Answered step by step

Verified Expert Solution

Question

1 Approved Answer

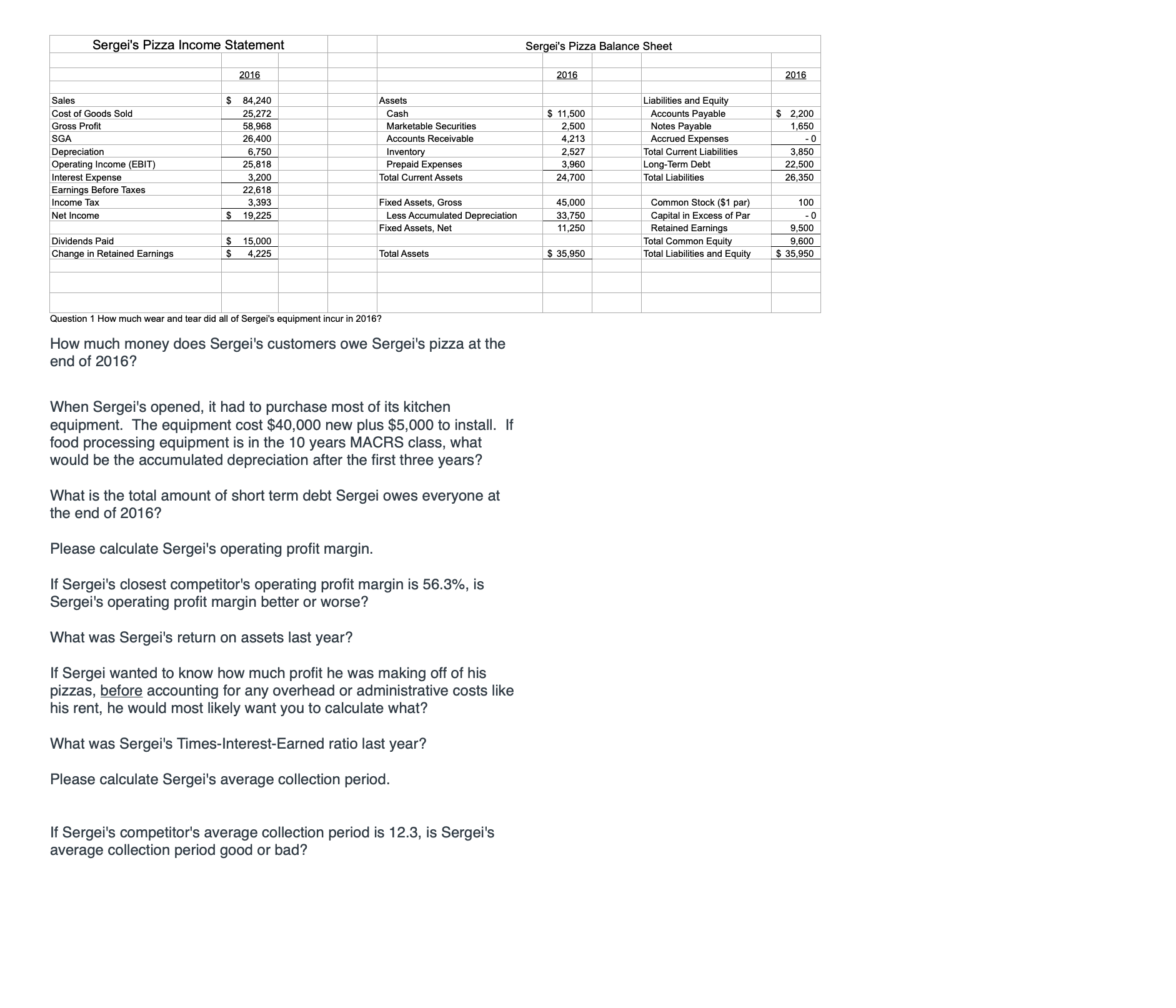

Sergei's Pizza Income Statement Sergei's Pizza Balance Sheet 2016 2016 2016 Sales $ 84,240 Assets Liabilities and Equity Cost of Goods Sold 25,272 Cash

Sergei's Pizza Income Statement Sergei's Pizza Balance Sheet 2016 2016 2016 Sales $ 84,240 Assets Liabilities and Equity Cost of Goods Sold 25,272 Cash $ 11,500 Accounts Payable $ 2,200 Gross Profit 58,968 Marketable Securities 2,500 Notes Payable 1,650 SGA 26,400 Accounts Receivable 4,213 Accrued Expenses -0 Depreciation 6,750 Inventory 2,527 Total Current Liabilities 3,850 Operating Income (EBIT) 25,818 Prepaid Expenses 3,960 Long-Term Debt 22,500 Interest Expense 3,200 Total Current Assets 24,700 Total Liabilities 26,350 Earnings Before Taxes 22,618 Income Tax 3,393 Fixed Assets, Gross 45,000 Common Stock ($1 par) 100 Net Income $ 19,225 Less Accumulated Depreciation 33,750 Fixed Assets, Net 11,250 Dividends Paid $ 15,000 Change in Retained Earnings $ 4,225 Total Assets $ 35,950 Capital in Excess of Par Retained Earnings Total Common Equity Total Liabilities and Equity -0 9,500 9,600 $ 35,950 Question 1 How much wear and tear did all of Sergei's equipment incur in 2016? How much money does Sergei's customers owe Sergei's pizza at the end of 2016? When Sergei's opened, it had to purchase most of its kitchen equipment. The equipment cost $40,000 new plus $5,000 to install. If food processing equipment is in the 10 years MACRS class, what would be the accumulated depreciation after the first three years? What is the total amount of short term debt Sergei owes everyone at the end of 2016? Please calculate Sergei's operating profit margin. If Sergei's closest competitor's operating profit margin is 56.3%, is Sergei's operating profit margin better or worse? What was Sergei's return on assets last year? If Sergei wanted to know how much profit he was making off of his pizzas, before accounting for any overhead or administrative costs like his rent, he would most likely want you to calculate what? What was Sergei's Times-Interest-Earned ratio last year? Please calculate Sergei's average collection period. If Sergei's competitor's average collection period is 12.3, is Sergei's average collection period good or bad?

Step by Step Solution

★★★★★

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answer To answer your questions lets start by calculating the wear and tear on Sergeis equipment the amount his customers owe him the accumulated depr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started