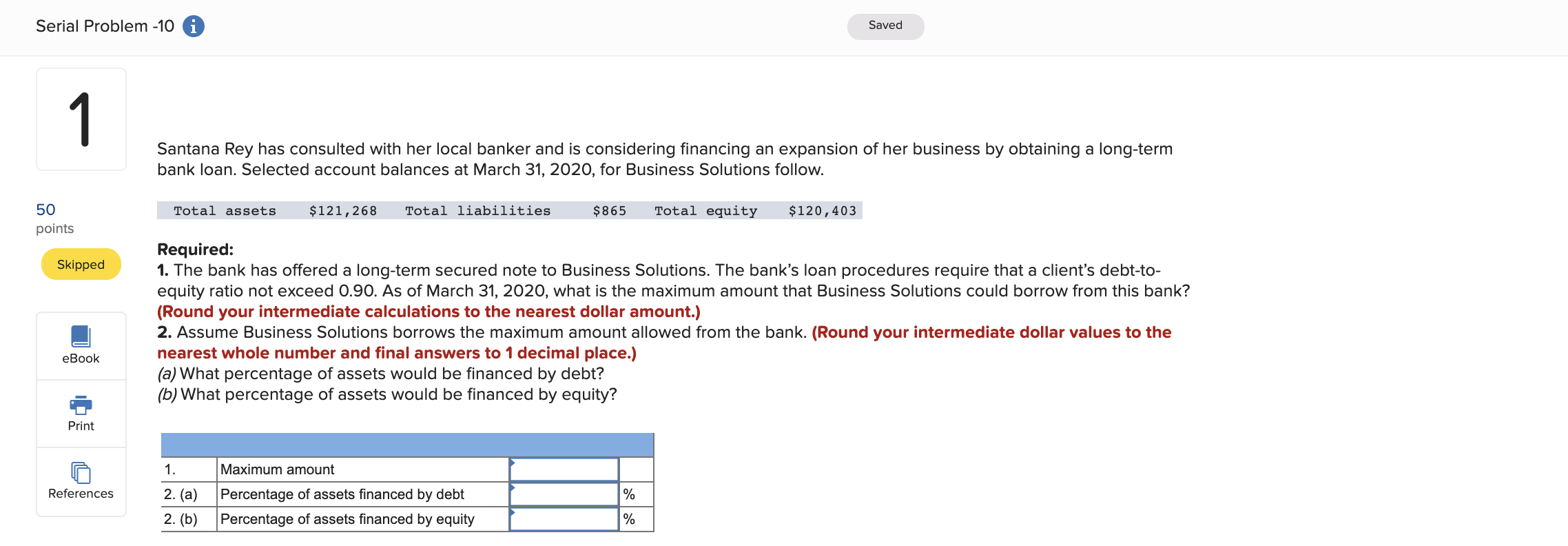

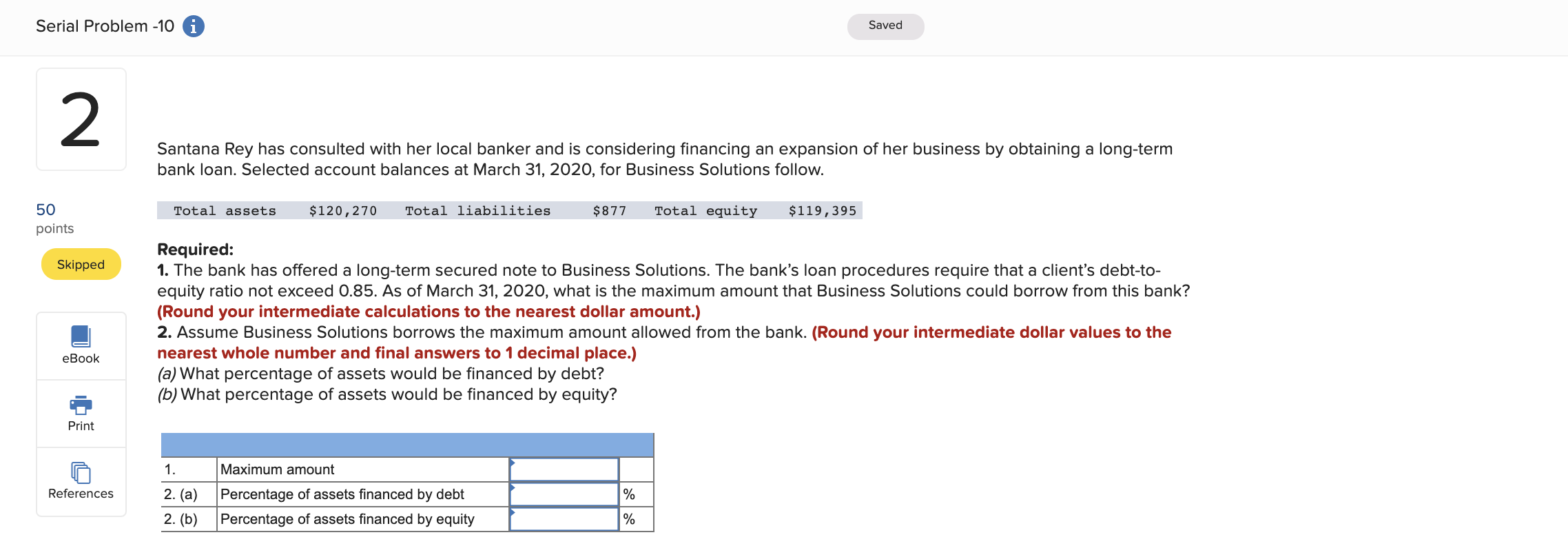

Serial Problem -10 A Saved Santana Rey has consulted with her local banker and is considering financing an expansion of her business by obtaining a long-term bank loan. Selected account balances at March 31, 2020, for Business Solutions follow. Total assets $121,268 Total liabilities $865 Total equity $120,403 50 points Skipped Required: 1. The bank has offered a long-term secured note to Business Solutions. The bank's loan procedures require that a client's debt-to- equity ratio not exceed 0.90. As of March 31, 2020, what is the maximum amount that Business Solutions could borrow from this bank? (Round your intermediate calculations to the nearest dollar amount.) 2. Assume Business Solutions borrows the maximum amount allowed from the bank. (Round your intermediate dollar values to the nearest whole number and final answers to 1 decimal place.) (a) What percentage of assets would be financed by debt? (b) What percentage of assets would be financed by equity? eBook Print Maximum amount References 1. 2. (a) 2. (b) Percentage of assets financed by debt Percentage of assets financed by equity Serial Problem -10 A Saved Santana Rey has consulted with her local banker and is considering financing an expansion of her business by obtaining a long-term bank loan. Selected account balances at March 31, 2020, for Business Solutions follow. Total assets $120,270 Total liabilities $877 Total equity $119,395 50 points Skipped Required: 1. The bank has offered a long-term secured note to Business Solutions. The bank's loan procedures require that a client's debt-to- equity ratio not exceed 0.85. As of March 31, 2020, what is the maximum amount that Business Solutions could borrow from this bank? (Round your intermediate calculations to the nearest dollar amount.) 2. Assume Business Solutions borrows the maximum amount allowed from the bank. (Round your intermediate dollar values to the nearest whole number and final answers to 1 decimal place.) (a) What percentage of assets would be financed by debt? (b) What percentage of assets would be financed by equity? eBook Print Maximum amount References 1. 2. (a) 2. (b) Percentage of assets financed by debt Percentage of assets financed by equity