Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sergio Sheen died February 14, 2017, survived by his spouse Jerry and several children. Sergio had not made any taxable gifts. Sergio's gross estate was

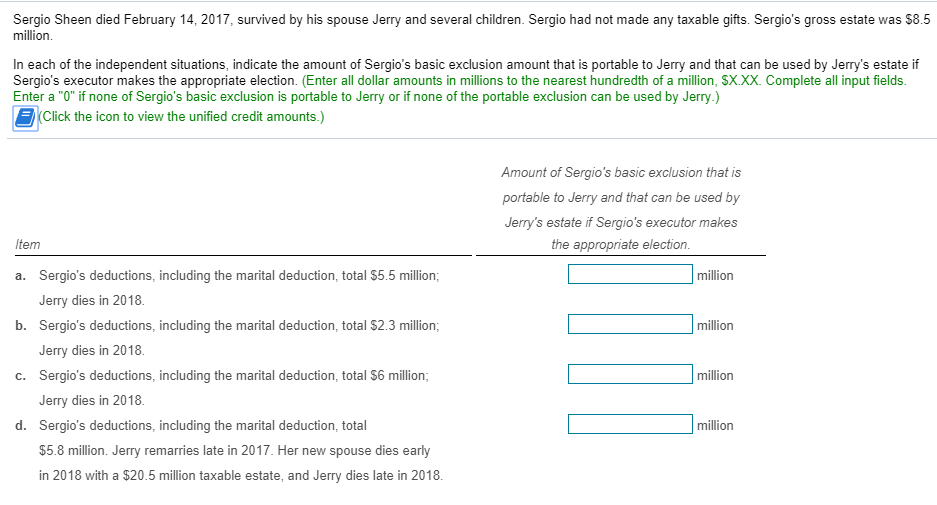

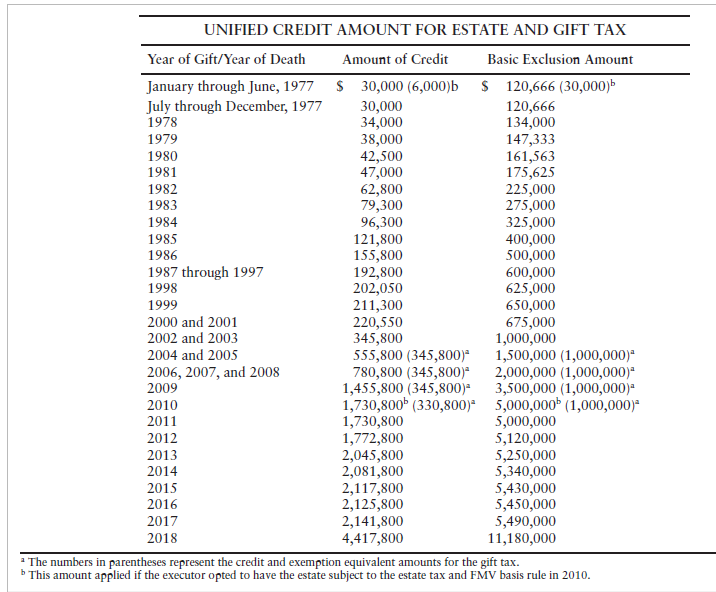

Sergio Sheen died February 14, 2017, survived by his spouse Jerry and several children. Sergio had not made any taxable gifts. Sergio's gross estate was $8.5 million In each of the independent situations, indicate the amount of Sergio's basic exclusion amount that is portable to Jerry and that can be used by Jerry's estate if Sergio's executor makes the appropriate election. (Enter all dollar amounts in millions to the nearest hundredth of a million, SX.XX. Complete all input fields Enter a "0" if none of Sergio's basic exclusion is portable to Jerry or if none of the portable exclusion can be used by Jerry.) EClick the icon to view the unified credit amounts.) Amount of Sergio's basic exclusion that is portable to Jerry and that can be used by Jerry's estate if Sergio's executor makes the appropriate election Item Sergio's deductions, including the marital deduction, total $5.5 million; Jerry dies in 2018. million a. b. Sergio's deductions, including the marital deduction, total $2.3 million; million Jerry dies in 2018. Sergio's deductions, including the marital deduction, total $6 million; million C. Jerry dies in 2018 d. Sergio's deductions, including the marital deduction, total million $5.8 million. Jerry remarries late in 2017. Her new spouse dies early in 2018 with a $20.5 million taxable estate, and Jerry dies late in 2018. UNIFIED CREDIT AMOUNT FOR ESTATE AND GIFT TAX Year of Gift/Year of Death Amount of Credit Basic Exclusion Amount $ 30,000 (6,000)b S 120,666 (30,000)b January through June, 1977 July through December, 1977 1978 30,000 34,000 38,000 42,500 47,000 62,800 79,300 120,666 134,000 147,333 161,563 175,625 225,000 275,000 325,000 400,000 500,000 600,000 625,000 650,000 675,000 1,000,000 1979 1980 1981 1982 1983 96,300 121,800 155,800 192,800 202,050 211,300 220,550 345,800 555,800 (345,800) 780,800 (345,800) 1984 1985 1986 1987 through 1997 1998 1999 2000 and 2001 2002 and 2003 2004 and 2005 2006, 2007, and 2008 2009 1,500,000 (1,000,000)* 2,000,000 (1,000,000)* 1,455,800 (345,800)*3,500,000 (1,000,000)* 1,730,800 (330,800)* 5,000,000 (1,000,000)* 5,000,000 5,120,000 5,250,000 5,340,000 5,430,000 5,450,000 5,490,000 11,180,000 2010 2011 1,730,800 1,772,800 2,045,800 2,081,800 2,117,800 2,125,800 2,141,800 4,417,800 2012 2013 2014 2015 2016 2017 2018 The numbers in parentheses represent the credit and exemption equivalent amounts for the gift tax This amount applied if the executor opted to have the estate subject to the estate tax and FMV basis rule in 2010. Sergio Sheen died February 14, 2017, survived by his spouse Jerry and several children. Sergio had not made any taxable gifts. Sergio's gross estate was $8.5 million In each of the independent situations, indicate the amount of Sergio's basic exclusion amount that is portable to Jerry and that can be used by Jerry's estate if Sergio's executor makes the appropriate election. (Enter all dollar amounts in millions to the nearest hundredth of a million, SX.XX. Complete all input fields Enter a "0" if none of Sergio's basic exclusion is portable to Jerry or if none of the portable exclusion can be used by Jerry.) EClick the icon to view the unified credit amounts.) Amount of Sergio's basic exclusion that is portable to Jerry and that can be used by Jerry's estate if Sergio's executor makes the appropriate election Item Sergio's deductions, including the marital deduction, total $5.5 million; Jerry dies in 2018. million a. b. Sergio's deductions, including the marital deduction, total $2.3 million; million Jerry dies in 2018. Sergio's deductions, including the marital deduction, total $6 million; million C. Jerry dies in 2018 d. Sergio's deductions, including the marital deduction, total million $5.8 million. Jerry remarries late in 2017. Her new spouse dies early in 2018 with a $20.5 million taxable estate, and Jerry dies late in 2018. UNIFIED CREDIT AMOUNT FOR ESTATE AND GIFT TAX Year of Gift/Year of Death Amount of Credit Basic Exclusion Amount $ 30,000 (6,000)b S 120,666 (30,000)b January through June, 1977 July through December, 1977 1978 30,000 34,000 38,000 42,500 47,000 62,800 79,300 120,666 134,000 147,333 161,563 175,625 225,000 275,000 325,000 400,000 500,000 600,000 625,000 650,000 675,000 1,000,000 1979 1980 1981 1982 1983 96,300 121,800 155,800 192,800 202,050 211,300 220,550 345,800 555,800 (345,800) 780,800 (345,800) 1984 1985 1986 1987 through 1997 1998 1999 2000 and 2001 2002 and 2003 2004 and 2005 2006, 2007, and 2008 2009 1,500,000 (1,000,000)* 2,000,000 (1,000,000)* 1,455,800 (345,800)*3,500,000 (1,000,000)* 1,730,800 (330,800)* 5,000,000 (1,000,000)* 5,000,000 5,120,000 5,250,000 5,340,000 5,430,000 5,450,000 5,490,000 11,180,000 2010 2011 1,730,800 1,772,800 2,045,800 2,081,800 2,117,800 2,125,800 2,141,800 4,417,800 2012 2013 2014 2015 2016 2017 2018 The numbers in parentheses represent the credit and exemption equivalent amounts for the gift tax This amount applied if the executor opted to have the estate subject to the estate tax and FMV basis rule in 2010

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started