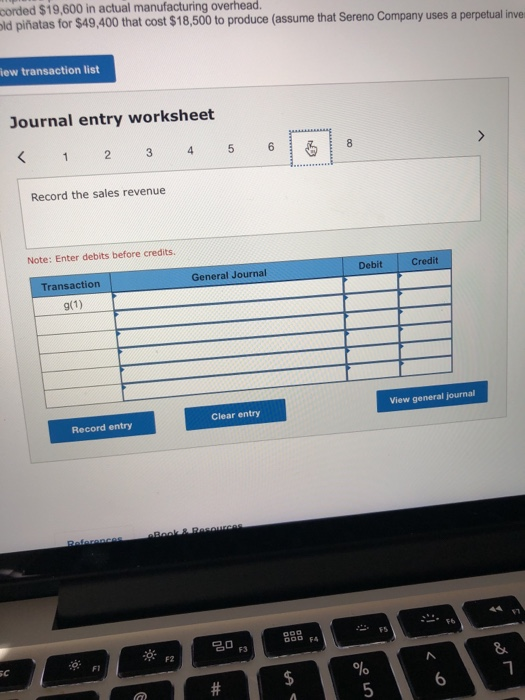

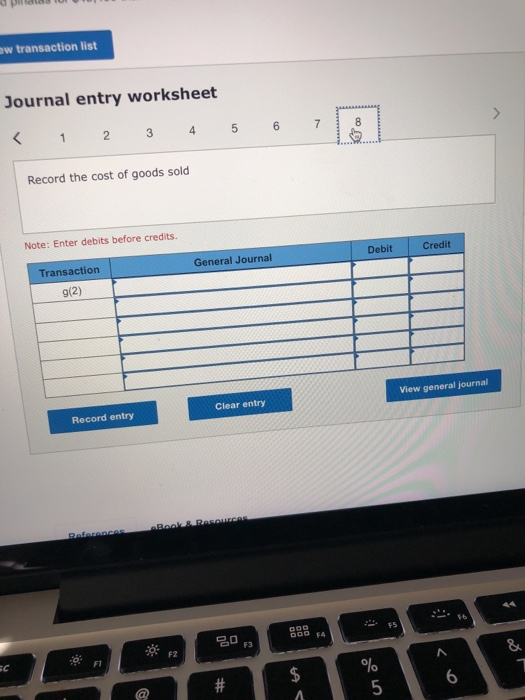

Sereno Company makes piatas for childrens birthday parties Information for Sereno's last six months of operation is listed below Required: Prepare the journal entries to record each of the following transactions.(f no entry is required for a transaction/event,selec "No Journal Entry Required" in the first account (a) Purchased $9,100 of raw materials on credit b) Issued $2,700 of direct materials into production (c) Recorded $16,000 in direct labor (d) Applied $16,900 in manufacturing overhead (e) Completed pinatas costing $20,550, () Recorded $19,600 in actual manufacturing overhead (9) Sold pinatas for 349,400 that cost $18,500 to produce (assume that Sereno Company uses a perpelual inventory system) Recorded $19,600 in actual manufacturing overhead. Sold piatas for $49,400 that cost $18,500 to produce (assume that Sereno Company use View transaction list Journal entry worksheet 2 Record the purchase of materials. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journal )Sold pinatas for $49,400 that ot $18,500 to produce (assume that Sereno Company uses a per View transaction list Journal entry worksheet 4 6 Record the transfer of materials to production. Note: Enter debits before credits. Debit Credit General Journal Transaction View general journal Clear entry Record entry Fb FS F3 F2 F1 Completed pinatas costing $20,550. Recorded $19,600 in actual manufacturing overhead ) Sold piatas for $49,400 that cost $18,500 to produce (assume that Sereno Company uses a perpetual View transaction list Journal entry worksheet Record the cost of labor. Note: Enter debits before credits. Debit Credit General Journal Transaction View general journal Clear entry Record entry FS 8 F2 F1 0 (c) Recorded $16,000 in direct labor (d) Applied $16,900 in manufacturing overhead. (e) Completed pinatas costing $20,550. () Recorded $19,600 in actual manufacturing overhead. (g) Sold piatas for $49,400 that cost $18,500 to produce (assume that Sereno Company uses a perpetuali View transaction list Journal entry worksheet Record the application of manufacturing overhead. Note: Enter debits before credits. Transaction General Journal Debit Credit View general journal Clear entry Record entry F5 F2 ) Completed pihatas ) Recorded $19,600 in actual manufacturing overhead. g) Sold piatas for $49,400 that cost $18,500 to produce (assume that Sereno Company uses a perpetua View transaction list Journal entry worksheet Record the cost of completed units to Finished Goods Inventory. Note: Enter debits before credits Transaction General Journal Debit Credit View general journal Clear entry Record entry FS FA F3 F2 sc Recorded $19,600 in actual manufacturing overhead. )Sold piatas for $49,400 that cost $18,500 to produce (assume that Sereno Company uses a perpetual View transaction list Journal entry worksheet Record the actual manufacturing overhead. Note: Enter debits before credits. Debit Credit Transaction General Journal View general journal Clear entry Record entry 6 DOD F 20 F3 F2 esc FI 6 corded $19,600 in actual manufacturing overhead. ld piatas for $49,400 that cost $18,500 to produce (assume that Sereno Company uses a perpetual inve iew transaction list Journal entry worksheet 4 Record the sales revenue Note: Enter debits before credits Debit Credit Transaction General Journal View general journal Clear entry Record entry F5 1 6 d pildtaS w transaction list Journal entry worksheet Record the cost of goods sold Note: Enter debits before credits. Credit Transaction 9(2) General Journal Debit View general journal Clear entry Record entry F6 es 20 3 F2 F1 8A 6 5